In the rugged and expansive state of Wyoming, small businesses form the backbone of the economy. From ranches and farms to local shops and restaurants, these enterprises contribute significantly to the state’s vitality. Ensuring the health and well-being of their employees is a priority for these businesses, but navigating the complexities of small business health insurance in Wyoming can be a daunting task.

Contents

The Challenges Faced by Small Businesses in Wyoming

Small businesses in Wyoming face unique challenges when it comes to providing health insurance to their employees. The state’s vast geography and dispersed population can lead to limited options and higher costs. Additionally, the relatively small size of many businesses can make it difficult to negotiate favorable rates with insurance providers.

Key Considerations for Small Businesses in Wyoming

When exploring small business health insurance in Wyoming, there are several key factors to consider:

- Group Size: The number of employees in your business can impact your eligibility for certain plans and the premiums you pay.

- Employee Demographics: The age and health status of your employees can also influence the cost of insurance.

- Coverage Options: Consider the level of coverage you want to provide, including medical, dental, and vision benefits.

- Network Providers: Ensure that the insurance plan includes a network of healthcare providers that is accessible to your employees.

- Cost: Evaluate the premiums, deductibles, and out-of-pocket expenses associated with different plans.

Exploring the Options: Types of Small Business Health Insurance in Wyoming

Small business health insurance in Wyoming typically falls into a few main categories:

- Fully Insured Plans: These plans are offered by insurance companies and provide a comprehensive set of benefits. The insurance company assumes the financial risk for claims.

- Self-Funded Plans: In this model, the employer assumes the financial risk for claims and pays for them directly. This approach can offer more flexibility but also carries greater risk.

- Level-Funded Plans: These plans combine elements of both fully insured and self-funded plans. The employer pays a fixed monthly premium, and any unused funds are returned at the end of the year.

- Health Reimbursement Arrangements (HRAs): HRAs allow employers to reimburse employees for qualified medical expenses, including individual health insurance premiums.

The Role of the Affordable Care Act (ACA)

The Affordable Care Act (ACA) has had a significant impact on small business health insurance in Wyoming. It established the Small Business Health Options Program (SHOP) Marketplace, which offers a platform for small businesses to compare and purchase health insurance plans. The ACA also introduced several provisions aimed at making health insurance more accessible and affordable for small businesses, such as tax credits and employer shared responsibility payments.

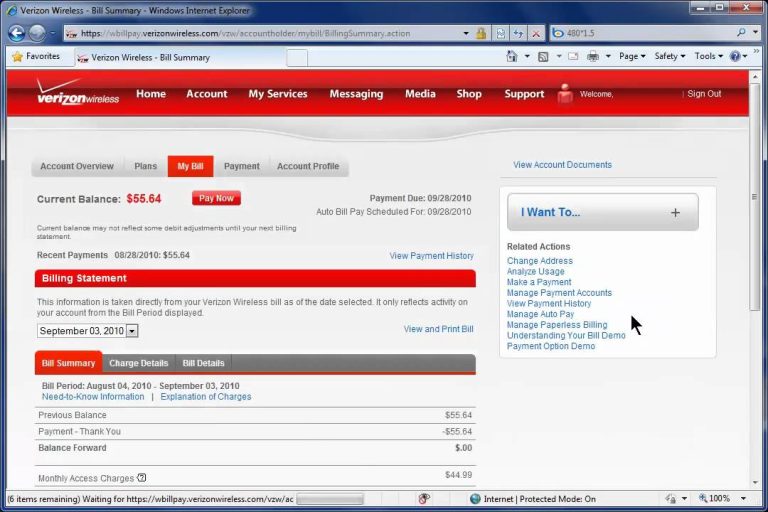

Navigating the SHOP Marketplace in Wyoming

The SHOP Marketplace in Wyoming provides a valuable resource for small businesses seeking health insurance. It offers a variety of plans from different insurance companies, allowing businesses to compare coverage options and costs. To be eligible for the SHOP Marketplace, a business must have fewer than 50 full-time equivalent employees.

Additional Resources for Small Businesses in Wyoming

In addition to the SHOP Marketplace, there are several other resources available to small businesses in Wyoming seeking health insurance:

- Wyoming Department of Insurance: The Department of Insurance provides information and assistance on insurance-related matters, including health insurance for small businesses.

- Wyoming Small Business Development Center (SBDC): The SBDC offers counseling and training programs to help small businesses navigate various challenges, including health insurance.

- Insurance Brokers and Agents: Licensed insurance professionals can provide expert guidance and assistance in selecting the right health insurance plan for your business.

The Importance of Employee Education and Engagement

Providing health insurance is only one part of the equation. It is equally important to educate your employees about their coverage options and encourage them to take an active role in their healthcare decisions. Consider offering wellness programs and resources to promote healthy behaviors and reduce healthcare costs.

The Future of Small Business Health Insurance in Wyoming

The landscape of small business health insurance in Wyoming is constantly evolving. As healthcare costs continue to rise, it is crucial for small businesses to stay informed about the latest developments and explore innovative solutions to provide affordable and comprehensive coverage to their employees.

Conclusion

Providing small business health insurance in Wyoming can be a complex undertaking, but it is an essential investment in the health and well-being of your employees. By understanding the challenges, exploring the options, and utilizing available resources, you can navigate the complexities and find the right coverage for your business. Remember, a healthy workforce is a productive workforce, and investing in their health is an investment in the success of your business.