For seniors and individuals with mobility challenges, bathing can become a daunting task. Walk-in tubs offer a safe and accessible solution, but the cost can be a concern. Fortunately, under certain circumstances, Medicare may provide coverage for walk-in tubs. In this comprehensive guide, we will delve into the intricacies of Medicare coverage for walk-in tubs, helping you navigate the process and make informed decisions about your bathing needs.

Contents

Understanding Medicare Coverage for Walk-in Tubs

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as certain younger individuals with disabilities. While Medicare does not typically cover walk-in tubs as a standalone item, there are specific scenarios where coverage may be possible.

Medicare Part B and Durable Medical Equipment

Medicare Part B covers medically necessary durable medical equipment (DME), which includes certain items that assist with daily living activities. In some cases, a walk-in tub may qualify as DME if it is deemed medically necessary by your physician.

Criteria for Medicare Coverage of Walk-in Tubs

For a walk-in tub to be considered medically necessary under Medicare, certain criteria must be met:

- Physician’s Prescription: Your physician must prescribe the walk-in tub as medically necessary for the treatment of a specific medical condition.

- Medical Necessity: The walk-in tub must be deemed essential for improving your health or preventing further deterioration of your condition.

- Documentation: Your physician must provide detailed documentation supporting the medical necessity of the walk-in tub.

- Supplier Requirements: The walk-in tub must be purchased from a Medicare-approved supplier.

Navigating the Medicare Claims Process

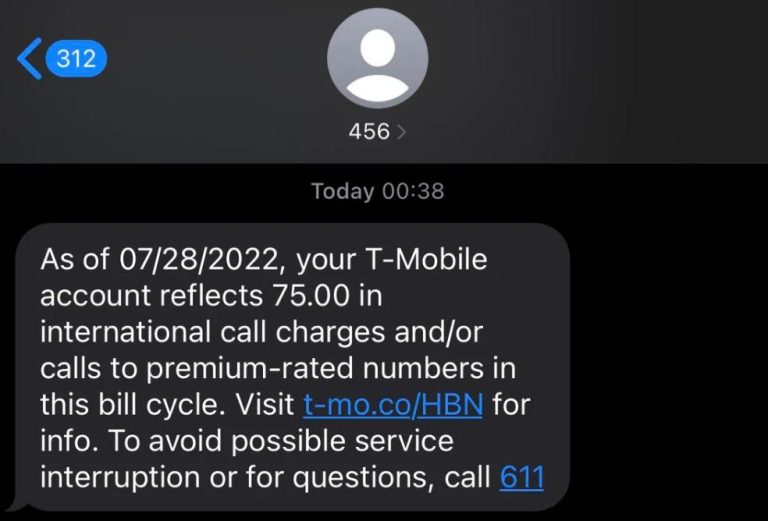

If you meet the criteria for Medicare coverage of a walk-in tub, the next step is to navigate the claims process. Here’s a general outline:

- Obtain a Prescription: Consult your physician to discuss your need for a walk-in tub and obtain a prescription if deemed medically necessary.

- Choose a Supplier: Select a Medicare-approved supplier who specializes in walk-in tubs.

- Submit Documentation: Your supplier will assist you in gathering the necessary documentation, including your physician’s prescription and supporting medical records.

- Medicare Review: Medicare will review your claim and determine if the walk-in tub meets the criteria for coverage.

- Coverage Decision: You will receive a decision from Medicare regarding coverage. If approved, Medicare will typically cover 80% of the cost, and you will be responsible for the remaining 20%.

Additional Considerations

- Medicare Advantage Plans: Medicare Advantage plans (Part C) may offer additional coverage for walk-in tubs. It’s important to review your plan’s specific benefits and coverage details.

- Medigap Plans: Medigap plans (Medicare Supplement Insurance) can help cover some of the out-of-pocket costs associated with walk-in tubs, such as coinsurance and deductibles.

- Home Modifications: In some cases, Medicare may also cover home modifications necessary for the installation of a walk-in tub, such as widening doorways or reinforcing floors.

Frequently Asked Questions

Q: Does Medicare cover the entire cost of a walk-in tub?

A: Typically, Medicare covers 80% of the approved cost, and you are responsible for the remaining 20%.

Q: Can I purchase a walk-in tub from any supplier?

A: No, the walk-in tub must be purchased from a Medicare-approved supplier.

Q: What if my claim is denied?

A: You have the right to appeal the decision. Your supplier can assist you with the appeals process.

Q: Are there any alternatives to Medicare coverage for walk-in tubs?

A: Some states offer financial assistance programs for home modifications, including walk-in tubs. Additionally, you may consider private financing options or explore long-term care insurance policies that may offer coverage.

Conclusion

Walk-in tubs can significantly enhance the safety and independence of individuals with mobility challenges. While Medicare coverage for walk-in tubs is not automatic, it is possible under specific circumstances. By understanding the criteria, navigating the claims process, and exploring additional options, you can make informed decisions about your bathing needs and improve your quality of life.

Read More: Who Accepts Everest Health Insurance? A Comprehensive Guide