In the complex world of healthcare, medical practitioners face a myriad of risks that could jeopardize their careers and financial stability. From malpractice lawsuits to property damage, the potential liabilities are substantial. That’s where insurance for medical practice comes into play. This essential safeguard provides financial protection and peace of mind, allowing medical professionals to focus on what they do best – providing quality care to their patients.

Types of Insurance for Medical Practice

A robust insurance plan for medical practice typically comprises several types of coverage, each designed to address specific risks. Let’s delve into some of the most crucial ones:

1. Medical Malpractice Insurance

Often considered the cornerstone of insurance for medical practice, medical malpractice insurance protects healthcare providers against claims of negligence or errors that result in patient harm. It covers legal fees, settlements, and judgments, shielding practitioners from potentially devastating financial losses.

-

Claims-Made vs. Occurrence Policies:

- Claims-made policies cover claims filed during the policy period, regardless of when the incident occurred.

- Occurrence policies cover claims arising from incidents that occurred during the policy period, even if the claim is filed after the policy expires.

-

Tail Coverage:

- Tail coverage extends the reporting period for claims-made policies after the policy expires, providing continued protection for incidents that occurred during the policy period but are reported later.

2. General Liability Insurance

General liability insurance protects medical practices against claims of bodily injury or property damage that occur on their premises or as a result of their operations. It covers legal fees, settlements, and medical expenses, safeguarding practitioners from financial losses due to accidents or injuries.

3. Business Property Insurance

Business property insurance protects medical practices against damage to their physical assets, including buildings, equipment, and inventory. It covers losses due to fire, theft, vandalism, and natural disasters, ensuring that practices can recover and resume operations quickly after an unexpected event.

4. Cyber Liability Insurance

In today’s digital age, cyberattacks pose a significant threat to medical practices. Cyber liability insurance protects against data breaches, ransomware attacks, and other cybercrimes, covering costs associated with data recovery, notification, credit monitoring, and legal defense.

5. Workers’ Compensation Insurance

Workers’ compensation insurance provides benefits to employees who suffer work-related injuries or illnesses. It covers medical expenses, lost wages, and disability benefits, ensuring that employees receive the care and financial support they need to recover.

6. Employment Practices Liability Insurance (EPLI)

EPLI protects medical practices against claims of discrimination, harassment, wrongful termination, and other employment-related issues. It covers legal fees, settlements, and judgments, shielding practices from financial losses and reputational damage.

7. Directors and Officers (D&O) Insurance

D&O insurance protects the directors and officers of medical practices against claims of mismanagement, breach of fiduciary duty, and other wrongful acts. It covers legal fees, settlements, and judgments, providing financial protection for those in leadership positions.

Factors Affecting Insurance Premiums

Several factors influence the cost of insurance for medical practice, including:

- Specialty: High-risk specialties, such as surgery and obstetrics, typically face higher premiums due to the increased likelihood of malpractice claims.

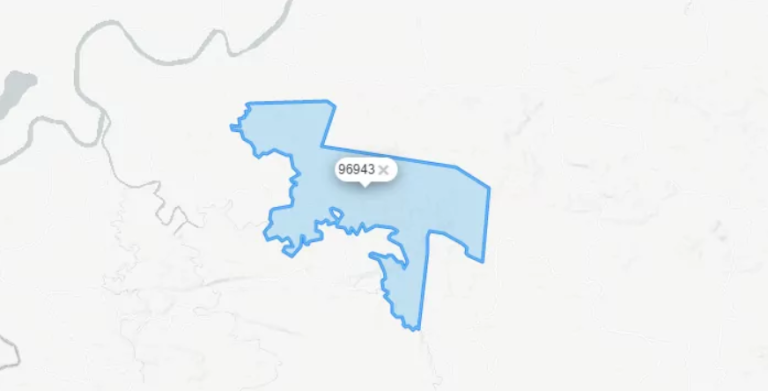

- Location: Premiums can vary depending on the location of the practice, with areas with higher litigation rates or healthcare costs generally having higher premiums.

- Claims History: Practices with a history of malpractice claims or other incidents may face higher premiums due to the perceived increased risk.

- Coverage Limits: Higher coverage limits naturally translate to higher premiums, as the insurer assumes a greater financial responsibility in the event of a claim.

- Deductibles: Opting for higher deductibles can lower premiums, but it also means that the practice will have to pay more out-of-pocket in the event of a claim.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial for ensuring adequate coverage and peace of mind. Consider the following factors when making your decision:

- Financial Strength: Choose a provider with a strong financial rating, indicating their ability to pay claims promptly and in full.

- Reputation: Look for a provider with a good reputation for customer service and claims handling.

- Coverage Options: Ensure that the provider offers the types of coverage you need and the flexibility to customize your policy.

- Premiums: Compare quotes from multiple providers to ensure you’re getting a competitive rate.

- Customer Service: Choose a provider that is responsive and accessible, providing support when you need it.

Tips for Managing Insurance Costs

While insurance for medical practice is essential, it’s also important to manage costs effectively. Here are some tips:

- Risk Management: Implement robust risk management practices to minimize the likelihood of claims and incidents.

- Loss Control: Take proactive steps to prevent accidents and injuries, such as implementing safety protocols and providing employee training.

- Claims Management: Report claims promptly and cooperate fully with the insurer’s investigation to facilitate a smooth and timely resolution.

- Policy Review: Review your policies annually to ensure they remain adequate and aligned with your practice’s evolving needs.

- Bundling: Consider bundling multiple policies with the same provider to potentially qualify for discounts.

Conclusion

Insurance for medical practice is an indispensable investment for healthcare providers, offering financial protection and peace of mind in an increasingly litigious and complex environment. By understanding the different types of coverage, factors affecting premiums, and tips for managing costs, medical practitioners can make informed decisions to safeguard their careers and financial well-being. Remember, the right insurance plan is not just an expense; it’s an invaluable asset that empowers medical professionals to focus on what matters most – delivering exceptional care to their patients.

Read More: Health Insurance Companies Charleston SC: Navigating Your Options in the Holy City