Understanding Car Insurance in Oklahoma

Mandatory Car Insurance in Oklahoma

In Oklahoma, it’s mandatory for all drivers to have a minimum level of car insurance coverage. This includes:

- Liability Coverage: This covers bodily injury and property damage you may cause to others in an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Factors Affecting Car Insurance Rates in Oklahoma

Several factors can influence your car insurance rates in Oklahoma. These include:

- Your Driving Record: Your driving history plays a crucial role in determining your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates.

- Your Vehicle: The type of car you drive can also impact your insurance costs. Cars with high safety ratings and low theft rates typically have lower insurance premiums.

- Your Location: Where you live in Oklahoma can affect your insurance rates. Urban areas with higher traffic density and crime rates might have higher insurance premiums compared to rural areas.

- Your Age and Gender: Statistically, young drivers and male drivers tend to pay higher insurance rates than older drivers and female drivers.

- Your Credit Score: In Oklahoma, insurance companies can use your credit score as a factor in determining your insurance rates. A good credit score can lead to lower insurance premiums.

- Your Coverage Limits and Deductibles: The coverage limits you choose and the deductibles you select can significantly impact your insurance costs. Higher coverage limits and lower deductibles will generally result in higher premiums.

Finding the Cheapest Insurance in Oklahoma

Now that you understand the factors that influence car insurance rates, let’s explore how to find the cheapest insurance in Oklahoma.

1. Compare Quotes from Multiple Insurance Companies

One of the most effective ways to find the cheapest insurance is to compare quotes from multiple insurance companies. Each company has its own unique rating system and pricing structure, so it’s essential to get quotes from several providers to find the best deal. You can use online comparison tools or contact insurance agents directly to get quotes.

2. Consider Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your insurance premiums. However, ensure you can afford the higher deductible in case of an accident.

3. Take Advantage of Discounts

Many insurance companies offer various discounts that can help you save money on your car insurance. Some common discounts include:

- Good Driver Discount: If you have a clean driving record, you may qualify for a good driver discount.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount.

- Homeowner’s Discount: If you own a home, you might be able to get a discount on your car insurance by bundling it with your homeowner’s insurance.

- Good Student Discount: If you’re a student with good grades, you may qualify for a good student discount.

- Safety Features Discount: If your car has safety features like airbags, anti-lock brakes, or an anti-theft device, you may be eligible for a safety features discount.

4. Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates in Oklahoma. Maintaining a good credit score can help you secure lower insurance premiums.

5. Choose the Right Car

When buying a new car, consider its impact on your insurance rates. Cars with high safety ratings and low theft rates typically have lower insurance premiums.

6. Drive Safely

Avoiding accidents and traffic violations is crucial for maintaining a clean driving record and securing lower insurance rates.

7. Review Your Policy Regularly

Your insurance needs may change over time. It’s essential to review your policy regularly and make adjustments as needed.

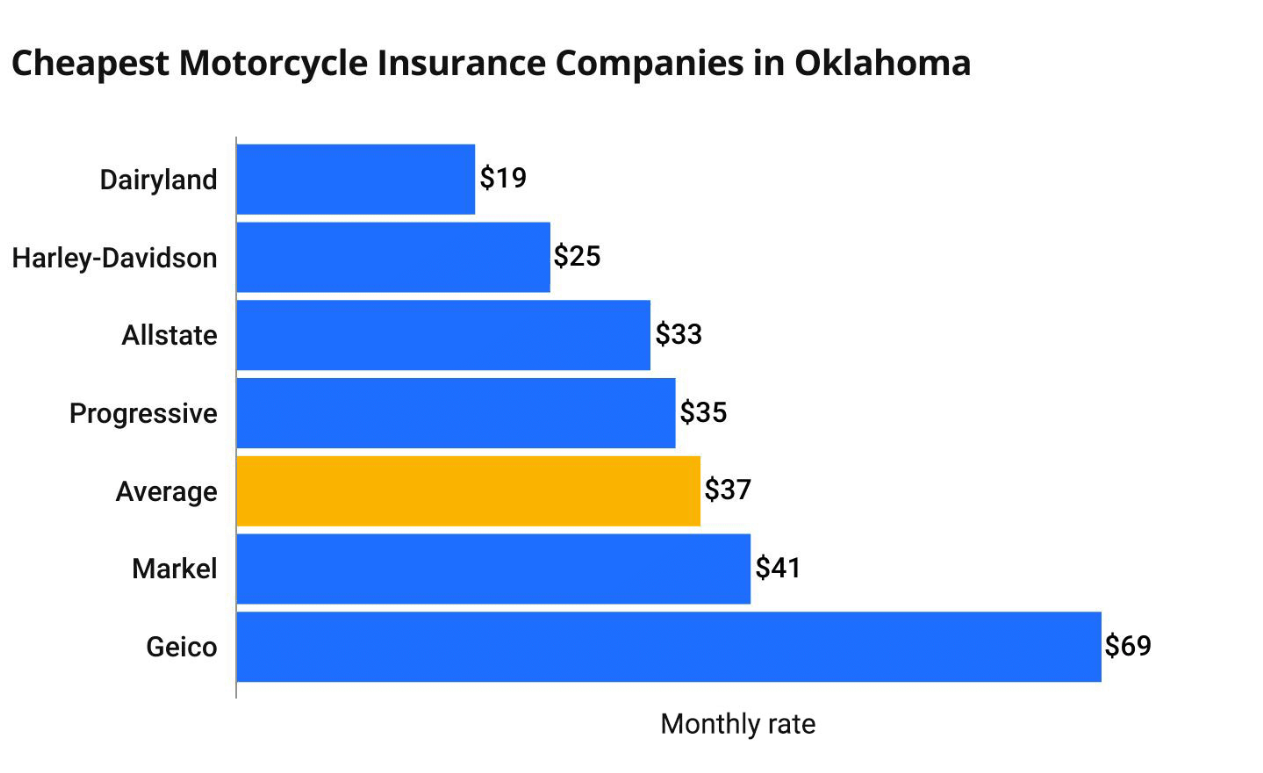

Cheapest Car Insurance Companies in Oklahoma

While the cheapest insurance in Oklahoma can vary depending on your individual circumstances, some insurance companies are known for offering competitive rates in the state. These include:

- GEICO

- State Farm

- Progressive

- USAA (available for military members and their families)

- Farmers

It’s important to compare quotes from multiple companies to find the best deal for your specific needs.

Tips for Saving Money on Car Insurance in Oklahoma

In addition to the strategies mentioned above, here are some additional tips to help you save money on your car insurance in Oklahoma:

- Ask about usage-based insurance programs: Some insurance companies offer usage-based insurance programs that track your driving habits and offer discounts based on your safe driving behavior.

- Consider a higher-mileage discount: If you drive your car infrequently, you may qualify for a higher-mileage discount.

- Pay your insurance premiums annually: Some insurance companies offer discounts for paying your premiums annually instead of monthly.

- Take a defensive driving course: Completing a defensive driving course may qualify you for a discount on your car insurance.

- Shop around for car insurance every year: Insurance rates can change over time, so it’s important to shop around for car insurance every year to ensure you’re getting the best deal.

Conclusion

Finding the cheapest insurance in Oklahoma requires careful consideration of various factors and a proactive approach to comparing quotes and exploring discounts. By following the tips and strategies outlined in this guide, you can save money on your car insurance while ensuring you have the necessary coverage to protect yourself and your vehicle on the roads of Oklahoma.

Read More: Cheap Health Insurance in Louisiana: A Comprehensive Guide