The question “Does LASIK take insurance?” is one that many people considering this vision correction procedure ask. While the allure of clear vision without glasses or contact lenses is strong, the potential cost can be a major factor in the decision-making process. So, can you use your insurance to cover LASIK?

Contents

The Short Answer

Generally speaking, most health insurance plans do not cover LASIK. It is considered an elective procedure, meaning it’s not medically necessary for your health. However, there are exceptions and nuances to this rule, which we will delve into in this article.

Why Doesn’t Health Insurance Usually Cover LASIK?

Health insurance is designed to cover medically necessary procedures and treatments, those essential for maintaining your health or treating an illness or injury. Since LASIK is primarily aimed at improving quality of life and convenience, it falls outside the scope of most health insurance plans.

Are There Any Exceptions?

While the general rule is that health insurance doesn’t cover LASIK, there are some exceptions:

- Occupational Requirements: In certain professions, such as aviation or law enforcement, excellent uncorrected vision might be a job requirement. In such cases, some insurance plans might offer partial or full coverage for LASIK.

- Medical Necessity: If you have a medical condition that makes wearing glasses or contact lenses problematic or impossible, your insurance might cover LASIK as a medically necessary procedure. Conditions such as severe dry eye or allergies to contact lens materials might qualify.

- Vision Insurance Plans: Some vision insurance plans offer discounts or partial coverage for LASIK, even though it’s not a covered benefit. These plans often work with a network of LASIK providers, offering reduced rates to their members.

How to Find Out If Your Insurance Covers LASIK

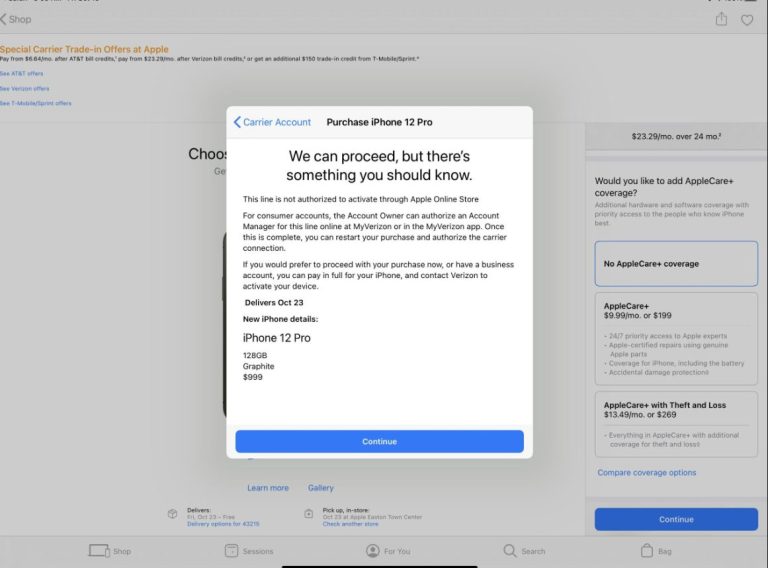

If you’re considering LASIK, it’s crucial to contact your insurance provider directly to inquire about coverage. Here are some questions to ask:

- Does my plan offer any coverage for LASIK?

- Are there any specific conditions under which LASIK would be covered?

- Do I need to get pre-authorization before the procedure?

- Are there any network providers I need to use?

- What is the maximum amount my plan will cover?

Alternatives to Insurance Coverage

If your insurance doesn’t cover LASIK, don’t despair. There are other ways to make this procedure more affordable:

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): These tax-advantaged accounts allow you to set aside pre-tax dollars to pay for eligible medical expenses, including LASIK.

- Financing Options: Many LASIK providers offer financing plans with low or no interest rates, making the procedure more manageable.

- LASIK Discounts and Promotions: Keep an eye out for special offers and discounts from LASIK providers.

The Importance of Considering the Overall Cost

While insurance coverage or discounts can significantly reduce the out-of-pocket cost of LASIK, it’s crucial to consider the overall cost, including any pre- and post-operative care, medications, and follow-up visits. It’s also essential to choose a reputable and experienced LASIK surgeon, even if it means paying a bit more. Remember, your vision is priceless.

Conclusion

So, does LASIK take insurance? The answer is not a simple yes or no. While most health insurance plans do not cover LASIK, there are exceptions and alternative ways to make the procedure more affordable. It’s crucial to do your research, contact your insurance provider, and explore all your options before making a decision. Remember, the goal is to achieve clear vision safely and effectively, and that might involve considering various financial strategies.

Read More: Life Insurance in Virginia: A Comprehensive Guide