Health insurance Greensboro NC is a vital aspect of safeguarding your well-being and financial stability in the face of unexpected medical expenses. Whether you’re a young professional, a growing family, or a retiree, finding the right health insurance plan is crucial. In this comprehensive guide, we will delve deep into the world of health insurance in Greensboro, NC, exploring various aspects, providers, and options to help you make informed decisions about your healthcare coverage.

Understanding Health Insurance in Greensboro, NC

What is Health Insurance?

Health insurance is a contract between you and an insurance company. You pay a monthly premium, and in return, the insurance company agrees to cover a portion of your medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care. The specific coverage depends on the type of plan you choose.

Why is Health Insurance Important?

Health insurance Greensboro NC is essential for several reasons:

- Financial Protection: Unexpected medical bills can be devastating. Health insurance protects you from financial hardship by covering a significant portion of your medical expenses.

- Access to Care: Having health insurance ensures you can access the medical care you need when you need it. You can see doctors, specialists, and get the necessary treatments without worrying about the cost.

- Preventive Care: Many health insurance plans cover preventive care services like annual checkups, vaccinations, and screenings. This helps you stay healthy and catch potential health issues early.

- Peace of Mind: Knowing you have health insurance provides peace of mind. You can focus on your health and well-being without the constant worry of medical bills.

Types of Health Insurance Plans in Greensboro, NC

Several health insurance plans are available in Greensboro, NC. Each has its own set of benefits, costs, and provider networks.

1. Health Maintenance Organization (HMO)

- Benefits:

- Lower monthly premiums

- Emphasis on preventive care

- Coordinated care through a primary care physician (PCP)

- Costs:

- Copays for doctor visits and prescriptions

- Out-of-pocket maximum for the year

- Provider Network:

- Limited to doctors and hospitals within the HMO network

- Referrals from PCP required for specialist visits

2. Preferred Provider Organization (PPO)

- Benefits:

- More flexibility in choosing doctors and hospitals

- No need for referrals for specialist visits

- Costs:

- Higher monthly premiums

- Copays and coinsurance for medical services

- Out-of-pocket maximum for the year

- Provider Network:

- Lower costs when using in-network providers

- Coverage for out-of-network providers, but at a higher cost

3. Exclusive Provider Organization (EPO)

- Benefits:

- Lower premiums than PPOs

- No need for referrals for specialist visits

- Costs:

- Copays and coinsurance for medical services

- Out-of-pocket maximum for the year

- Provider Network:

- Limited to doctors and hospitals within the EPO network

- No coverage for out-of-network providers

4. Point of Service (POS)

- Benefits:

- Combines features of HMOs and PPOs

- Choice between using a PCP for coordinated care or seeing out-of-network providers

- Costs:

- Copays and coinsurance for medical services

- Out-of-pocket maximum for the year

- Provider Network:

- Lower costs when using in-network providers

- Coverage for out-of-network providers, but at a higher cost

5. High Deductible Health Plan (HDHP)

- Benefits:

- Lowest monthly premiums

- Can be paired with a Health Savings Account (HSA) for tax-advantaged savings

- Costs:

- High deductible that must be met before insurance coverage kicks in

- Copays and coinsurance for medical services after the deductible is met

- Out-of-pocket maximum for the year

- Provider Network:

- Typically, a PPO network with more flexibility in choosing providers

Factors to Consider When Choosing a Health Insurance Plan

Selecting the right health insurance plan requires careful consideration of several factors:

- Your Budget: Determine how much you can afford to pay in monthly premiums and out-of-pocket costs.

- Your Healthcare Needs: Consider your current health status, any pre-existing conditions, and the frequency with which you typically seek medical care.

- Provider Network: Ensure your preferred doctors and hospitals are included in the plan’s network.

- Coverage: Review the plan’s coverage for essential health benefits, prescription drugs, and any specific services you may need.

- Deductibles, Copays, and Coinsurance: Understand how much you’ll have to pay out-of-pocket for medical services.

- Out-of-Pocket Maximum: This is the most you’ll have to pay for covered services in a year.

Health Insurance Providers in Greensboro, NC

Several reputable health insurance providers offer plans in Greensboro, NC. Some of the major players include:

- Blue Cross and Blue Shield of North Carolina

- UnitedHealthcare

- Aetna

- Cigna

- Humana

These providers offer a variety of plans to suit different needs and budgets. It’s essential to compare plans from multiple providers to find the best fit for you.

How to Get Health Insurance in Greensboro, NC

There are several ways to obtain health insurance in Greensboro, NC:

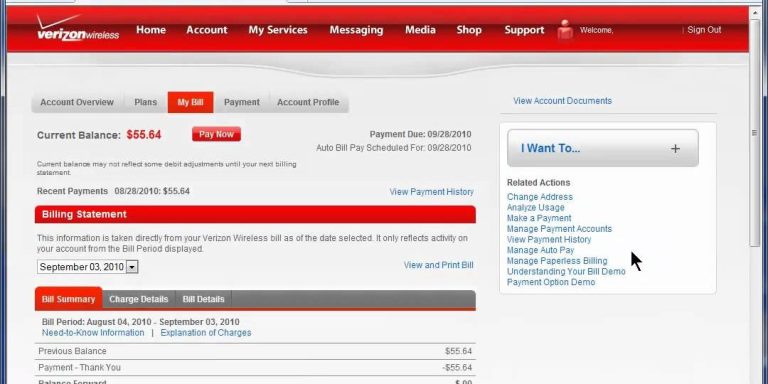

- Through Your Employer: If you’re employed, your employer may offer health insurance benefits. This is often the most convenient and cost-effective way to get coverage.

- Through the Health Insurance Marketplace: The Affordable Care Act (ACA) established the Health Insurance Marketplace, where you can compare and purchase individual health insurance plans. You may also be eligible for subsidies to help lower your costs.

- Directly from an Insurance Company: You can also purchase health insurance directly from an insurance company. This option gives you more control over your plan selection but may be more expensive.

- Through a Broker: A health insurance broker can help you navigate the complexities of the insurance market and find a plan that meets your needs.

Tips for Choosing the Right Health Insurance Plan

- Start Early: Don’t wait until you need medical care to start looking for health insurance. The earlier you start, the more options you’ll have.

- Do Your Research: Compare plans from multiple providers, and read the fine print carefully.

- Ask Questions: If you’re unsure about anything, don’t hesitate to ask your insurance agent or broker for clarification.

- Review Your Coverage Annually: Your healthcare needs and the insurance market can change. Review your coverage annually to ensure it still meets your needs.

Conclusion

Health insurance Greensboro NC is a critical investment in your health and financial well-being. By understanding the different types of plans, providers, and factors to consider, you can make informed decisions about your healthcare coverage. Remember, the right health insurance plan can provide you with peace of mind and access to the care you need, when you need it.

Read More: Keytruda Cost Medicare: Navigating the Financial Landscape