Small business owners often wear many hats, from marketing to finance, and insurance can easily slip through the cracks. However, it’s a crucial component of risk management. This article will delve into the world of Pennsylvania small business insurance, providing insights on essential coverages, cost factors, and how to find the right policy.

Contents

What is Small Business Insurance?

Small business insurance is a safety net designed to protect your business from financial loss due to unforeseen events. It covers various risks, including property damage, liability claims, and employee injuries. The specific coverages you need will depend on your industry, business size, and location.

Why is Small Business Insurance Important?

- Protects your assets: Insurance safeguards your business property, equipment, and inventory from damage or theft.

- Manages liability: It covers legal expenses and damages if someone is injured or property is damaged on your business premises.

- Covers employee injuries: Workers’ compensation insurance is mandatory in most states, including Pennsylvania, and protects your business from costs related to employee injuries.

- Provides business interruption coverage: This helps cover lost income if your business is temporarily unable to operate due to a covered event.

- Builds customer confidence: Insurance demonstrates your commitment to professionalism and risk management.

Essential Insurance Coverages for PA Small Businesses

While the specific needs of each business vary, the following coverages are commonly recommended for Pennsylvania small businesses:

General Liability Insurance

This is often considered the backbone of small business insurance. It protects your business from claims of bodily injury, property damage, and personal and advertising injury. Examples of covered incidents include slip and falls on your premises, product liability, and copyright infringement.

Commercial Property Insurance

This coverage safeguards your business property, including buildings, equipment, inventory, and furniture, against losses from fire, theft, vandalism, and natural disasters.

Business Interruption Insurance

This policy provides financial compensation if your business is unable to operate due to a covered loss, such as a fire or natural disaster. It helps cover lost income, continuing expenses, and payroll.

Workers’ Compensation Insurance

As mentioned earlier, this is mandatory in Pennsylvania and covers medical expenses, lost wages, and disability benefits for employees injured on the job.

Professional Liability Insurance (Errors and Omissions)

If your business provides professional services, this insurance protects you from claims of negligence or mistakes in your work. It’s essential for consultants, accountants, lawyers, and other professionals.

Commercial Auto Insurance

This covers vehicles used for business purposes, including accidents, theft, and property damage. It’s crucial if you have company cars or employees who use their personal vehicles for work.

Factors Affecting the Cost of Small Business Insurance

Several factors influence the cost of small business insurance premiums:

- Industry: Businesses in high-risk industries, such as construction or manufacturing, typically pay higher premiums.

- Business size: Larger businesses with more employees and assets generally require more coverage and pay higher premiums.

- Location: Businesses in areas prone to natural disasters or with higher crime rates may face higher insurance costs.

- Claims history: A history of claims can lead to increased premiums.

- Deductibles: Choosing a higher deductible can lower your premium but increases your out-of-pocket expenses in case of a claim.

- Coverage limits: The amount of coverage you choose affects your premium. Higher limits generally result in higher premiums.

Is Verizon Business Cheaper Than Personal?

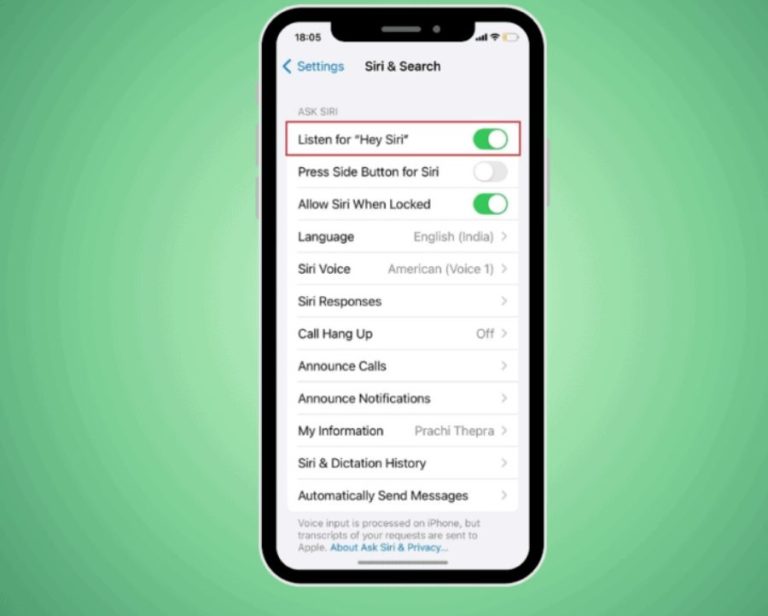

The short answer is: it depends. While Verizon offers both business and personal insurance plans, the cost comparison is not straightforward. Factors such as coverage levels, deductibles, and specific business needs will influence the pricing. It’s essential to compare quotes from multiple providers to find the best value for your business.

To determine if Verizon Business insurance is cheaper than personal, consider the following:

- Coverage comparison: Carefully analyze the coverage offered by both plans to ensure you have adequate protection for your business.

- Cost per employee: If you have employees, compare the cost per employee for each plan.

- Discounts and bundling: Check if Verizon offers discounts for bundling services or if there are any special promotions available.

- Customer reviews: Read reviews from other business owners to get insights into their experiences with Verizon Business insurance.

How to Choose the Right Small Business Insurance Policy

Selecting the right insurance policy can be overwhelming. Here are some tips to help you make an informed decision:

- Assess your risks: Identify potential risks your business faces and determine the appropriate coverage levels.

- Compare quotes: Get quotes from multiple insurers to compare prices and coverage options.

- Read policy documents carefully: Understand the terms, conditions, and exclusions of each policy.

- Consider your budget: Balance the cost of insurance with your business’s financial capabilities.

- Seek professional advice: Consult with an insurance agent who specializes in small businesses.

Conclusion

Small business insurance is an essential investment to protect your hard-earned assets and mitigate financial risks. By understanding the different types of coverage available, comparing quotes, and carefully selecting a policy, you can ensure your business is adequately protected. Remember, the cost of insurance is often much lower than the potential financial consequences of not having it.