Idaho’s entrepreneurial spirit is thriving, with small businesses forming the backbone of the state’s economy. As a small business owner in Idaho, protecting your hard work and investment is paramount. That’s where small business insurance comes in. This comprehensive guide will help you navigate the world of small business insurance in Idaho, ensuring you’re equipped to safeguard your venture.

Contents

Key Takeaways:

- Small business insurance in Idaho is not just a legal requirement but a strategic investment for your business.

- Understanding the different types of small business insurance will help you choose the right coverage.

- Factors like industry, location, and number of employees can influence your small business insurance needs.

- Partnering with an experienced small business insurance agent can simplify the process and ensure you’re adequately protected.

Why Small Business Insurance Idaho Matters

Small business insurance in Idaho provides a financial safety net for your business, protecting you from unexpected events and liabilities that could jeopardize your operations. Whether it’s a natural disaster, a lawsuit, or an employee injury, small business insurance can help cover the costs and keep your business running.

Types of Small Business Insurance in Idaho

There are several types of small business insurance available in Idaho, each designed to address specific risks:

-

General Liability Insurance: This covers common risks such as bodily injury, property damage, and personal injury caused by your business operations.

-

Professional Liability Insurance (Errors and Omissions Insurance): This protects you against claims of negligence, errors, or omissions in your professional services.

-

Commercial Property Insurance: This covers damage to your business property caused by fire, theft, vandalism, and other covered perils.

-

Workers’ Compensation Insurance: This covers medical expenses and lost wages for employees who are injured or become ill on the job.

-

Business Interruption Insurance: This replaces lost income if your business is forced to close temporarily due to a covered event.

-

Commercial Auto Insurance: This covers accidents and damages involving your business vehicles.

-

Cyber Liability Insurance: This protects you against financial losses caused by cyber attacks, data breaches, and other cyber risks.

Choosing the Right Small Business Insurance in Idaho

The specific types of small business insurance you need will depend on several factors, including:

- Industry: Certain industries, such as construction and healthcare, face unique risks that require specialized coverage.

- Location: Some areas of Idaho are more prone to natural disasters, such as floods and earthquakes, necessitating additional coverage.

- Number of Employees: If you have employees, you are legally required to carry workers’ compensation insurance in Idaho.

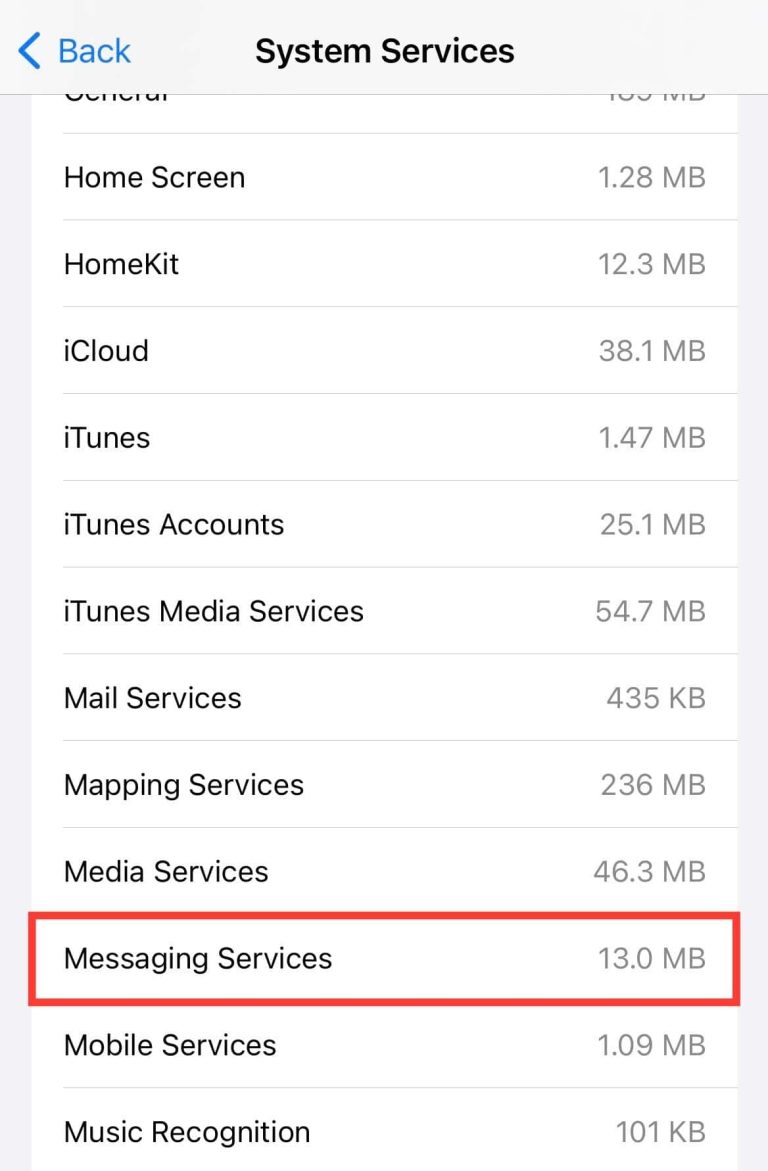

Small Business Insurance Idaho: Costs and Considerations

The cost of small business insurance in Idaho varies depending on several factors, including:

- Type of coverage: Some types of insurance, such as professional liability, tend to be more expensive than others.

- Coverage limits: Higher coverage limits will generally result in higher premiums.

- Deductibles: Choosing a higher deductible can lower your premiums, but you’ll have to pay more out of pocket in the event of a claim.

Finding the Best Small Business Insurance in Idaho

It’s essential to shop around and compare quotes from different small business insurance providers in Idaho. An experienced small business insurance agent can help you understand your options and choose the right coverage for your business.

Idaho Small Business Insurance Requirements

Idaho law requires all small businesses with employees to carry workers’ compensation insurance. Additionally, if your business owns vehicles, you must have commercial auto insurance that meets Idaho’s minimum requirements.

Additional Tips for Small Business Insurance in Idaho

- Review your small business insurance policies annually to ensure they still meet your needs.

- Consider bundling different types of insurance to save on premiums.

- Ask your insurance agent about discounts for safety measures, such as installing security systems or implementing employee safety programs.

- Keep detailed records of your business assets and operations to simplify the claims process in case of a loss.

Small Business Insurance Idaho: Your Partner in Success

Small business insurance in Idaho is an investment in your business’s future. By securing the right coverage, you can protect your hard work and investment from unexpected events, allowing you to focus on growing your business and achieving your goals.