Contents

Understanding the Importance of Iowa Business Insurance

Iowa business insurance serves as a financial safety net, safeguarding your enterprise from potential risks and uncertainties. It provides coverage for property damage, liability claims, employee injuries, and other unforeseen events that could disrupt your business operations. By investing in comprehensive Iowa business insurance, you can mitigate risks, protect your assets, and ensure the continuity of your business.

Types of Iowa Business Insurance

1. General Liability Insurance

General liability insurance is a fundamental component of Iowa business insurance. It protects your business from claims of bodily injury, property damage, and personal injury caused by your operations, products, or services. For example, if a customer slips and falls on your premises, general liability insurance can cover their medical expenses and legal costs.

2. Property Insurance

Property insurance is essential for safeguarding your physical assets, such as buildings, equipment, inventory, and furniture. It provides coverage against damage caused by fire, theft, vandalism, and natural disasters. In Iowa, where severe weather events like tornadoes and hailstorms are common, property insurance is particularly crucial.

3. Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory in Iowa for businesses with one or more employees. It provides benefits to employees who suffer work-related injuries or illnesses, covering medical expenses, lost wages, and rehabilitation costs. By complying with Iowa’s workers’ compensation laws, you protect your employees and your business from potential lawsuits.

4. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is vital for businesses that provide professional services, such as consultants, lawyers, accountants, and healthcare providers. It protects against claims of negligence, errors, or omissions in the performance of professional duties.

5. Business Interruption Insurance

Business interruption insurance provides coverage for lost income and ongoing expenses if your business is forced to close temporarily due to a covered event, such as a fire or natural disaster. It can help you meet financial obligations, such as rent, payroll, and loan payments, while your business recovers.

6. Commercial Auto Insurance

Commercial auto insurance is necessary if your business owns or leases vehicles for business purposes. It provides coverage for liability claims, property damage, and medical expenses arising from accidents involving your business vehicles.

7. Cyber Liability Insurance

In today’s digital age, cyber liability insurance is becoming increasingly important. It protects your business from financial losses and reputational damage resulting from cyberattacks, data breaches, and other cybercrimes.

Factors Affecting Iowa Business Insurance Costs

Several factors influence the cost of Iowa business insurance. These include:

- Industry: The nature of your business and the associated risks play a significant role in determining insurance premiums. High-risk industries, such as construction and manufacturing, typically have higher insurance costs.

- Size of Business: The size of your business, measured by factors such as revenue, number of employees, and square footage, affects insurance premiums. Larger businesses typically require more extensive coverage and therefore face higher costs.

- Location: Your business location within Iowa can influence insurance rates. Areas prone to natural disasters or high crime rates may have higher premiums.

- Coverage Limits and Deductibles: The coverage limits you choose and the deductibles you select impact insurance costs. Higher coverage limits and lower deductibles typically result in higher premiums.

- Claims History: Your business’s claims history can influence insurance rates. A clean claims history demonstrates responsible risk management and can lead to lower premiums.

- Insurance Provider: Different insurance providers offer varying rates and coverage options. It’s essential to compare quotes from multiple providers to find the best fit for your business needs and budget.

Tips for Choosing the Right Iowa Business Insurance

- Assess Your Risks: Identify the specific risks faced by your business based on your industry, location, and operations. This will help you determine the types and levels of coverage you need.

- Consult an Insurance Agent: An experienced insurance agent can guide you through the complex world of Iowa business insurance, help you assess your risks, and recommend appropriate coverage options.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare rates, coverage options, and customer service.

- Review Coverage Annually: As your business evolves, your insurance needs may change. Review your coverage annually to ensure it remains adequate and aligned with your current operations.

- Bundle Policies: Many insurance providers offer discounts for bundling multiple policies, such as unforeseen risks and ensuring its long-term success. By investing in comprehensive coverage, you can mitigate potential losses, safeguard your assets, and maintain business continuity. Remember, Iowa business insurance is not just an expense; it’s an investment in the future of your business.

Additional Tips for Iowa Businesses

- Develop a Risk Management Plan: In addition to insurance, implement risk management strategies to reduce the likelihood of claims and potential losses. This can include safety training for employees, regular equipment maintenance, and cybersecurity protocols.

- Consider Industry-Specific Coverage: Some industries have unique risks that require specialized coverage. Consult with an insurance agent to explore industry-specific options that may be relevant to your business.

- Maintain Accurate Records: Keep detailed records of your business assets, inventory, and financial information. This will facilitate the claims process in the event of a loss.

- Report Claims Promptly: If you experience a covered loss, report it to your insurance provider promptly. This will help expedite the claims process and ensure timely compensation.

- Stay Informed: Stay abreast of changes in Iowa’s insurance laws and regulations. This will help you ensure compliance and avoid potential penalties.

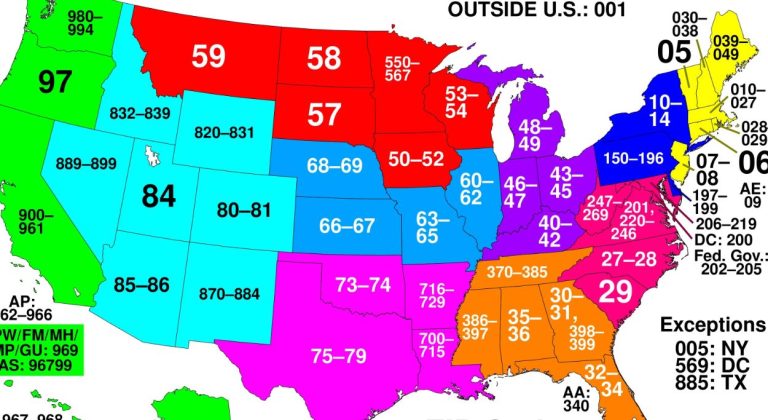

Read More: ZIP Code Info: Unlocking the Secrets Behind the Numbers