Tennessee’s entrepreneurial spirit is thriving, with countless small businesses contributing to the state’s economy. Whether you’re in Memphis, Nashville, Knoxville, or a smaller town, protecting your business is paramount. That’s where small business insurance in TN comes into play.

Contents

Why Small Business Insurance is Essential in Tennessee

Operating a small business in Tennessee comes with its share of risks, from property damage to customer injuries. Small business insurance TN isn’t just a safety net; it’s often a legal requirement and a smart business move. Here’s why:

- Protection Against Lawsuits: General liability insurance shields you from the financial burden of legal claims.

- Financial Security: Covers the costs of property damage, theft, or vandalism.

- Employee Well-being: Workers’ compensation provides benefits to employees injured on the job.

- Business Continuity: Business interruption insurance helps you recover lost income after a covered event.

- Professional Reputation: Errors and omissions insurance protects against claims of negligence or mistakes.

Types of Small Business Insurance TN

Understanding the different types of insurance available is crucial for tailoring coverage to your specific needs. Here are the key types of small business insurance TN:

1. General Liability Insurance:

- Covers bodily injury, property damage, and personal injury claims.

- Protects your business from lawsuits and legal fees.

- A fundamental policy for most small businesses.

2. Property Insurance:

- Covers damage to your business property from fire, theft, vandalism, and certain natural disasters.

- Protects equipment, inventory, furniture, and fixtures.

3. Business Interruption Insurance:

- Replaces lost income and covers ongoing expenses if your business is temporarily closed due to a covered event.

- Helps maintain cash flow during recovery.

4. Workers’ Compensation Insurance:

- Provides wage replacement and medical benefits to employees injured or ill due to work-related causes.

- A legal requirement in most states, including Tennessee, if you have employees.

5. Professional Liability Insurance (Errors and Omissions Insurance):

- Protects service-based businesses against claims of negligence, errors, or mistakes.

- Essential for professionals like consultants, accountants, and IT specialists.

6. Commercial Auto Insurance:

- Covers accidents involving business-owned vehicles.

- Protects against liability and property damage claims.

7. Cyber Liability Insurance:

- Covers financial losses and liabilities resulting from data breaches and cyberattacks.

- Protects sensitive customer information.

Tailoring Coverage to Your Business

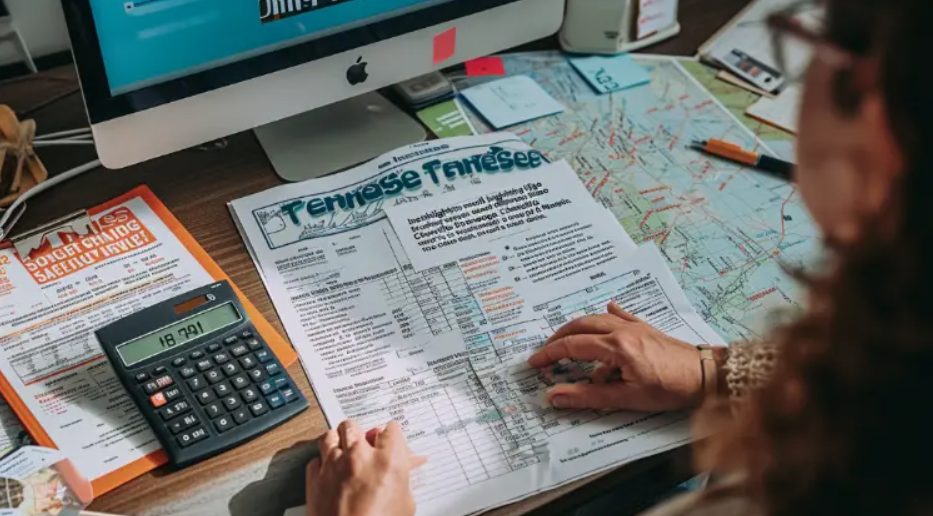

Not all businesses face the same risks. Here’s how to tailor small business insurance TN to your unique situation:

- Assess Your Risks: Consider the nature of your business, the industry you operate in, and your location.

- Consult with an Agent: A licensed insurance agent can help you identify potential risks and recommend appropriate coverage.

- Review Policies Annually: Your business needs evolve, so review your policies regularly to ensure they still meet your needs.

Finding Affordable Small Business Insurance in TN

Affordability is a top concern for small businesses. Here are some tips for finding the right coverage at a reasonable price:

- Shop Around: Get quotes from multiple insurers to compare rates and coverage options.

- Bundle Policies: Many insurers offer discounts for bundling multiple policies together.

- Increase Deductibles: Opting for higher deductibles can lower your premiums.

- Ask About Discounts: Inquire about discounts for safety measures or industry affiliations.

- Consider a Captive Insurance Company: Captives can provide cost-effective coverage for certain types of risks.

Small Business Insurance TN: Beyond the Basics

In addition to standard coverage, consider these additional options:

- Employment Practices Liability Insurance (EPLI): Protects against claims of discrimination, wrongful termination, or harassment.

- Key Person Insurance: Provides financial protection if a key employee becomes disabled or deceased.

- Umbrella Insurance: Offers additional liability coverage beyond the limits of your other policies.

The Future of Small Business Insurance in TN

As technology advances and risks evolve, small business insurance in TN will adapt to meet the changing needs of entrepreneurs. Expect to see:

- More Digital Solutions: Online platforms will make it easier to compare quotes and purchase policies.

- Data-Driven Underwriting: Insurers will use data analytics to assess risks and personalize coverage.

- Emerging Risks Coverage: New policies will emerge to address risks like cyberattacks and climate change.

Your Guide to Success

Protecting your small business with small business insurance in TN is an investment in your future. By understanding your risks, choosing the right coverage, and staying informed about industry trends, you can safeguard your business and set yourself up for success in the Volunteer State.

Remember, a well-protected business is a thriving business.