Alabama business insurance is a crucial safeguard for any enterprise operating in the Yellowhammer State. It protects your business from financial losses caused by unexpected events such as property damage, liability claims, employee injuries, and natural disasters. In this comprehensive guide, we’ll delve deep into the world of Alabama business insurance, exploring its various types, legal requirements, and key considerations for choosing the right coverage for your business.

Contents

Types of Alabama Business Insurance

There is a wide range of insurance options available to Alabama businesses, each designed to address specific risks and liabilities. Some of the most common types include:

1. General Liability Insurance

General liability insurance is the cornerstone of business protection in Alabama. It safeguards your business from financial losses arising from third-party bodily injury, property damage, and personal and advertising injury claims. This insurance covers legal fees, medical expenses, and settlement costs, ensuring your business’s financial stability in the face of unexpected liability claims.

2. Property Insurance

Property insurance is vital for protecting your business’s physical assets, including buildings, equipment, inventory, and furniture. It covers losses caused by fire, theft, vandalism, and certain natural disasters. This insurance ensures that you can rebuild and replace your property in the event of damage or loss, allowing your business to continue operating without significant financial setbacks.

3. Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory for most Alabama businesses with one or more employees. It provides financial benefits to employees who suffer work-related injuries or illnesses, covering medical expenses, lost wages, and rehabilitation costs. This insurance protects both employees and employers, ensuring that injured workers receive necessary care and compensation while shielding employers from potentially devastating lawsuits.

4. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for businesses that provide professional services, such as consultants, lawyers, accountants, and healthcare providers. It covers financial losses arising from claims of negligence, errors, or omissions in the performance of professional duties. This insurance protects your business’s reputation and financial stability in the face of professional liability claims.

5. Commercial Auto Insurance

Commercial auto insurance is mandatory for businesses that own or lease vehicles for business purposes. It covers liability claims arising from accidents involving your business vehicles, as well as damage to your vehicles caused by collisions, theft, or vandalism. This insurance protects your business from financial losses associated with auto accidents and ensures that your vehicles can be repaired or replaced in the event of damage or loss.

6. Business Interruption Insurance

Business interruption insurance provides financial assistance to businesses that are forced to temporarily close or reduce operations due to a covered event, such as a fire, natural disaster, or civil unrest. It covers lost income, ongoing expenses, and relocation costs, allowing your business to continue paying its bills and employees during a period of disruption. This insurance ensures your business’s survival and financial stability in the face of unexpected events that disrupt your operations.

7. Cyber Liability Insurance

Cyber liability insurance is becoming increasingly important for businesses of all sizes in Alabama. It covers financial losses arising from data breaches, cyberattacks, and other cyber incidents. This insurance covers costs associated with data recovery, notification of affected individuals, credit monitoring services, and legal fees. It protects your business’s reputation and financial stability in the increasingly digital business landscape.

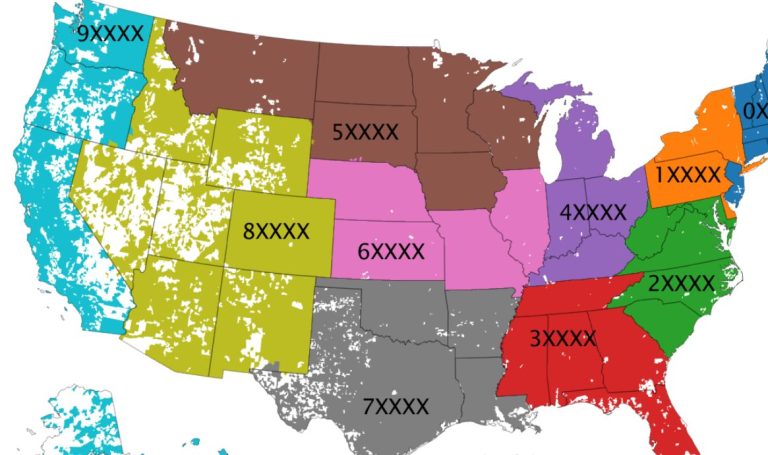

Legal Requirements for Alabama Business Insurance

Alabama business insurance requirements vary depending on the type and size of your business. However, certain types of insurance are mandatory for most businesses operating in the state. These include:

- Workers’ compensation insurance: Mandatory for most businesses with one or more employees.

- Commercial auto insurance: Mandatory for businesses that own or lease vehicles for business purposes.

- Unemployment insurance: Mandatory for most businesses with one or more employees.

Key Considerations for Choosing Alabama Business Insurance

Choosing the right Alabama business insurance coverage for your business requires careful consideration of several factors, including:

- Type of business: The type of business you operate will significantly influence the types of insurance you need. For example, a construction company may need more extensive general liability and workers’ compensation coverage than a consulting firm.

- Size of business: The size of your business, including the number of employees and annual revenue, will also affect your insurance needs. Larger businesses typically require more comprehensive coverage than smaller businesses.

- Industry-specific risks: Certain industries face unique risks that require specialized insurance coverage. For example, a restaurant may need liquor liability insurance, while a healthcare provider may need medical malpractice insurance.

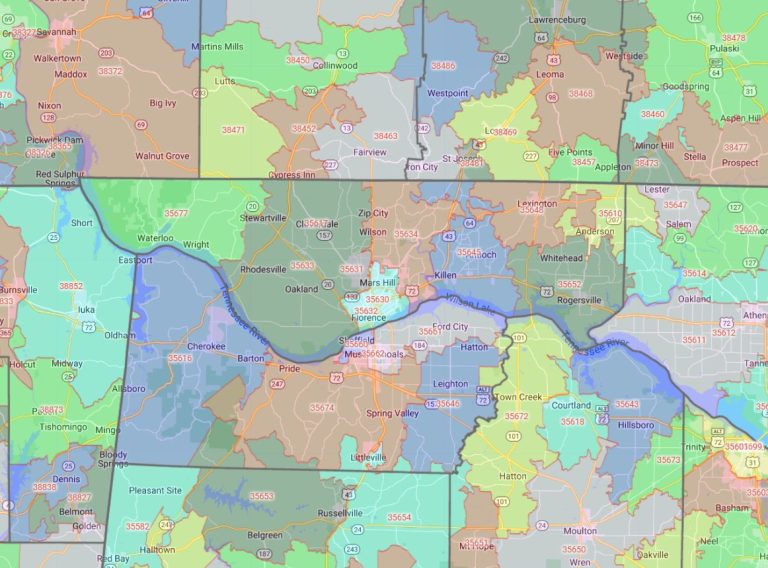

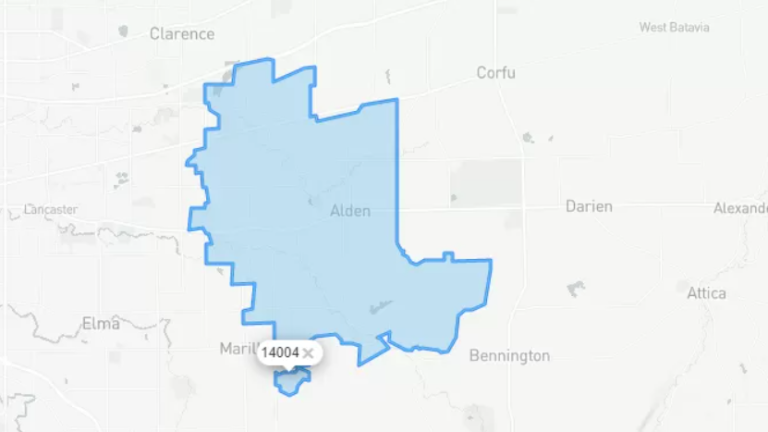

- Location: Your business’s location can also influence your insurance needs. Businesses located in areas prone to natural disasters may need more extensive property insurance coverage.

- Budget: It’s important to balance your insurance needs with your budget. While comprehensive coverage is ideal, it’s essential to choose policies that fit within your financial constraints.

Tips for Choosing the Right Alabama Business Insurance

Here are some tips to help you choose the right Alabama business insurance coverage for your business:

- Consult an insurance agent: An experienced insurance agent can help you assess your business’s risks and recommend appropriate coverage options.

- Get multiple quotes: Compare quotes from different insurance providers to find the best coverage at the most competitive price.

- Review your policies annually: Your business’s insurance needs may change over time, so it’s important to review your policies annually and make adjustments as necessary.

- Understand your policy limits and deductibles: Make sure you understand the limits and deductibles of your policies to avoid surprises in the event of a claim.

- Keep your policies up-to-date: Notify your insurance provider of any changes to your business, such as new employees, equipment, or locations, to ensure your coverage remains adequate.

Conclusion

Alabama business insurance is a vital investment for any enterprise operating in the state. It provides financial protection against unexpected events that can disrupt your operations, damage your property, or expose you to liability claims. By choosing the right coverage for your business, you can safeguard your financial stability, protect your assets, and ensure your business’s long-term success. Remember, consulting an experienced insurance agent and comparing quotes from different providers are crucial steps in finding the best Alabama business insurance coverage for your specific needs.