Understanding Your Insurance Coverage

-

Review Your Plan:

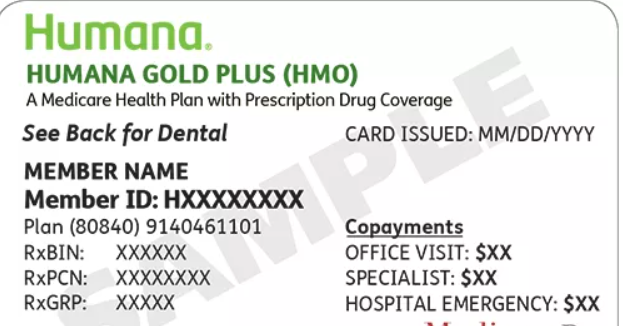

- Carefully examine your insurance plan documents or contact your insurance provider to understand your mental health benefits.

- Identify covered services, including therapy types, session limits, deductibles, copays, and out-of-pocket maximums.

-

In-Network vs. Out-of-Network Providers:

- In-network providers are contracted with your insurance company, offering services at lower costs.

- Out-of-network providers may not be covered, or you might face higher out-of-pocket expenses.

- Check your plan’s network directory for a list of covered therapists.

-

Pre-Authorization and Referrals:

- Some plans require pre-authorization or a referral from your primary care physician before starting therapy.

- Contact your insurance provider to confirm if these are needed.

Finding a Therapist

-

Insurance Provider’s Directory:

- Start your search by using your insurance company’s online directory of in-network therapists.

- Filter results based on location, specialty, therapy type, and language preferences.

-

Online Therapist Directories:

- Utilize online directories like Psychology Today, GoodTherapy, or TherapyDen to find therapists who accept your insurance.

-

Referrals from Trusted Sources:

- Ask your primary care physician, friends, family, or support groups for recommendations.

-

Contacting Therapists:

- When contacting potential therapists, verify their in-network status, availability, and areas of expertise.

- Inquire about their approach, fees, and any sliding scale options if cost is a concern.

Questions to Ask Potential Therapists

-

Insurance and Fees:

- Do you accept my insurance plan?

- What are your session fees?

- Do you offer a sliding scale or payment plans?

-

Experience and Expertise:

- What is your experience in treating my specific concerns?

- What therapeutic approaches do you use?

- Are you licensed and credentialed?

-

Availability and Logistics:

- What are your available appointment times?

- Do you offer virtual or in-person sessions?

- What is your cancellation policy?

-

Therapeutic Fit:

- What is your approach to building a therapeutic relationship?

- How do you measure progress in therapy?

- Can you provide testimonials or references?

Maximizing Your Insurance Benefits

-

Understand Your Out-of-Pocket Costs:

- Be aware of your deductible, copays, and coinsurance responsibilities.

- Factor in these costs when budgeting for therapy.

-

Track Your Claims:

- Keep track of submitted claims, payments, and any explanations of benefits (EOBs) received.

- Contact your insurance provider if you have any questions or discrepancies.

-

Appeal Denied Claims:

- If a claim is denied, request a detailed explanation and consider filing an appeal.

- Provide any necessary documentation or supporting evidence.

-

Utilize Employee Assistance Programs (EAPs):

- If your employer offers an EAP, inquire about available mental health services and any potential cost savings.

Overcoming Challenges

-

Limited In-Network Options:

- If your options are limited, consider advocating for an out-of-network exception or seeking a single-case agreement.

- Explore community mental health centers or sliding scale clinics for affordable options.

-

Long Waitlists:

- If waitlists are long, consider joining multiple waitlists, exploring group therapy, or seeking temporary support through crisis hotlines or online resources.

-

Insurance Denials:

- If claims are consistently denied, consult with a patient advocate or attorney specializing in insurance issues.

Additional Tips

-

Be Your Own Advocate:

- Don’t hesitate to ask questions, seek clarification, and advocate for your needs throughout the process.

- Be persistent and proactive in navigating any challenges that arise.

-

Prioritize Your Mental Health:

- Remember that seeking therapy is an investment in your well-being.

- Don’t let financial concerns prevent you from accessing the care you deserve.

-

Explore Alternative Options:

- If insurance coverage is unavailable or inadequate, consider community resources, online therapy platforms, or support groups.

Conclusion

Accessing therapy through insurance can be a complex process, but it’s a worthwhile endeavor to prioritize your mental health. By understanding your coverage, researching therapists, and maximizing your benefits, you can successfully navigate the system and receive the care you need. Remember, you’re not alone in this journey, and numerous resources are available to support you along the way.

Read More: Delaware Medicare Supplement Plans: A Comprehensive Guide