Introduction

In the intricate world of business operations, safeguarding your enterprise and your workforce from unforeseen risks is paramount. This is where public liability and workers’ compensation insurance come into play. These two distinct yet complementary insurance policies offer crucial protection for businesses against different types of liabilities. In this comprehensive guide, we’ll delve deep into the nuances of public liability and workers’ compensation insurance, exploring their coverage, benefits, and the critical role they play in shielding your business from financial and legal repercussions.

Public Liability Insurance: Shielding Your Business from Third-Party Claims

- Understanding Public Liability Insurance

Public liability insurance, often referred to as general liability insurance, is designed to protect your business from claims made by third parties for injuries, property damage, or financial loss caused by your business operations, products, or services. It covers legal expenses, compensation payouts, and other associated costs arising from such claims.

- Coverage and Benefits

Public liability insurance typically covers a wide range of scenarios, including:

-

Bodily Injury: If a customer slips and falls on your premises or gets injured due to your product, public liability insurance can cover their medical expenses, lost wages, and other damages.

-

Property Damage: If your business operations accidentally damage a third party’s property, this insurance can cover the repair or replacement costs.

-

Product Liability: If a product you manufacture or sell causes harm to a consumer, public liability insurance can protect you from legal action and compensation claims.

-

Personal Injury: This includes coverage for defamation, libel, slander, and other personal injury claims made by third parties against your business.

-

Who Needs Public Liability Insurance?

While not always mandatory, public liability insurance is strongly recommended for businesses of all sizes and across various industries. If your business interacts with the public, has a physical location, or provides products or services, you should consider obtaining public liability insurance.

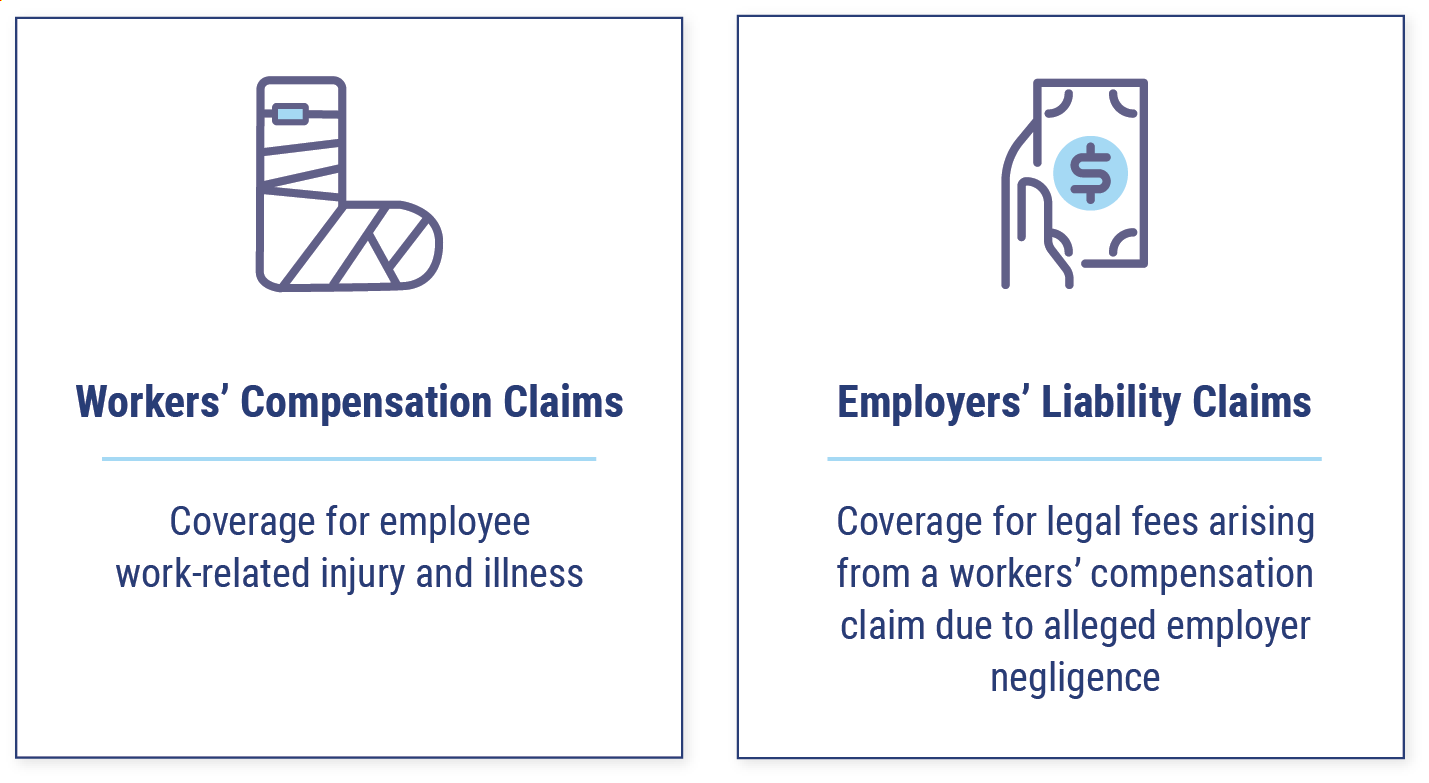

Workers’ Compensation Insurance: Protecting Your Workforce

- Understanding Workers’ Compensation Insurance

Workers’ compensation insurance is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses. It covers medical expenses, lost wages, rehabilitation costs, and, in the unfortunate event of a fatality, death benefits to the employee’s family.

- Coverage and Benefits

Workers’ compensation insurance typically covers:

-

Medical Expenses: This includes doctor’s visits, hospitalization, medication, surgery, and other medical treatments related to the work-related injury or illness.

-

Lost Wages: If an employee is unable to work due to their injury or illness, workers’ compensation insurance replaces a portion of their lost wages.

-

Rehabilitation Costs: This covers the costs of physical therapy, occupational therapy, and other rehabilitation services to help the employee recover and return to work.

-

Death Benefits: In the tragic event of an employee’s death due to a work-related injury or illness, workers’ compensation insurance provides death benefits to their dependents.

-

Mandatory Requirement

In most jurisdictions, workers’ compensation insurance is a legal requirement for businesses with employees. The specific requirements and regulations vary from state to state, so it’s important to consult with an insurance professional to ensure compliance.

The Importance of Both Policies

While public liability and workers’ compensation insurance serve different purposes, they are both essential components of a comprehensive risk management strategy for businesses.

- Public liability insurance protects your business from the financial and legal consequences of third-party claims, while workers’ compensation insurance safeguards your employees and ensures their well-being in the event of work-related accidents or illnesses.

- By having both policies in place, you demonstrate your commitment to responsible business practices and create a safer environment for your customers, employees, and the wider community.

Factors Affecting Premiums

The cost of public liability and workers’ compensation insurance premiums can vary significantly depending on several factors, including:

- Industry: The type of industry you operate in and the associated risks play a major role in determining premiums.

- Number of Employees: The size of your workforce directly impacts the cost of workers’ compensation insurance.

- Claims History: Your business’s past claims history can influence both public liability and workers’ compensation insurance premiums.

- Coverage Limits: The level of coverage you choose will naturally affect the cost of your insurance policies.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial to ensure you receive the best coverage and support for your business needs. Consider the following factors when choosing an insurance provider:

- Reputation and Financial Stability: Opt for a reputable insurer with a strong financial track record to ensure they can fulfill their obligations in the event of a claim.

- Coverage Options: Choose a provider that offers comprehensive coverage options tailored to your specific industry and business risks.

- Customer Service: Excellent customer service is essential for timely claims processing and support throughout the insurance process.

- Pricing: While cost is a factor, it shouldn’t be the sole determining factor. Prioritize comprehensive coverage and reliable service over the lowest price.

Conclusion

In the unpredictable landscape of business, protecting your assets and your workforce is non-negotiable. Public liability and workers’ compensation insurance are not merely expenses; they are investments in the long-term security and sustainability of your business. By understanding the nuances of these policies, their coverage, and their benefits, you can make informed decisions to safeguard your enterprise from unforeseen risks and ensure the well-being of your employees. Remember, a well-protected business is a thriving business, and the right insurance policies are your partners in achieving lasting success.

I hope this comprehensive article provides you with a thorough understanding of public liability and workers’ compensation insurance. Should you have any further questions or require additional information, please don’t hesitate to ask.