In the fiercely competitive landscape of today’s job market, small business benefit packages play a crucial role in attracting and retaining top talent. While large corporations may have the resources to offer lavish perks, small businesses can still create attractive and competitive benefit packages that cater to the needs and desires of their employees. In this comprehensive guide, we will explore the various aspects of small business benefit packages, providing valuable insights and practical tips to help you build a benefits program that sets your company apart.

Contents

Understanding the Importance of Small Business Benefit Packages

Small Business Benefit Packages are more than just a collection of perks. They are a strategic investment in your most valuable asset: your employees. A well-structured benefits program can significantly impact your company’s success by:

- Attracting top talent: In a competitive job market, a comprehensive benefits package can be the deciding factor for talented candidates choosing between similar job offers.

- Improving employee morale and engagement: When employees feel valued and supported, they are more likely to be engaged and motivated, leading to increased productivity and better overall performance.

- Reducing employee turnover: A strong benefits package can help reduce employee turnover by fostering a sense of loyalty and commitment to the company.

- Enhancing your company’s reputation: A reputation for offering attractive benefits can help your company attract not only top talent but also potential clients and partners.

Key Components of Small Business Benefit Packages

While small business benefit packages can vary depending on the industry, company size, and budget, there are several key components that are essential for any successful program. These include:

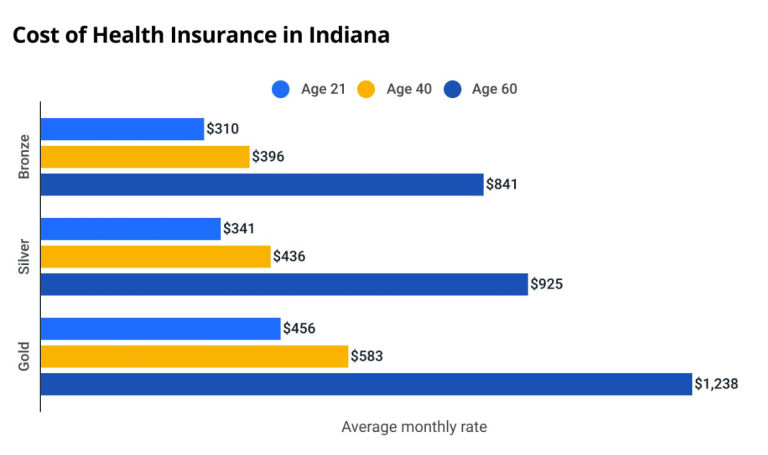

- Health Insurance: Providing health insurance is crucial for attracting and retaining employees. Consider offering a variety of plans to cater to the diverse needs of your workforce.

- Retirement Plans: Offering retirement plans, such as 401(k)s, can help employees secure their financial future and demonstrates your commitment to their long-term well-being.

- Paid Time Off (PTO): PTO allows employees to take time off for vacation, sick leave, or personal reasons, promoting work-life balance and overall well-being.

- Flexible Work Arrangements: Offering flexible work arrangements, such as telecommuting or flexible schedules, can be a valuable benefit for employees with families or other commitments.

- Professional Development Opportunities: Investing in your employees’ professional development through training programs, workshops, or conferences can help them grow and enhance their skills, benefiting both the individual and the company.

Creative and Cost-Effective Small Business Benefit Packages Ideas

While traditional benefits are important, small business benefit packages can also include creative and cost-effective perks that make your company stand out. Some ideas include:

- Wellness Programs: Offering wellness programs, such as gym memberships, yoga classes, or healthy snacks, can promote employee health and well-being, leading to increased productivity and reduced absenteeism.

- Employee Recognition Programs: Recognizing and rewarding employees for their hard work and achievements can boost morale and foster a positive company culture.

- Company-Sponsored Social Events: Organizing company-sponsored social events, such as team outings or holiday parties, can help build camaraderie and strengthen team relationships.

- Employee Discounts: Partnering with local businesses to offer employee discounts on products or services can be a valuable perk that doesn’t cost your company anything.

- Volunteer Time Off (VTO): Providing VTO allows employees to give back to their communities while also promoting your company’s values and social responsibility.

Building Your Small Business Benefit Packages

Creating an effective small business benefit packages requires careful planning and consideration. Here are some steps to help you build a program that meets the needs of your employees and your company:

- Assess your company’s needs and budget: Before designing your benefits package, evaluate your company’s needs, goals, and budget. Consider the size of your workforce, industry standards, and the competitive landscape.

- Gather employee feedback: Involve your employees in the process by conducting surveys or focus groups to gather their feedback on what benefits they value most.

- Research and compare options: Research different benefit providers and compare their offerings, costs, and customer service.

- Communicate your benefits package effectively: Once you’ve designed your benefits package, communicate it clearly and effectively to your employees, highlighting its value and how it supports their well-being.

- Regularly review and update your benefits package: As your company grows and evolves, it’s important to regularly review and update your benefits package to ensure it remains competitive and meets the changing needs of your workforce.

Conclusion

Small business benefit packages are a powerful tool for attracting, retaining, and motivating top talent. By offering a comprehensive and competitive benefits program, you can create a positive work environment, enhance your company’s reputation, and ultimately drive success. Remember, investing in your employees is an investment in the future of your business.

Additional Tips for Creating Effective Small Business Benefit Packages:

- Be transparent: Clearly communicate the details of your benefits package to your employees, including eligibility requirements, costs, and any limitations.

- Offer choice: Provide a variety of benefit options to cater to the diverse needs and preferences of your workforce.

- Make it personal: Consider offering personalized benefits, such as birthday celebrations or anniversary gifts, to show your employees that you care.

- Promote your benefits package: Highlight your benefits package in your job postings, on your company website, and during the onboarding process to attract top talent and showcase your commitment to employee well-being.

- Seek professional advice: If you’re unsure about which benefits to offer or how to structure your program, consult with a benefits advisor or HR professional for expert guidance.

By following these tips and incorporating creativity and flexibility into your small business benefit packages, you can create a program that not only attracts and retains top talent but also fosters a positive and supportive work environment where employees thrive.

Remember, your employees are the heart of your business. Investing in their well-being through a comprehensive benefits package is a smart business strategy that will pay dividends in the long run.

Frequently Asked Questions about Small Business Benefit Packages:

- What are the most common benefits offered by small businesses? The most common benefits offered by small businesses include health insurance, retirement plans, paid time off, and flexible work arrangements.

- How much should small businesses spend on employee benefits? The amount small businesses spend on employee benefits varies depending on the industry, company size, and budget. However, it’s generally recommended to allocate around 10-20% of payroll costs to benefits.

- Can small businesses offer benefits to part-time employees? Yes, small businesses can offer benefits to part-time employees, although the eligibility requirements and coverage levels may differ from those offered to full-time employees.

- Are there any tax advantages to offering employee benefits? Yes, there are several tax advantages to offering employee benefits, both for the employer and the employee. Consult with a tax advisor to learn more about the specific tax benefits available to your business.

- How can small businesses compete with larger companies in terms of benefits? Small businesses can compete with larger companies by offering creative and cost-effective benefits, such as wellness programs, employee recognition programs, and flexible work arrangements. They can also focus on building a strong company culture and emphasizing their unique values and mission to attract top talent.

Remember: Building a successful small business benefit packages is an ongoing process. By regularly evaluating your program, gathering employee feedback, and staying informed about industry trends, you can ensure that your benefits package remains competitive and continues to attract and retain the best talent for your company.

Read More: AthenaHealth Cost: Unveiling the Pricing Structure