South Carolina, known for its beautiful coastline, historic charm, and Southern hospitality, also has a thriving insurance market. Whether you’re a longtime resident or new to the state, understanding insurance quotes SC is crucial for protecting yourself, your loved ones, and your assets. In this comprehensive guide, we’ll delve into the intricacies of insurance quotes in South Carolina, exploring different types of coverage, factors influencing premiums, and tips for securing the best deals.

Contents

Understanding Insurance Quotes SC: The Basics

Insurance quotes SC are essentially estimates of what you’ll pay for a specific insurance policy in the state. These quotes consider various factors such as your age, driving history, location, type of vehicle, and coverage options. It’s important to compare insurance quotes SC from multiple providers to ensure you’re getting the most competitive rates and the coverage that best suits your needs.

Types of Insurance Coverage in South Carolina

South Carolina, like other states, mandates certain types of insurance coverage to protect drivers and vehicle owners. The most common types of insurance quotes SC you’ll encounter include:

- Auto Insurance Quotes SC: This covers damages to your vehicle and others involved in an accident, as well as liability for bodily injury and property damage.

- Homeowners Insurance Quotes SC: Protects your home and belongings from perils such as fire, theft, and natural disasters.

- Life Insurance Quotes SC: Provides financial security to your loved ones in the event of your passing.

- Health Insurance Quotes SC: Covers medical expenses, hospital stays, and other healthcare services.

Factors Affecting Insurance Quotes SC

Several factors influence insurance quotes SC. Understanding these can help you anticipate potential costs and make informed decisions about your coverage:

- Driving History: A clean driving record typically leads to lower auto insurance quotes SC.

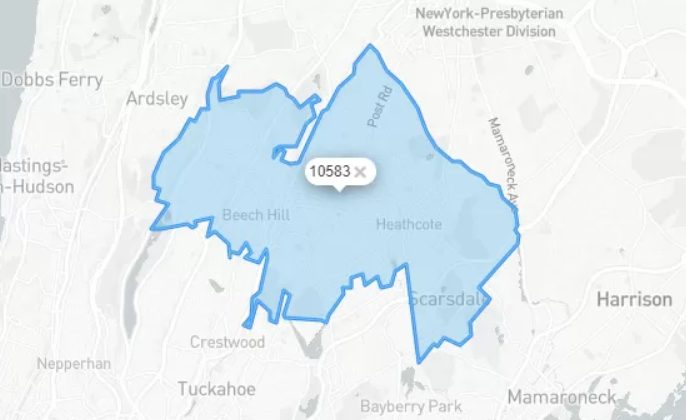

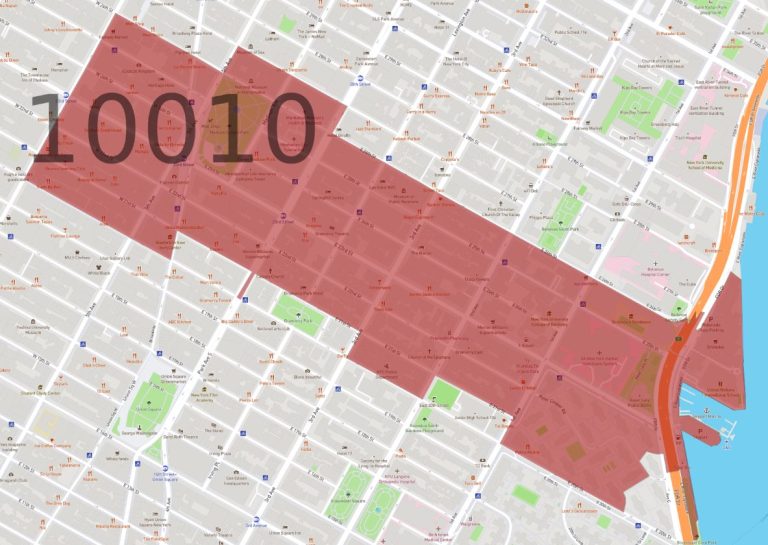

- Location: Where you live in South Carolina can impact your homeowners insurance quotes SC, as some areas are more prone to natural disasters or crime.

- Age and Gender: Younger drivers and males often face higher auto insurance quotes SC.

- Credit Score: A good credit score can sometimes result in lower insurance quotes SC across various types of coverage.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles usually mean higher insurance quotes SC.

- Discounts: Many insurers offer discounts for things like bundling multiple policies, having safety features in your car, or completing a defensive driving course.

How to Get the Best Insurance Quotes SC

- Shop Around: Don’t settle for the first insurance quote SC you receive. Compare quotes from multiple providers to find the best rates and coverage options.

- Bundle Policies: Many insurers offer discounts if you bundle your auto, home, and other insurance policies with them.

- Ask About Discounts: Inquire about available discounts, such as those for good driving, safety features, or students with good grades.

- Review Your Coverage Annually: Your insurance needs may change over time, so it’s important to review your coverage annually and make adjustments as needed.

- Maintain a Good Credit Score: A good credit score can sometimes lead to lower insurance quotes SC.

- Consider Increasing Your Deductible: Opting for a higher deductible can lower your monthly premiums, but ensure you can afford the out-of-pocket expense in case of a claim.

Additional Tips for Finding Affordable Insurance Quotes SC

- Work with an Independent Agent: An independent insurance agent can help you compare insurance quotes SC from multiple providers and find the best coverage for your needs.

- Look for Group Insurance: If you’re employed, check if your employer offers group insurance plans, as these can often be more affordable than individual policies.

- Take Advantage of Online Comparison Tools: Online comparison tools can help you quickly and easily compare insurance quotes SC from various providers.

Insurance Quotes SC: A Final Word

Securing the right insurance quotes SC is essential for safeguarding your financial well-being and peace of mind. By understanding the types of coverage available, factors influencing premiums, and tips for finding affordable rates, you can make informed decisions and protect yourself from unexpected events. Remember, shopping around and comparing insurance quotes SC is crucial to finding the best deals and ensuring you have the coverage you need in the Palmetto State.