Small business insurance Hawaii is an essential safeguard for entrepreneurs in the Aloha State. Whether you’re running a surf shop in Waikiki, a food truck in Hilo, or a tech startup in Honolulu, understanding your insurance options is crucial for protecting your business from unexpected events.

Contents

Why Small Business Insurance Matters in Hawaii

Small business insurance Hawaii provides financial protection against a wide range of risks, including:

- Property Damage: Covers damage to your business property caused by fire, theft, vandalism, or natural disasters.

- Liability Claims: Protects your business from lawsuits arising from customer injuries, product defects, or other incidents.

- Business Interruption: Replaces lost income and covers ongoing expenses if your business is forced to close temporarily due to a covered event.

- Worker’s Compensation: Provides benefits to employees who are injured or become ill on the job.

Types of Small Business Insurance in Hawaii

Here’s a breakdown of the key types of small business insurance Hawaii that you should consider:

-

General Liability Insurance: A fundamental policy that protects your business from claims of bodily injury, property damage, or personal and advertising injury. It’s often required for commercial leases and contracts.

-

Commercial Property Insurance: This policy covers your business property, including buildings, equipment, inventory, and furniture, from damage caused by fire, theft, vandalism, and other covered perils.

-

Business Income Insurance: If your business is forced to close due to a covered event (like a fire or hurricane), this insurance replaces lost income and covers ongoing expenses such as rent, utilities, and payroll.

-

Professional Liability Insurance (Errors and Omissions Insurance): This type of insurance protects professionals (like consultants, lawyers, and accountants) from claims of negligence, errors, or omissions in their professional services.

-

Workers’ Compensation Insurance: In Hawaii, workers’ compensation insurance is mandatory for businesses with one or more employees. It provides benefits to employees who are injured or become ill on the job.

-

Commercial Auto Insurance: If your business owns vehicles, this insurance covers liability and damage related to accidents.

Factors Affecting Small Business Insurance Premiums in Hawaii

Several factors influence the cost of small business insurance Hawaii, including:

- Industry: Some industries are inherently riskier than others, leading to higher premiums.

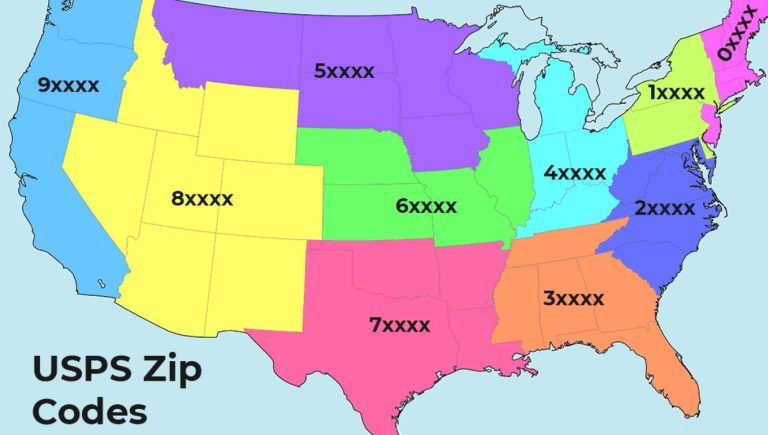

- Location: Businesses located in areas prone to natural disasters may face higher premiums.

- Number of Employees: The more employees you have, the higher your workers’ compensation premiums will be.

- Claims History: A history of insurance claims can lead to higher premiums.

- Coverage Limits: The higher your coverage limits, the higher your premiums will be.

- Deductible: A higher deductible will lower your premiums but means you’ll pay more out of pocket in the event of a claim.

How to Choose the Right Small Business Insurance in Hawaii

Choosing the right small business insurance Hawaii can seem overwhelming, but these tips can help:

- Assess Your Risks: Identify the specific risks your business faces. Consider your industry, location, and activities.

- Get Multiple Quotes: Compare quotes from different insurance providers to find the best coverage and rates.

- Read Your Policy Carefully: Before purchasing a policy, understand the coverage, exclusions, and limitations.

- Work with an Independent Agent: An independent insurance agent can help you assess your needs and find the right coverage for your business.

Additional Considerations for Small Business Insurance in Hawaii

- Natural Disasters: Hawaii is prone to hurricanes, tsunamis, and earthquakes. Consider additional coverage for natural disasters.

- Tourism Industry: If your business caters to tourists, you may need specialized liability insurance to cover activities like snorkeling, surfing, or hiking.

- Volcanic Activity: If your business is located near an active volcano, you may need additional coverage for volcanic eruptions and related damage.

Conclusion

Small business insurance Hawaii is an investment in your business’s future. By protecting yourself from unexpected events, you can focus on what you do best – growing your business and serving your customers in the beautiful Aloha State.