Running a small business with one employee can be both rewarding and demanding. Payroll, though essential, doesn’t have to be a complex chore. Let’s delve into the most efficient and streamlined strategies for managing payroll when you have a single team member.

Understanding the Payroll Essentials

- Legal Requirements: Before diving in, familiarize yourself with the legal requirements for payroll in your area. These typically include:

- Employer Identification Number (EIN): Obtain an EIN from the IRS if you don’t already have one.

- State and Local Tax IDs: Register for any required state or local tax identification numbers.

- Withholding Taxes: Understand federal income tax, Social Security, and Medicare withholding rates.

- Unemployment Insurance: Comply with state unemployment insurance requirements.

- Employee Information: Collect the necessary information from your employee, including:

- Form W-4: This form determines federal income tax withholding.

- State Tax Forms: Collect state-specific tax forms if applicable.

- Direct Deposit Information: For electronic payments.

Choosing the Right Payroll Method

There are several effective ways to manage payroll for a single employee:

-

DIY Payroll:

- Pros: Complete control, potentially cost-effective for very small businesses.

- Cons: Time-consuming, requires meticulous attention to detail and legal compliance.

-

Payroll Software:

- Pros: Automates calculations, tax filings, and payments, reducing errors and saving time. Many options cater specifically to small businesses.

- Cons: Monthly or per-payroll fees can add up.

-

Online Payroll Services:

- Pros: Comprehensive solution, handles everything from calculations to tax filings and payments. Excellent for businesses with limited accounting expertise.

- Cons: Can be more expensive than DIY or basic software, but the added features and support may be worth it.

-

Professional Payroll Provider:

- Pros: Complete peace of mind, experts handle all aspects of payroll, ensuring compliance and accuracy.

- Cons: Typically the most expensive option, but can be worthwhile for complex situations or for businesses wanting to completely outsource payroll.

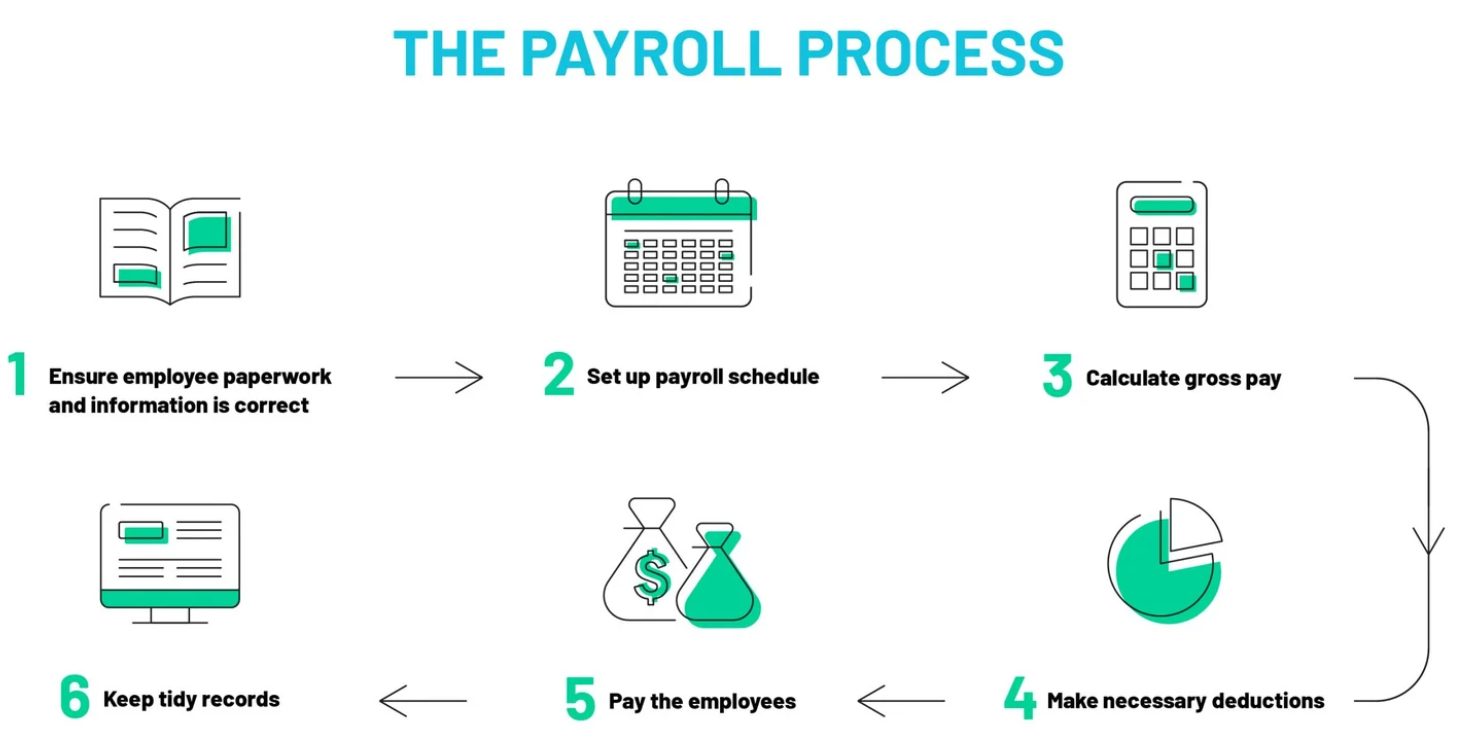

Step-by-Step Payroll Process (Using Software or Service)

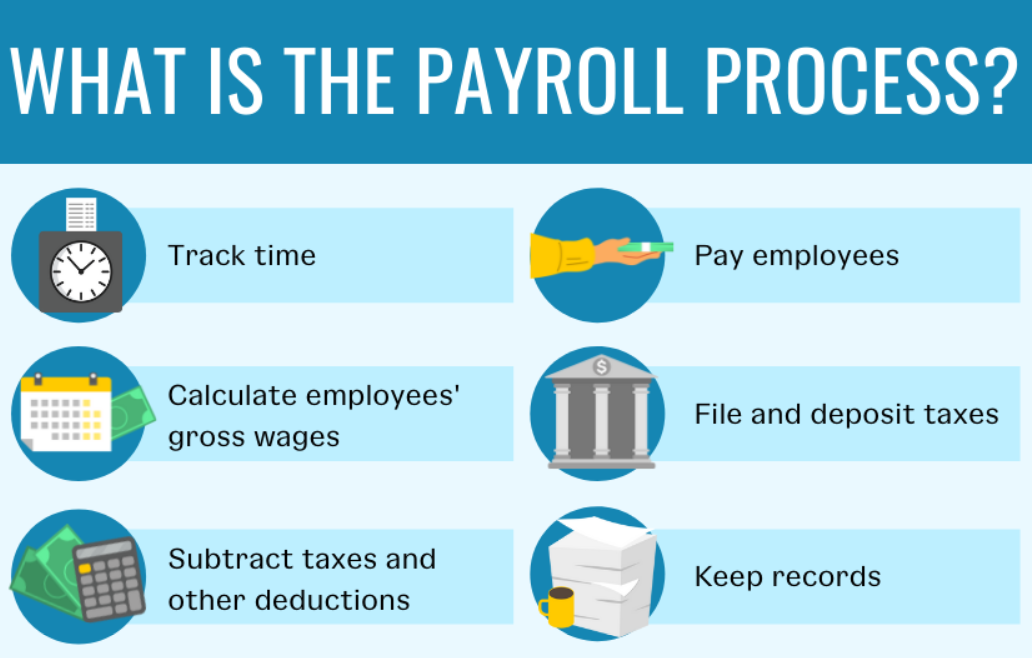

- Gather Employee Information: Collect W-4, state forms, and direct deposit details.

- Set Up Payroll Schedule: Determine if you’ll pay weekly, bi-weekly, or monthly.

- Enter Employee Details: Input information into your chosen software or service.

- Track Hours (If Applicable): Use time-tracking software or manual records.

- Calculate Gross Pay: Multiply hours by the hourly rate (or enter the salary).

- Calculate Taxes and Deductions: Software/service will typically do this automatically.

- Review and Approve Payroll: Ensure accuracy before finalizing.

- Process Payment: Pay your employee through direct deposit or check.

- File Taxes: Software/service can often help with tax filings, or you can hire an accountant.

- Maintain Records: Keep meticulous payroll records for at least three years.

Tips for Simplified Payroll

- Pay on Time: Late payments can lead to penalties and employee dissatisfaction.

- Automate: Use direct deposit and automatic tax payments to save time and avoid errors.

- Use Cloud-Based Tools: This provides access to payroll information from anywhere.

- Keep Up with Regulations: Tax laws and regulations change, so stay informed.

- Consider a Professional: If payroll becomes overwhelming, consult an accountant or payroll specialist.

Choosing the Best Payroll Solution

- Cost: Compare prices and features of different software and services.

- Ease of Use: Look for user-friendly interfaces and intuitive workflows.

- Features: Does it offer direct deposit, tax filing, and reporting?

- Customer Support: Is there readily available help if you have questions?

- Scalability: Will it grow with your business if you hire more employees?

Compliance and Recordkeeping

- Stay Compliant: Keep up with changing tax laws and regulations.

- Maintain Records: Keep meticulous payroll records, including pay stubs, tax forms, and payment history. These records are crucial for tax filings and potential audits.

- Data Security: Protect sensitive employee information by using secure software and adhering to data privacy practices.

- Independent Contractor vs. Employee: Ensure you correctly classify your worker. Misclassification can lead to legal and financial issues.

Embracing the Future of Payroll

Technology is transforming payroll. Explore emerging trends like:

- Mobile Payroll Apps: These allow you to manage payroll on the go.

- Artificial Intelligence: AI-powered payroll software can automate even more tasks, freeing you up to focus on your core business.

- Integration with Accounting Software: Seamless integration streamlines your financial processes.

Conclusion: Payroll Made Easy

With the right approach and tools, payroll for a single employee doesn’t have to be a burden. By understanding the essentials, choosing the right method, and leveraging technology, you can simplify the process and ensure compliance. Remember, well-managed payroll is not just a legal obligation, but it’s also a key factor in maintaining a positive relationship with your valuable employee.

I hope this comprehensive article provides you with the guidance you need to streamline your payroll process and focus on growing your business!