Life insurance for those with pre-existing conditions can seem like an insurmountable challenge. The fear of rejection, coupled with the misconception that it’s unaffordable, often deters individuals from seeking this essential financial protection. However, contrary to popular belief, securing life insurance with pre-existing conditions is not only possible but also crucial for safeguarding your loved ones’ financial future.

Understanding Pre-Existing Conditions

What are Pre-Existing Conditions?

A pre-existing condition is any medical condition that existed before applying for a life insurance policy. These conditions can range from chronic illnesses like diabetes and heart disease to mental health conditions like depression and anxiety.

How Pre-Existing Conditions Affect Life Insurance

Traditionally, insurers viewed pre-existing conditions as high-risk factors, leading to higher premiums or even outright denials. The rationale behind this was the increased likelihood of claims due to the individual’s health condition. However, with advancements in medical technology and a better understanding of risk assessment, the landscape of life insurance for those with pre-existing conditions has evolved significantly.

The Importance of Life Insurance for Those with Pre-Existing Conditions

Financial Security for Your Loved Ones

The primary purpose of life insurance is to provide financial security to your beneficiaries in the event of your untimely demise. For individuals with pre-existing conditions, this becomes even more critical. The death benefit can help your family cover funeral expenses, outstanding debts, mortgage payments, and other living expenses, ensuring their financial well-being during a difficult time.

Peace of Mind

Knowing that your loved ones are financially protected can offer immense peace of mind. It allows you to focus on managing your health and living your life to the fullest without worrying about the financial burden your passing might place on your family.

Navigating the Life Insurance Market with Pre-Existing Conditions

Types of Life Insurance Policies

When exploring life insurance options with pre-existing conditions, you’ll encounter several policy types. Each has its own features and benefits, and the right choice for you will depend on your individual needs and circumstances.

-

Term Life Insurance: This policy provides coverage for a specific term, typically 10, 20, or 30 years. It’s generally the most affordable option and ideal for those seeking temporary protection.

-

Whole Life Insurance: This policy offers lifelong coverage and also includes a cash value component that grows over time. It’s a more expensive option but provides permanent protection and can be used for various financial goals.

-

Guaranteed Issue Life Insurance: This policy guarantees acceptance regardless of your health condition. However, it typically comes with lower coverage limits and higher premiums.

-

Simplified Issue Life Insurance: This policy requires answering a few health-related questions but doesn’t necessitate a medical exam. It offers a balance between affordability and accessibility.

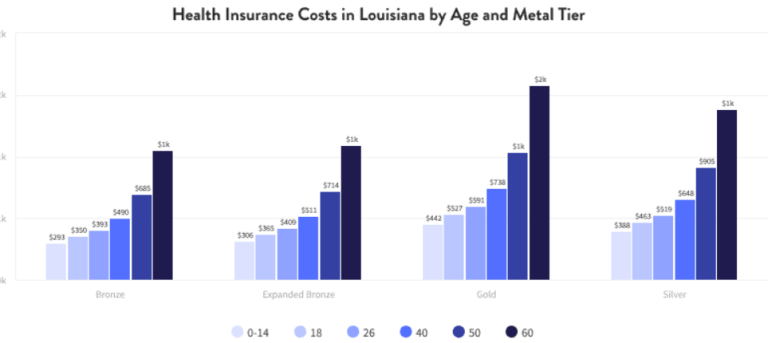

Factors Affecting Life Insurance Premiums

Several factors influence life insurance premiums for those with pre-existing conditions. Understanding these factors can help you make informed decisions and find the most suitable policy.

-

Type and Severity of the Pre-Existing Condition: The specific condition you have and its severity will significantly impact your premiums. Conditions considered high-risk, such as heart disease or cancer, may lead to higher premiums.

-

Age and Gender: Age and gender play a role in premium calculations. Generally, older individuals and males tend to pay higher premiums.

-

Lifestyle Factors: Lifestyle choices, such as smoking or engaging in high-risk activities, can also affect your premiums.

-

Coverage Amount and Policy Term: The amount of coverage you choose and the policy term will directly influence your premiums. Higher coverage and longer terms typically result in higher premiums.

Finding the Right Life Insurance Policy

Securing life insurance with pre-existing conditions requires careful research and consideration. Here are some essential steps to help you find the right policy:

-

Consult with an Independent Insurance Agent: An independent agent can access multiple insurance carriers and compare quotes, ensuring you get the best possible coverage at the most competitive price.

-

Be Honest and Transparent: Disclose all your pre-existing conditions upfront. Withholding information can lead to policy denial or claim rejection in the future.

-

Consider a Medical Exam: While some policies don’t require a medical exam, undergoing one can potentially lower your premiums if your health condition is well-managed.

-

Compare Quotes: Don’t settle for the first policy you come across. Compare quotes from different insurers to find the most suitable option.

-

Review the Policy Carefully: Before signing any documents, thoroughly review the policy terms and conditions to ensure you understand the coverage, exclusions, and limitations.

Tips for Securing Affordable Life Insurance with Pre-Existing Conditions

While premiums for those with pre-existing conditions might be higher, there are ways to secure affordable coverage:

-

Manage Your Health: Effectively managing your pre-existing condition through medication, lifestyle changes, and regular medical checkups can demonstrate to insurers that you’re taking proactive steps to maintain your health.

-

Shop Around: Comparing quotes from multiple insurers is crucial. Different insurers have varying underwriting guidelines and risk assessments, which can lead to significant premium differences.

-

Consider a Guaranteed or Simplified Issue Policy: If traditional policies prove too expensive, guaranteed or simplified issue policies offer an alternative, albeit with lower coverage limits.

-

Work with a Specialized Agent: Some insurance agents specialize in helping individuals with pre-existing conditions find suitable coverage. Their expertise can be invaluable in navigating the complex insurance market.

-

Review Your Policy Regularly: Your health and financial needs may change over time. Review your policy periodically to ensure it still meets your requirements.

Conclusion

Life insurance for those with pre-existing conditions is not an impossibility. With the right approach and guidance, you can secure the financial protection your loved ones deserve. Remember, it’s never too early to start planning for the future. By taking proactive steps today, you can ensure your family’s financial well-being even in the face of challenging health conditions.

Read More: Small Business Benefit Packages: A Comprehensive Guide to Attracting and Retaining Top Talent