Wisconsin business insurance is an essential tool for safeguarding your company’s financial health and ensuring its longevity in the face of unexpected events. Whether you’re a small startup in Madison or a large manufacturer in Milwaukee, understanding the intricacies of Wisconsin business insurance is crucial. This comprehensive guide will delve into the types of coverage available, the legal requirements, and tips for selecting the right policies for your unique needs.

Contents

The Landscape of Wisconsin Business Insurance

The Wisconsin business insurance market offers a diverse range of coverage options tailored to various industries and risks. Some of the most common types of insurance include:

-

General Liability Insurance: This fundamental coverage protects your business from claims of bodily injury, property damage, and personal injury caused by your operations or products.

-

Commercial Property Insurance: This policy safeguards your physical assets, including buildings, equipment, inventory, and furniture, from damage or loss due to fire, theft, vandalism, and other covered perils.

-

Workers’ Compensation Insurance: In Wisconsin, businesses with three or more employees are legally required to carry workers’ compensation insurance. This coverage provides benefits to employees who suffer work-related injuries or illnesses.

-

Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this policy protects professionals such as lawyers, accountants, and consultants from claims of negligence or malpractice.

-

Business Interruption Insurance: This coverage helps compensate for lost income and ongoing expenses if your business is forced to temporarily close due to a covered event, such as a fire or natural disaster.

Legal Requirements for Wisconsin Business Insurance

Wisconsin law mandates certain types of business insurance for specific industries and situations. For example:

-

Workers’ Compensation: As mentioned earlier, most businesses with three or more employees must provide workers’ compensation coverage.

-

Commercial Auto Insurance: If your business owns or leases vehicles, you must carry liability insurance to cover damages or injuries caused by accidents.

-

Liquor Liability Insurance: Businesses that sell or serve alcohol are typically required to have liquor liability insurance to protect against claims arising from alcohol-related incidents.

It’s crucial to consult with an experienced insurance agent to ensure your business complies with all relevant Wisconsin business insurance regulations.

Choosing the Right Wisconsin Business Insurance

Selecting the appropriate Wisconsin business insurance policies for your company requires careful consideration of your specific risks and needs. Here are some key factors to consider:

- Industry: Different industries face unique risks. For instance, a construction company may need more extensive liability coverage than a software development firm.

- Size and Scope: The size of your business and the nature of your operations will influence the types and amounts of coverage you require.

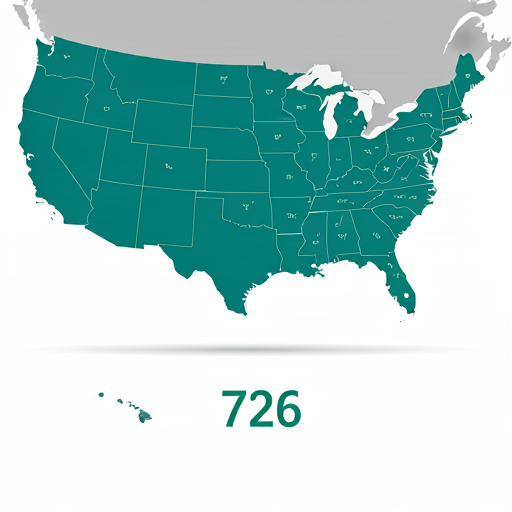

- Location: Your location in Wisconsin can affect your insurance premiums due to varying risk factors such as weather patterns and crime rates.

- Budget: It’s important to balance your budget with the need for adequate protection. Don’t skimp on essential coverage, but also avoid overspending on unnecessary policies.

Tips for Obtaining Affordable Wisconsin Business Insurance

Wisconsin business insurance costs can vary significantly depending on the factors mentioned above. However, there are several strategies you can employ to potentially lower your premiums:

- Shop Around: Compare quotes from multiple insurers to find the most competitive rates for the coverage you need.

- Bundle Policies: Many insurers offer discounts for bundling multiple policies, such as general liability and commercial property insurance.

- Increase Deductibles: Opting for higher deductibles can reduce your premiums, but be sure you can afford the out-of-pocket expenses if you file a claim.

- Risk Mitigation: Implement safety measures and risk management practices to reduce the likelihood of claims and potentially qualify for discounts.

- Consult an Agent: A knowledgeable insurance agent can help you identify potential savings and tailor a policy package to your specific needs.

The Future of Wisconsin Business Insurance

The Wisconsin business insurance landscape is constantly evolving, driven by factors such as emerging technologies, changing regulations, and shifting economic conditions. For instance, cyber insurance is becoming increasingly important as businesses face growing threats of data breaches and cyberattacks. It’s essential to stay informed about the latest trends and innovations in the insurance industry to ensure your business remains adequately protected.

In Conclusion

Wisconsin business insurance is not merely a legal obligation; it’s a strategic investment in your company’s future. By understanding the various coverage options, complying with legal requirements, and making informed decisions about your policies, you can safeguard your business from unexpected events and ensure its continued success in the Badger State.