Contents

Understanding the Importance of Minnesota Business Insurance

In a world where uncertainties abound, businesses face a multitude of risks that can jeopardize their operations and financial stability. Natural disasters, property damage, accidents, lawsuits, and cyberattacks are just a few examples of the potential threats that loom over businesses. The consequences of these events can be devastating, leading to financial losses, reputational damage, and even closure.

Minnesota business insurance serves as a protective barrier, mitigating the impact of these risks and ensuring that businesses can recover and thrive. It provides financial compensation for losses, covers legal expenses, and offers peace of mind to business owners, allowing them to focus on what they do best – running their businesses.

Types of Minnesota Business Insurance

Minnesota business insurance encompasses a range of coverage options, each designed to address specific risks and needs. Let’s explore some of the most common types of business insurance available in Minnesota:

1. General Liability Insurance

General liability insurance is the cornerstone of business insurance, providing broad protection against common risks. It covers bodily injury, property damage, and personal and advertising injury that may occur on your business premises or as a result of your operations. For example, if a customer slips and falls in your store, general liability insurance can cover their medical expenses and any legal costs associated with a potential lawsuit.

2. Property Insurance

Property insurance safeguards your business’s physical assets, including buildings, equipment, inventory, and furniture. It covers losses resulting from fire, theft, vandalism, and other covered perils. Whether your business owns or leases its premises, property insurance ensures that you can rebuild and replace damaged or stolen property.

3. Workers’ Compensation Insurance

In Minnesota, workers’ compensation insurance is mandatory for most businesses with employees. It provides benefits to employees who suffer work-related injuries or illnesses, covering medical expenses, lost wages, and rehabilitation costs. This insurance not only protects your employees but also shields your business from potential lawsuits and financial burdens.

4. Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is essential for businesses that provide professional services, such as consultants, lawyers, accountants, and healthcare providers. It covers claims arising from negligence, errors, or omissions in the performance of professional services. For example, if a client alleges that your advice led to financial losses, professional liability insurance can cover your legal defense and any settlements or judgments.

5. Commercial Auto Insurance

If your business owns or uses vehicles for business purposes, commercial auto insurance is crucial. It covers bodily injury, property damage, and medical payments resulting from accidents involving your business vehicles. Whether your employees use company cars, trucks, or vans, commercial auto insurance ensures that you are protected on the road.

6. Business Interruption Insurance

Business interruption insurance provides financial support if your business operations are disrupted by a covered event, such as a fire or natural disaster. It covers lost income,

In today’s digital age, cyber liability insurance is increasingly important. It covers losses resulting from data breaches, cyberattacks, and other cyber incidents. This insurance can cover the costs of notifying affected individuals, providing credit monitoring services, and defending against lawsuits or regulatory actions.

Choosing the Right Minnesota Business Insurance

Selecting the appropriate Minnesota business insurance for your business requires careful consideration of your specific needs and risks. Here are some key factors to consider:

1. Industry and Business Type

Different industries face unique risks, and your business type will influence the types of insurance coverage you need. For example, a construction company may require more extensive liability coverage than a retail store.

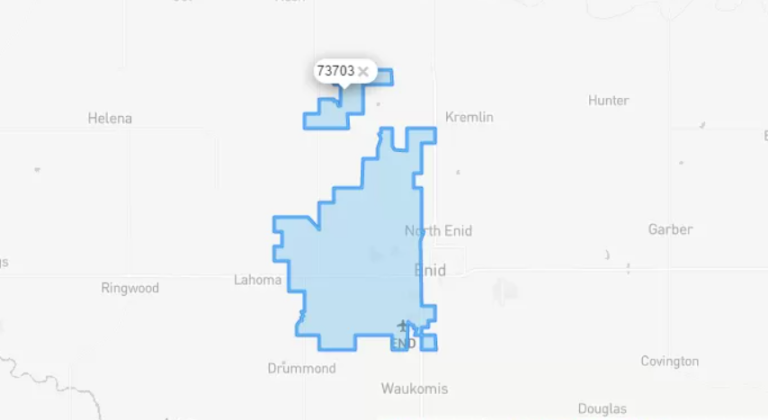

2. Size and Location

The size and location of your business can also impact your insurance needs. Larger businesses with multiple locations may require higher coverage limits than smaller businesses. Additionally, businesses located in areas prone to natural disasters may need to consider additional coverage for those risks.

3. Risk Tolerance

Your risk tolerance plays a role in determining the level of coverage you choose. If you are comfortable with a higher deductible in exchange for lower premiums, you may opt for less extensive coverage. However, if you prefer greater peace of mind, you may choose higher coverage limits and lower deductibles.

4. Budget

Minnesota business insurance premiums can vary depending on the coverage options you choose and the insurance provider you select. It’s essential to consider your budget and balance the cost of insurance with the level of protection it provides.

Working with a Minnesota Business Insurance Agent

Navigating the complexities of Minnesota business insurance can be overwhelming. A knowledgeable and experienced insurance agent can guide you through the process, assess your risks, and recommend the most appropriate coverage options for your business. They can also help you compare quotes from different insurance providers and ensure that you get the best value for your money.

Conclusion

In the dynamic business landscape of Minnesota, uncertainties are inevitable. However, with the right Minnesota business insurance in place, businesses can face these challenges with confidence and resilience. By protecting against financial losses, legal liabilities, and operational disruptions, business insurance empowers entrepreneurs to pursue their dreams and achieve their goals.