In the dynamic world of business, unforeseen challenges can arise at any moment. A fire could damage your inventory, a customer could slip and fall on your premises, or a cyberattack could compromise your valuable data. These risks can translate to significant financial losses, legal battles, and even the closure of your business. This is where affordable business insurance steps in, providing a crucial safety net that protects your company from the unexpected. This comprehensive guide will delve deeper into the types of affordable business insurance, the factors influencing cost, and strategies for finding the most cost-effective coverage to safeguard your business.

Contents

Why Affordable Business Insurance is Essential

Every business, from a small startup to a large corporation, faces risks. Affordable business insurance is not merely an option; it’s a necessity for safeguarding your company’s financial health and future. Let’s explore some real-world scenarios to understand why business insurance is so critical:

- Example 1: The Devastating Fire: A small bakery suffers a devastating fire caused by faulty wiring. Without property insurance, the owner faces the daunting task of rebuilding the entire establishment from scratch, a cost that could easily bankrupt the business.

- Example 2: The Slip and Fall Lawsuit: A customer slips on a wet floor in a retail store and sustains a serious injury. The customer sues the store owner, resulting in a lengthy legal battle and a hefty settlement. General liability insurance covers legal fees and potential damages, protecting the business from financial ruin.

- Example 3: The Cyberattack: A cybercriminal hacks into a company’s network, stealing sensitive customer data and demanding a ransom. The company must pay for data recovery, notify affected customers, and potentially face legal action. Cyber liability insurance covers these costs and helps the business recover from the attack.

These examples highlight the wide range of risks businesses face and the potential financial devastation they can cause. Affordable business insurance mitigates these risks, allowing you to focus on growing your business without the constant fear of the unknown.

Types of Affordable Business Insurance Coverage: A Deeper Dive

Now that we understand the importance of business insurance, let’s delve deeper into the various types of coverage available and how they can benefit your company:

-

General Liability Insurance: This policy is often considered the foundation of business insurance. It protects your business from claims of bodily injury, property damage, personal injury (such as libel or slander), and advertising injury. It typically covers legal fees, settlements, and judgments, even if the claims are groundless.

-

Professional Liability Insurance (Errors and Omissions Insurance): This type of insurance is crucial for professionals who provide services, such as consultants, lawyers, accountants, and healthcare providers. It covers claims of negligence, mistakes, or failure to deliver on promised services.

-

Commercial Property Insurance: This policy protects your business property, including buildings, equipment, inventory, and furniture, from damage or loss due to fire, theft, vandalism, and natural disasters. It can also cover the cost of business interruption if your property is damaged and you cannot operate.

-

Workers’ Compensation Insurance: In most states, this insurance is mandatory for businesses with employees. It covers medical expenses, disability benefits, and lost wages for employees who are injured or become ill due to their work.

-

Business Interruption Insurance: This policy replaces lost income and covers ongoing expenses if your business is temporarily closed due to a covered event, such as a fire or natural disaster. It helps you stay afloat during difficult times and ensures you can reopen your doors as soon as possible.

-

Cyber Liability Insurance: With the increasing threat of cyberattacks, this type of insurance is becoming increasingly important. It covers losses resulting from cyberattacks, data breaches, and other cyber risks, including the cost of notifying affected customers, legal fees, and regulatory fines.

-

Product Liability Insurance: If your business manufactures, distributes, or sells products, this insurance is essential. It protects you against claims for injuries or damages caused by your products, including legal fees, settlements, and medical expenses.

-

Commercial Auto Insurance: If your business uses vehicles for business purposes, this insurance is mandatory in most states. It covers liability and physical damage to your vehicles, as well as injuries to other drivers and passengers.

Factors Affecting Affordable Business Insurance Costs

The cost of affordable business insurance varies depending on several factors, including:

- Industry: Some industries are inherently riskier than others, leading to higher premiums. For example, construction and manufacturing businesses typically face higher insurance costs due to the potential for injuries and accidents.

- Business Size: Larger businesses with more employees and assets generally require more extensive coverage, resulting in higher premiums.

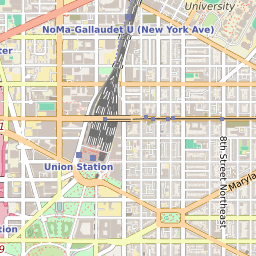

- Location: Insurance rates can vary significantly depending on your location. Businesses in areas prone to natural disasters, such as earthquakes or hurricanes, may face higher premiums.

- Claims History: If your business has a history of frequent claims, insurers may view you as a higher risk and charge higher premiums.

Finding Affordable Business Insurance: Beyond the Basics

In addition to the tips mentioned earlier, here are some additional strategies for finding the most cost-effective business insurance:

- Consider a Business Owners Policy (BOP): A BOP combines several types of coverage, such as general liability, property insurance, and business interruption insurance, into one convenient package. This can often be more affordable than purchasing individual policies.

- Work with an Independent Insurance Agent: An independent agent can shop around for you, comparing quotes from multiple insurers to find the best coverage and rates for your specific needs.

- Review Your Policy Annually: Your business insurance needs may change over time. Review your policy annually to ensure you have adequate coverage and are not paying for coverage you no longer need.

- Implement Risk Management Practices: Taking steps to reduce risks in your business can make you more attractive to insurers and potentially lower your premiums. This could include installing security cameras, implementing safety protocols for employees, or conducting regular cybersecurity audits.

Conclusion

Affordable business insurance is not a luxury; it’s a critical investment in the future of your company. By understanding the types of coverage available, the factors influencing cost, and the strategies for finding the most cost-effective options, you can protect your business from unexpected events and ensure its long-term success. Remember, the cheapest insurance is not always the best. It’s essential to choose a policy that provides adequate coverage for your specific risks and business needs. Don’t hesitate to seek the advice of an insurance professional to help you navigate the complex world of business insurance and find the perfect fit for your company.