Navigating the world of small business insurance in Illinois can be a daunting task. The cost of insurance is a critical factor for any small business owner, but it’s important to remember that the cheapest option isn’t always the best. This guide aims to provide a comprehensive overview of small business insurance in Illinois, including the factors that influence cost, the types of coverage available, and tips for finding the right policy for your business.

Key Takeaways:

- The cost of small business insurance in Illinois varies widely depending on several factors, including the type of business, its location, the number of employees, and the level of coverage chosen.

- Several types of insurance are available for small businesses in Illinois, including general liability, property, workers’ compensation, and professional liability insurance.

- It’s essential to compare quotes from multiple insurers to find the best coverage at the most competitive price.

- Working with an independent insurance agent can help you navigate the complex world of small business insurance and find the right policy for your needs.

Factors Affecting Small Business Insurance Cost in Illinois

Several factors can influence the cost of small business insurance in Illinois. Understanding these factors can help you make informed decisions when choosing a policy.

- Type of Business: The type of business you operate plays a significant role in determining insurance costs. Businesses with higher risks, such as construction or manufacturing, typically pay more for insurance than those with lower risks, such as retail or professional services.

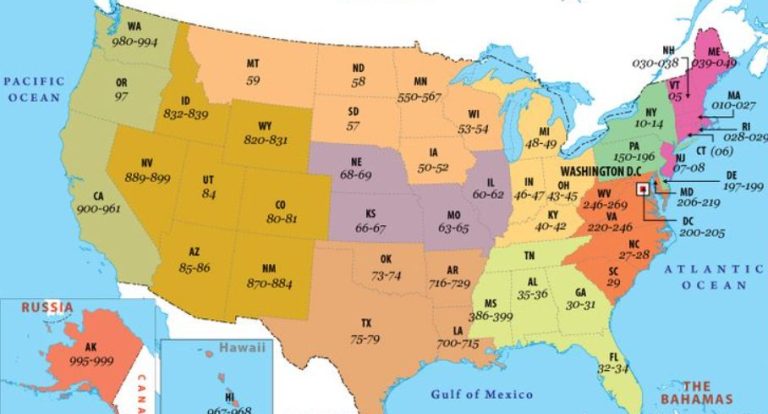

- Location: The location of your business can also impact insurance costs. Businesses located in areas with higher crime rates or natural disaster risks may face higher premiums.

- Number of Employees: The number of employees you have can also affect your insurance costs. Businesses with more employees typically pay more for insurance, especially for workers’ compensation coverage.

- Coverage Limits and Deductibles: The coverage limits and deductibles you choose will also influence your insurance costs. Higher coverage limits and lower deductibles typically result in higher premiums.

- Claims History: Your business’s claims history can also impact your insurance costs. Businesses with a history of frequent claims may face higher premiums.

- Insurance Provider: Different insurance providers may offer different rates for the same coverage. It’s essential to compare quotes from multiple insurers to find the best deal.

Types of Small Business Insurance in Illinois

Several types of insurance are available for small businesses in Illinois. The specific types of coverage you need will depend on the nature of your business and its risks.

General Liability Insurance

General liability insurance is one of the most important types of insurance for small businesses. It provides coverage for bodily injury, property damage, and personal and advertising injury claims made against your business. This type of insurance can protect your business from financial losses due to lawsuits and settlements.

Property Insurance

Property insurance provides coverage for damage to your business’s physical assets, such as buildings, equipment, and inventory. This type of insurance can protect your business from financial losses due to fire, theft, vandalism, and other covered perils.

Workers’ Compensation Insurance

Workers’ compensation insurance is required for most businesses in Illinois with employees. It provides coverage for medical expenses, lost wages, and disability benefits for employees who are injured or become ill on the job.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims made against your business due to professional negligence or errors. This type of insurance is especially important for businesses that provide professional services, such as consultants, accountants, and lawyers.

Other Types of Insurance

In addition to these common types of insurance, other types of coverage may be available for small businesses in Illinois, depending on their specific needs. These may include:

- Business interruption insurance: Provides coverage for lost income and expenses due to a covered event that disrupts your business operations.

- Cyber liability insurance: Provides coverage for data breaches, cyberattacks, and other cyber-related risks.

- Commercial auto insurance: Provides coverage for vehicles used for business purposes.

- Employment practices liability insurance: Provides coverage for claims made against your business due to employment-related issues, such as discrimination or wrongful termination.

Tips for Finding Affordable Small Business Insurance in Illinois

Finding affordable small business insurance in Illinois requires careful research and comparison shopping. Here are some tips to help you find the best coverage at the most competitive price:

- Shop around and compare quotes: Get quotes from multiple insurance providers to compare coverage and costs.

- Work with an independent insurance agent: An independent agent can help you navigate the complex world of small business insurance and find the right policy for your needs.

- Consider bundling policies: Bundling multiple policies with the same insurer can often lead to discounts.

- Review your coverage regularly: As your business grows and changes, your insurance needs may also change. Review your coverage regularly to ensure you have adequate protection.

- Implement risk management practices: Implementing risk management practices can help reduce the likelihood of claims, which may lead to lower premiums.

- Ask about discounts: Many insurers offer discounts for various factors, such as having a good claims history, implementing safety measures, or paying your premium in full.

Average Cost of Small Business Insurance in Illinois

The average cost of small business insurance in Illinois varies widely depending on the factors mentioned earlier. However, to give you a general idea, here are some average costs for different types of insurance:

- General liability insurance: $400 – $1,000 per year

- Property insurance: $1,000 – $2,500 per year

- Workers’ compensation insurance: $1,500 – $3,000 per year

- Professional liability insurance: $500 – $2,000 per year

It’s important to remember that these are just averages, and your actual costs may be higher or lower depending on your specific circumstances.

Conclusion

Small business insurance is a crucial investment for any business owner in Illinois. It can protect your business from financial losses due to unexpected events, such as lawsuits, property damage, and employee injuries. By understanding the factors that influence cost and the types of coverage available, you can make informed decisions and find the right policy for your business. Remember, the cheapest option isn’t always the best. It’s essential to choose a policy that provides adequate coverage for your business’s specific risks.

Read More: Best Insurance in Arizona: A Comprehensive Guide