Running a small business in Kansas comes with its fair share of risks. From property damage to liability claims, unforeseen events can disrupt your operations and even threaten your company’s survival. That’s where small business insurance Kansas steps in, providing a safety net that protects your hard-earned investment. In this comprehensive guide, we will delve into the world of small business insurance Kansas, exploring the different types of coverage available, the factors that influence premiums, and how to choose the right policy for your specific needs.

Contents

Understanding Small Business Insurance Kansas

Small business insurance Kansas is a collection of insurance policies designed to safeguard various aspects of your business. These policies offer financial protection against a range of risks, including:

- Property damage: This covers damage to your business property, such as your building, equipment, and inventory, caused by fire, theft, vandalism, or natural disasters.

- Liability claims: This protects your business if you are sued for bodily injury or property damage caused by your products, services, or operations.

- Business interruption: This covers lost income and expenses if your business is forced to close temporarily due to a covered event, such as a fire or natural disaster.

- Workers’ compensation: This provides benefits to employees who are injured or become ill on the job.

- Commercial auto insurance: This covers damage to your business vehicles and liability claims arising from accidents.

Types of Small Business Insurance Kansas

Several types of small business insurance Kansas are available, and the specific coverage you need will depend on the nature of your business and the risks you face. Some of the most common types of small business insurance Kansas include:

- General liability insurance: This provides broad coverage for a range of risks, including bodily injury, property damage, and personal and advertising injury. It is often required by landlords and clients.

- Property insurance: This covers damage to your business property, including your building, equipment, and inventory.

- Business interruption insurance: This covers lost income and expenses if your business is forced to close temporarily due to a covered event.

- Professional liability insurance: This protects professionals, such as doctors, lawyers, and accountants, against claims of negligence or malpractice.

- Workers’ compensation insurance: This is required by law in most states and provides benefits to employees who are injured or become ill on the job.

- Commercial auto insurance: This is required if your business owns or leases vehicles and covers damage to your vehicles and liability claims arising from accidents.

Factors That Influence Small Business Insurance Premiums in Kansas

Several factors can influence the cost of your small business insurance Kansas premiums, including:

- The type of business you operate: The nature of your business and the risks associated with it will play a significant role in determining your premiums. For example, a construction company will likely pay higher premiums than a retail store.

- The size of your business: The size of your business, measured by the number of employees, revenue, and square footage, will also affect your premiums.

- Your claims history: Your past claims history will be considered by insurers when determining your premiums. A clean claims history can lead to lower premiums.

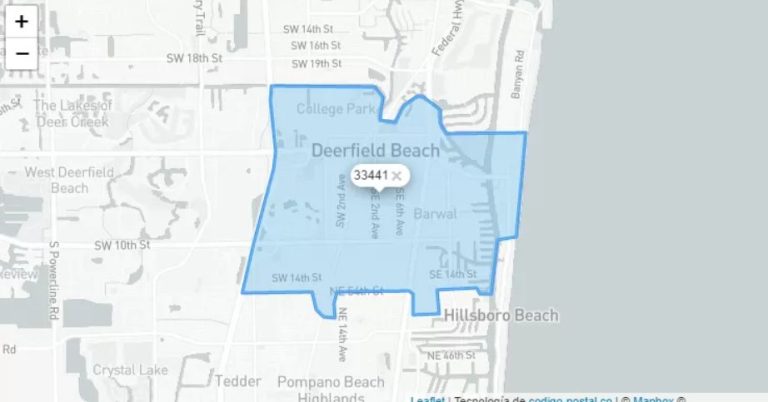

- Your location: The location of your business can also influence your premiums. Businesses in high-crime areas or areas prone to natural disasters may pay higher premiums.

- The coverage limits and deductibles you choose: The amount of coverage you select and the deductibles you choose will also impact your premiums. Higher coverage limits and lower deductibles will generally lead to higher premiums.

Choosing the Right Small Business Insurance Kansas Policy

Choosing the right small business insurance Kansas policy can be a daunting task. However, by following these tips, you can make an informed decision:

- Assess your risks: Start by identifying the risks your business faces. This will help you determine the types of coverage you need.

- Get quotes from multiple insurers: Don’t just go with the first insurer you come across. Get quotes from several different insurers to compare coverage and premiums.

- Read the fine print: Before you purchase a policy, be sure to read the fine print carefully. This will help you understand the coverage limits, exclusions, and conditions of the policy.

- Work with an independent insurance agent: An independent insurance agent can help you assess your risks, compare quotes, and choose the right policy for your needs.

Conclusion

Small business insurance Kansas is an essential investment for any business owner. By protecting your business from unforeseen events, you can ensure its continued success. By understanding the different types of coverage available, the factors that influence premiums, and how to choose the right policy, you can make an informed decision and secure the protection your business needs.

Read More: Business Insurance in Arkansas: A Comprehensive Guide