Navigating the world of Medicare can be overwhelming, especially when it comes to understanding the nuances of Medicare Supplement plans, also known as Medigap plans. In Missouri, these plans offer crucial additional coverage to help you manage out-of-pocket costs that Original Medicare doesn’t cover. In this exclusive article, we delve into the intricacies of Medicare Supplement plans Missouri, providing you with a comprehensive guide to make informed decisions about your healthcare coverage.

Understanding Medicare Supplement Plans

Original Medicare (Parts A and B) provides essential healthcare coverage, but it doesn’t cover everything. This is where Medicare Supplement plans step in. These plans are designed to fill the “gaps” in Original Medicare coverage, such as deductibles, coinsurance, and copayments. By choosing the right Medigap plan, you can significantly reduce your out-of-pocket expenses and enjoy greater peace of mind.

Key Benefits of Medicare Supplement Plans in Missouri

- Predictable Costs: Medigap plans offer predictable out-of-pocket costs, allowing you to budget for your healthcare expenses more effectively.

- Freedom of Choice: With a Medicare Supplement plan, you have the freedom to see any doctor or specialist who accepts Medicare, without needing referrals.

- Nationwide Coverage: Most Medigap plans provide coverage anywhere in the United States, giving you the flexibility to travel and receive care wherever you go.

- Guaranteed Renewable: As long as you pay your premiums on time, your Medigap plan is guaranteed renewable, even if your health changes.

- No Network Restrictions: Unlike Medicare Advantage plans, Medigap plans don’t have network restrictions, giving you access to a wider range of healthcare providers.

Medicare Supplement Plan Options in Missouri

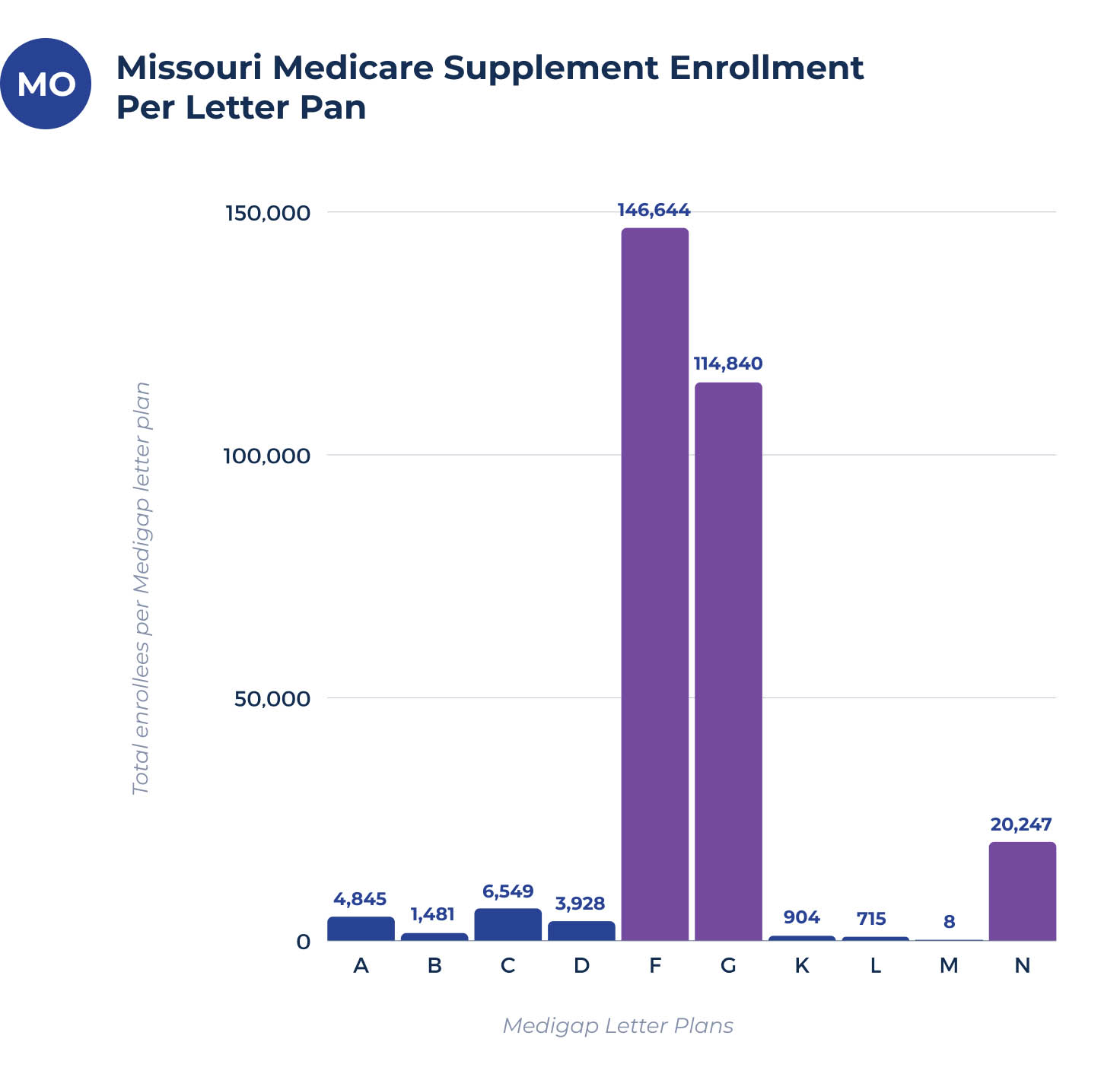

In Missouri, there are ten standardized Medicare Supplement plans, each labeled with a letter (A, B, C, D, F, G, K, L, M, N). Each plan offers a different set of benefits, so it’s important to compare them carefully to find the one that best suits your needs and budget.

Plan A: This is the most basic Medigap plan, offering core benefits such as coverage for Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

Plan B: Plan B offers all the benefits of Plan A, plus coverage for Medicare Part B coinsurance or copayments.

Plan C: This plan provides comprehensive coverage, including coverage for Medicare Part A deductible, Part B deductible, Part B excess charges, skilled nursing facility care coinsurance, and foreign travel emergency care.

Plan D: Plan D offers similar coverage to Plan C but doesn’t cover Part B excess charges.

Plan F: This plan was the most comprehensive Medigap plan available, offering all the benefits of Plan C plus coverage for Part B excess charges. However, it’s no longer available to new Medicare beneficiaries as of January 1, 2020.

Plan G: Plan G is now considered the most comprehensive Medigap plan available to new beneficiaries. It offers all the benefits of Plan F except for coverage of the Part B deductible.

Plan K: This plan offers partial coverage for certain Medicare costs, including 50% coverage for Part A coinsurance and hospital costs, Part B coinsurance or copayments, and hospice care copayments or coinsurance.

Plan L: Plan L also offers partial coverage, including 75% coverage for Part A coinsurance and hospital costs, Part B coinsurance or copayments, and hospice care copayments or coinsurance.

Plan M: This plan offers similar coverage to Plan D but with a lower premium and some additional benefits, such as coverage for foreign travel emergency care.

Plan N: Plan N offers similar coverage to Plan G but with a lower premium and some cost-sharing requirements, such as copayments for doctor visits and emergency room visits.

Choosing the Right Medicare Supplement Plan in Missouri

Selecting the right Medicare Supplement plan requires careful consideration of several factors:

- Your Healthcare Needs: Assess your current and anticipated healthcare needs. If you have frequent doctor visits or require specialized care, a more comprehensive plan might be beneficial.

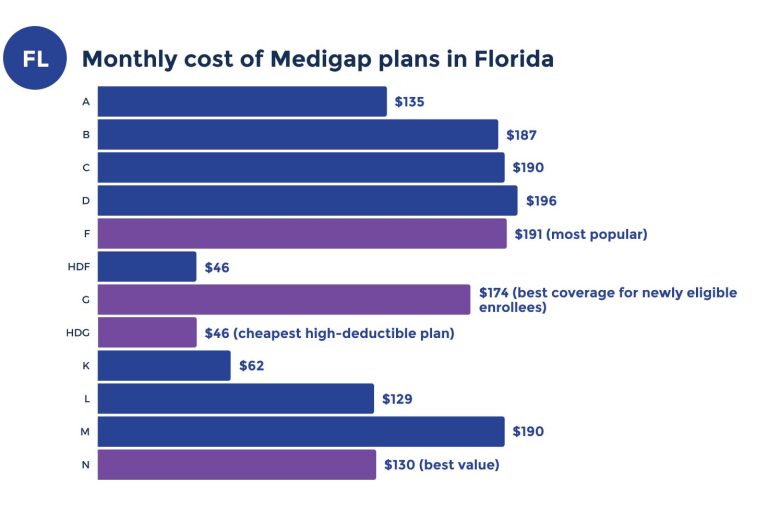

- Your Budget: Medigap plans have varying premiums. Consider your budget and choose a plan that offers adequate coverage without straining your finances.

- Your Risk Tolerance: If you prefer predictable costs and comprehensive coverage, a plan with higher premiums might be suitable. If you’re comfortable with some cost-sharing and are willing to accept a bit more risk, a plan with lower premiums might be a better fit.

- Your Eligibility: Some Medigap plans have specific enrollment periods. It’s crucial to understand these periods to avoid potential enrollment restrictions or higher premiums.

How to Enroll in a Medicare Supplement Plan in Missouri

The best time to enroll in a Medicare Supplement plan Missouri is during your Medigap Open Enrollment Period. This period starts on the first day of the month you turn 65 and are enrolled in Medicare Part B and lasts for six months. During this time, you have the guaranteed right to enroll in any Medigap plan available in your area, regardless of your health condition.

If you miss your Medigap Open Enrollment Period, you might still be able to enroll in a plan, but you could face medical underwriting. This means that insurance companies can assess your health and potentially deny coverage or charge higher premiums based on your health status.

To enroll in a Medigap plan, you can contact insurance companies directly or work with a licensed insurance agent who specializes in Medicare. They can help you compare plans, understand the enrollment process, and choose the best option for your needs.

Tips for Comparing Medicare Supplement Plans in Missouri

- Get Quotes from Multiple Companies: Don’t settle for the first plan you come across. Get quotes from several insurance companies to compare premiums and benefits.

- Consider the Company’s Reputation: Choose a reputable insurance company with a strong financial rating and a history of good customer service.

- Read the Fine Print: Carefully review the plan’s policy documents to understand the coverage details, exclusions, and limitations.

- Ask Questions: If you have any questions about a specific plan, don’t hesitate to ask the insurance company or agent for clarification.

Additional Resources for Medicare Supplement Plans in Missouri

- Missouri Department of Insurance, Financial Institutions & Professional Registration (DIFP): The DIFP provides valuable information and resources about Medicare Supplement plans in Missouri. You can visit their website or contact them directly for assistance.

- State Health Insurance Assistance Program (SHIP): SHIP offers free, unbiased counseling and assistance to Medicare beneficiaries in Missouri. They can help you understand your options, compare plans, and enroll in coverage.

- Medicare.gov: The official Medicare website provides detailed information about Medicare Supplement plans, including plan comparisons and enrollment guidelines.

Conclusion

Choosing the right Medicare Supplement plan is a crucial step in securing your healthcare coverage and managing your out-of-pocket costs. By understanding the different Medicare Supplement plans Missouri options, comparing plans carefully, and enrolling during your Medigap Open Enrollment Period, you can ensure that you have the coverage you need to enjoy a healthy and financially secure retirement. Remember, it’s never too early to start planning for your Medicare coverage. Take the time to research your options, ask questions, and make informed decisions about your healthcare future.

Read More: Short-Term Health Insurance in Wyoming: A Comprehensive Guide