Medicare is a vital lifeline for millions of Americans aged 65 and older, providing essential health coverage for hospital stays, doctor visits, and other medical services. However, Medicare doesn’t cover everything, leaving gaps in coverage that can lead to significant out-of-pocket costs. That’s where Medigap plans, also known as Medicare Supplement Insurance, come in.

In this comprehensive guide, we will delve into the world of Medigap plans, exploring their benefits, different plan options, enrollment process, and factors to consider when making a decision. Whether you are newly eligible for Medicare or looking to switch your existing Medigap plan, this guide will equip you with the knowledge you need to make an informed choice.

Understanding Medigap Plans

What are Medigap Plans?

Medigap plans 2020 are standardized insurance policies offered by private insurance companies. These plans are designed to fill the “gaps” in Original Medicare coverage, helping you pay for expenses such as deductibles, copayments, and coinsurance.

Benefits of Medigap Plans

-

Predictable Costs: Medigap plans provide financial security by helping you budget for healthcare expenses. You’ll know in advance what your out-of-pocket costs will be, allowing you to plan accordingly.

-

Freedom of Choice: With a Medigap plan, you have the freedom to see any doctor or specialist who accepts Medicare, without the need for referrals or network restrictions.

-

Peace of Mind: Knowing that you have comprehensive coverage can give you peace of mind and reduce stress related to healthcare costs.

-

Travel Coverage: Most Medigap plans offer coverage for emergency care while traveling outside the United States.

Medigap Plan Options

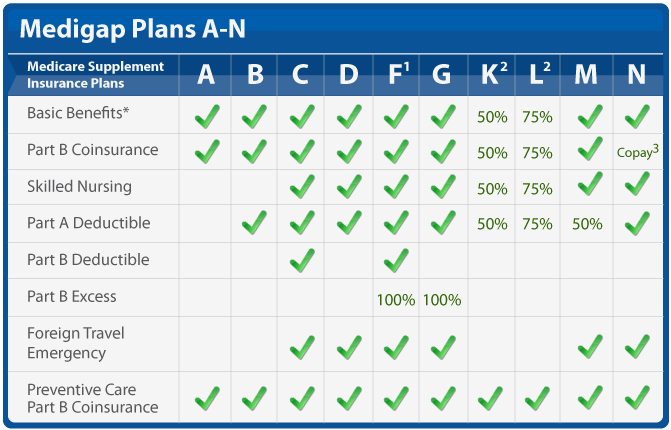

There are ten standardized Medigap plans available, each labeled with a letter (A, B, C, D, F, G, K, L, M, N). Each plan offers a different set of benefits, with Plan A providing the most basic coverage and Plan F offering the most comprehensive coverage (Plan F is no longer available to new enrollees as of January 1, 2020).

Key Differences Between Plans:

-

Coverage for Medicare Part A Deductible: Plans A, B, C, D, F, G, M, and N cover the Part A deductible.

-

Coverage for Medicare Part B Deductible: Plans C and F cover the Part B deductible.

-

Coverage for Part B Excess Charges: Plans F and G cover Part B excess charges (the difference between what a doctor charges and what Medicare approves).

-

Coverage for Skilled Nursing Facility Coinsurance: Plans A, B, C, D, F, G, K, L, M, and N cover the coinsurance for skilled nursing facility care.

-

Coverage for Foreign Travel Emergency: Plans C, D, F, G, M, and N provide coverage for emergency care while traveling outside the United States.

Choosing the Right Medigap Plan

Selecting the right Medigap plan requires careful consideration of your individual needs and budget. Here are some factors to keep in mind:

-

Your Health Needs: If you have pre-existing conditions or anticipate needing frequent medical care, a more comprehensive plan might be a better choice.

-

Your Budget: Medigap plans have monthly premiums, and more comprehensive plans typically have higher premiums. Consider your budget and choose a plan that you can comfortably afford.

-

Your Preferences: Some people prefer the peace of mind that comes with a more comprehensive plan, while others are comfortable with a more basic plan and are willing to accept some out-of-pocket costs.

-

Availability in Your Area: Not all Medigap plans are available in every area. Check with insurance companies to see which plans are offered where you live.

Medigap Open Enrollment Period

The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. This six-month period begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this period, you have the guaranteed right to enroll in any Medigap plan available in your area, regardless of your health status.

Important Considerations

-

Medigap plans do not cover prescription drugs. You will need a separate Medicare Part D plan for prescription drug coverage.

-

You cannot have both a Medigap plan and a Medicare Advantage plan. You must choose one or the other.

-

Medigap plan premiums can vary significantly between insurance companies. It’s important to compare quotes from multiple companies before making a decision.

-

Once you enroll in a Medigap plan, you generally cannot be denied coverage or charged higher premiums based on your health status. However, there are some exceptions, such as if you have a pre-existing condition and enroll outside of your Medigap Open Enrollment Period.

Conclusion

Medigap plans 2020 play a crucial role in supplementing Original Medicare coverage, providing financial protection and peace of mind for millions of beneficiaries. By understanding the different plan options, considering your individual needs, and enrolling during your Medigap Open Enrollment Period, you can make an informed decision and secure the coverage you need to enjoy a healthy and worry-free retirement.

Read More: Group Health Quotes: Navigating the Complexities of Employer-Sponsored Health Insurance