Understanding Medicare Supplement Plans

Before we dive into the specifics of Medicare Supplement Plan G in Florida, let’s first grasp the concept of Medicare Supplement plans, also known as Medigap plans.

What are Medicare Supplement Plans?

- Medicare Supplement plans are private insurance policies designed to fill the “gaps” in Original Medicare (Part A and Part B) coverage.

- Original Medicare covers a significant portion of your healthcare expenses, but it doesn’t cover everything. This is where Medigap plans step in, helping you pay for out-of-pocket costs such as deductibles, copayments, and coinsurance.

Why Choose a Medicare Supplement Plan?

- Predictable Costs: Medigap plans offer predictable out-of-pocket costs, allowing you to budget for your healthcare expenses effectively.

- Freedom of Choice: With a Medigap plan, you have the freedom to choose any doctor or hospital that accepts Medicare, giving you flexibility and control over your healthcare decisions.

- Travel Benefits: Most Medigap plans offer coverage nationwide, ensuring you have access to care even when you’re away from home.

Medicare Supplement Plan G in Florida: An In-Depth Look

Now, let’s turn our attention to the star of the show: Medicare Supplement Plan G in Florida.

What Does Medicare Supplement Plan G Cover?

Medicare Supplement Plan G in Florida offers comprehensive coverage, leaving you with minimal out-of-pocket expenses. Here’s a breakdown of what it covers:

- Part A Deductible: Plan G covers the Part A deductible, which is the amount you pay when you’re hospitalized.

- Part B Coinsurance: It covers the 20% coinsurance for Part B services, such as doctor visits, outpatient procedures, and medical equipment.

- Part B Excess Charges: Plan G covers Part B excess charges, which are additional fees some doctors may charge beyond the Medicare-approved amount.

- Blood: It covers the first 3 pints of blood needed for medical procedures.

- Skilled Nursing Facility Coinsurance: Plan G covers the coinsurance for skilled nursing facility care after a hospital stay.

- Hospice Care Coinsurance or Copayment: It covers any coinsurance or copayments for hospice care.

- Foreign Travel Emergency: Plan G offers coverage for emergency care while traveling outside the U.S., up to plan limits.

What Doesn’t Medicare Supplement Plan G Cover?

While Medicare Supplement Plan G in Florida offers extensive coverage, it’s important to be aware of what it doesn’t cover:

- Part B Deductible: Plan G does not cover the Part B deductible, which is the annual amount you pay before Medicare starts covering Part B services.

- Part D Prescription Drug Coverage: It does not include prescription drug coverage. You’ll need to enroll in a separate Part D plan for that.

Is Medicare Supplement Plan G Right for You?

Medicare Supplement Plan G in Florida is an excellent option for individuals seeking comprehensive coverage and predictable healthcare costs. However, it’s crucial to consider your individual needs and budget before making a decision.

- If you value comprehensive coverage and want to minimize out-of-pocket expenses, Plan G is a strong contender.

- If you’re comfortable paying the Part B deductible and prefer a slightly lower monthly premium, Plan N might be a suitable alternative.

- If you require prescription drug coverage, remember to enroll in a separate Part D plan.

Choosing the Right Insurance Company

Once you’ve decided on Medicare Supplement Plan G in Florida, the next step is to choose a reputable insurance company. Here are some factors to consider:

- Financial Stability: Ensure the company has a strong financial rating, indicating its ability to pay claims.

- Customer Service: Choose a company with excellent customer service, providing prompt and helpful assistance when you need it.

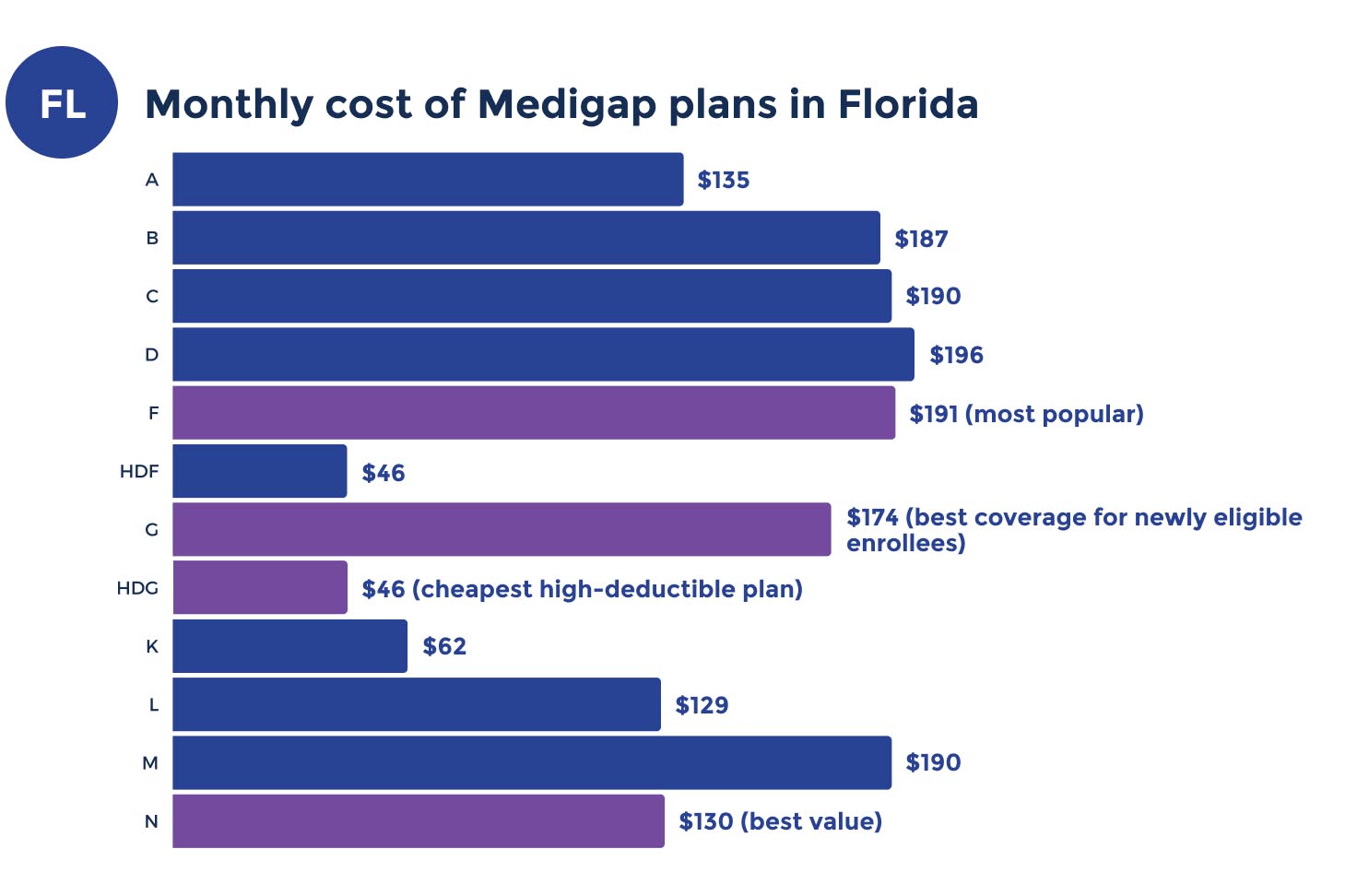

- Plan Pricing: Compare quotes from different companies to find the most competitive rates for Medicare Supplement Plan G in Florida.

Tips for Enrolling in Medicare Supplement Plan G in Florida

- Open Enrollment Period: The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period, which starts on the first day of the month you turn 65 and are enrolled in Part B. During this period, you have guaranteed issue rights, meaning you cannot be denied coverage or charged higher premiums based on your health condition.

- Underwriting: If you miss your Open Enrollment Period, you may be subject to medical underwriting, where the insurance company can evaluate your health and potentially deny coverage or charge higher premiums.

- Seek Assistance: If you’re overwhelmed by the enrollment process, don’t hesitate to seek assistance from a licensed insurance agent specializing in Medicare. They can guide you through the available options and help you choose the right plan for your needs.

Conclusion

Medicare Supplement Plan G in Florida provides comprehensive coverage and peace of mind, allowing you to focus on your health and well-being. By understanding the ins and outs of this plan, comparing quotes from different insurance companies, and enrolling during your Open Enrollment Period, you can secure the best possible healthcare coverage for your golden years in the Sunshine State.

Read More: CT Insurance Companies: Navigating the Insurance Landscape in Connecticut