Navigating the world of small business health insurance can be a daunting task. With numerous options available, it’s important to choose a plan that provides comprehensive coverage and fits your budget. Blue Cross Blue Shield (BCBS) is a trusted name in health insurance, offering a wide range of plans specifically designed for small businesses. In this comprehensive guide, we will delve into the intricacies of BCBS small business health insurance, exploring its benefits, plan options, cost considerations, and the application process.

Benefits of BCBS Small Business Health Insurance

Extensive Network of Providers

One of the significant advantages of BCBS small business health insurance is its extensive network of healthcare providers. This allows your employees to access quality care from a wide range of doctors, specialists, and hospitals, ensuring they receive the treatment they need without limitations.

Comprehensive Coverage Options

BCBS offers a variety of health insurance plans tailored to meet the diverse needs of small businesses. These plans typically include essential health benefits such as preventive care, hospitalization, prescription drugs, and mental health services. Depending on your specific requirements and budget, you can choose a plan that provides the right balance of coverage and affordability.

Cost-Saving Opportunities

As a small business owner, controlling costs is crucial. BCBS recognizes this and offers various cost-saving opportunities for small businesses. These may include wellness programs, health savings accounts (HSAs), and flexible spending accounts (FSAs), allowing you to manage your healthcare expenses effectively.

Dedicated Customer Support

BCBS understands the importance of providing exceptional customer service. They have dedicated teams available to assist small businesses with any questions or concerns related to their health insurance plans. This ensures that you receive prompt and personalized support throughout your journey.

Plan Options for Small Businesses

Health Maintenance Organization (HMO) Plans

HMO plans are a popular choice for small businesses due to their cost-effectiveness. With an HMO plan, your employees will have a designated primary care physician (PCP) who will coordinate their care and refer them to specialists when needed. While HMO plans offer lower premiums, they typically have a more restricted network of providers compared to other options.

Preferred Provider Organization (PPO) Plans

PPO plans provide more flexibility in choosing healthcare providers compared to HMO plans. Your employees can visit any doctor or specialist within the network without needing a referral from their PCP. While PPO plans may have slightly higher premiums, they offer greater freedom and access to a wider range of providers.

Point of Service (POS) Plans

POS plans combine features of both HMO and PPO plans. Like HMO plans, your employees will have a designated PCP who coordinates their care. However, they also have the option to see out-of-network providers, albeit at a higher cost. POS plans offer a balance between cost-effectiveness and flexibility.

High Deductible Health Plans (HDHPs)

HDHPs are characterized by lower monthly premiums but higher deductibles. These plans are often paired with HSAs, allowing your employees to save pre-tax dollars for qualified medical expenses. HDHPs are a suitable option for individuals who anticipate lower healthcare needs and are comfortable with managing their healthcare costs proactively.

Cost Considerations

When selecting a BCBS small business health insurance plan, it’s important to consider the cost implications. Several factors influence the cost of your premiums, including:

Number of Employees

The size of your workforce plays a significant role in determining the cost of your health insurance premiums. Larger businesses may benefit from economies of scale and receive more competitive rates.

Age and Health of Employees

The age and health of your employees also impact the cost of premiums. Older individuals or those with pre-existing conditions may have higher healthcare needs, leading to increased premiums.

Plan Type and Coverage Level

The type of plan you choose and the level of coverage it provides directly affect the cost. Plans with richer benefits and broader networks typically have higher premiums.

Location

The cost of healthcare services varies across different regions. Therefore, your location can influence the cost of your premiums.

Applying for BCBS Small Business Health Insurance

Gather Employee Information

Before applying for BCBS small business health insurance, gather the necessary information about your employees, including their names, dates of birth, and Social Security numbers. This will streamline the application process and ensure accuracy.

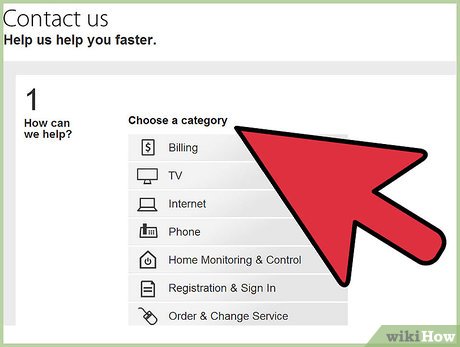

Contact a BCBS Representative

Reach out to a BCBS representative or licensed insurance agent specializing in small business health insurance. They will guide you through the application process, answer any questions, and help you compare different plan options.

Complete the Application

Fill out the application form accurately and provide all the required documentation. Double-check all information before submitting the application to avoid delays or errors.

Review and Select a Plan

Once your application is processed, review the available plan options and their associated costs. Compare the benefits, coverage levels, and provider networks to select a plan that best suits your business needs and budget.

Conclusion

Providing health insurance to your employees is not only a legal requirement in many cases but also an essential aspect of attracting and retaining top talent. Blue Cross Blue Shield small business health insurance offers a comprehensive solution, providing access to quality care, cost-saving opportunities, and dedicated customer support. By carefully considering your business needs, exploring plan options, and understanding cost considerations, you can make an informed decision and secure a health insurance plan that safeguards the well-being of your employees and contributes to the overall success of your business.

Read More: Elite POS: Revolutionizing Point-of-Sale Systems for Modern Businesses