Contents

Understanding Medicare Supplement Plans

Before we dive into the specifics of Medicare Supplement plans in Delaware, it’s important to establish a clear understanding of what these plans entail. Essentially, Medicare Supplement plans are private insurance policies designed to complement Original Medicare. They cover a range of expenses that Original Medicare doesn’t fully cover, such as deductibles, copayments, and coinsurance.

Why Choose Medicare Supplement Plans?

- Predictable Costs: One of the primary advantages of Medicare Supplement plans in Delaware is the predictability they offer in terms of healthcare costs. By covering many of the out-of-pocket expenses associated with Original Medicare, these plans help you avoid unexpected medical bills, providing peace of mind and financial stability.

- Freedom of Choice: Medicare Supplement plans grant you the freedom to choose any doctor or hospital that accepts Medicare, ensuring you have access to the healthcare providers you prefer. This flexibility is a key factor in maintaining your autonomy and receiving the best possible care.

- Travel Benefits: Many Medicare Supplement plans in Delaware offer coverage for emergency medical expenses while traveling outside the United States. This feature is particularly valuable for those who enjoy traveling or have family and friends living abroad.

Types of Medicare Supplement Plans in Delaware

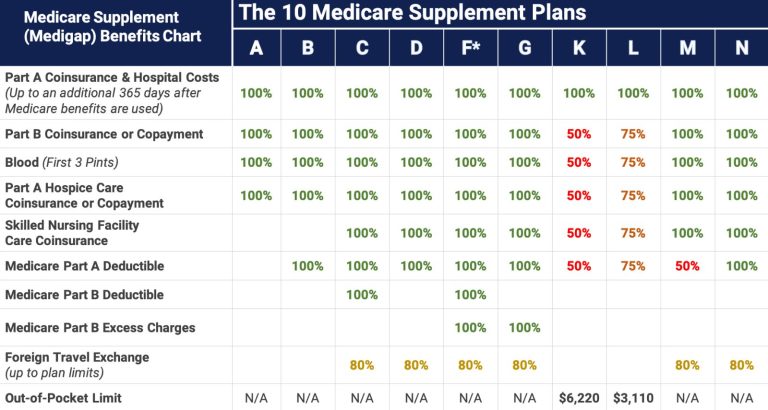

In Delaware, as in other states, Medicare Supplement plans are standardized and identified by letters (A, B, C, D, F, G, K, L, M, and N). Each plan offers a specific set of benefits, allowing you to choose the one that best suits your needs and budget. Let’s take a closer look at some of the most popular plans:

- Plan F: Plan F offers the most comprehensive coverage among all Medicare Supplement plans in Delaware. It covers all Medicare-approved charges, including deductibles, copayments, and coinsurance. While Plan F is no longer available to new Medicare enrollees, those who were eligible for Medicare before January 1, 2020, can still enroll in this plan.

- Plan G: Plan G is a close second to Plan F in terms of coverage. It covers all Medicare-approved charges except for the Part B deductible. This plan is a popular choice for those seeking comprehensive coverage at a slightly lower premium than Plan F.

- Plan N: Plan N offers a balance between coverage and affordability. It covers most Medicare-approved charges, but you may be responsible for a small copayment for doctor visits and emergency room visits.

Choosing the Right Medicare Supplement Plan in Delaware

Selecting the right Medicare Supplement plan in Delaware requires careful consideration of several factors, including your healthcare needs, budget, and personal preferences. Here are some key points to keep in mind:

- Assess Your Healthcare Needs: Start by evaluating your current health status and anticipated healthcare needs. If you have chronic conditions or require frequent medical attention, a more comprehensive plan like Plan F or Plan G might be the best option.

- Consider Your Budget: Medicare Supplement plans come with varying premiums. It’s essential to choose a plan that fits comfortably within your budget while still providing adequate coverage.

- Compare Plans: Take the time to compare different Medicare Supplement plans in Delaware offered by various insurance companies. Pay close attention to the benefits covered, premium costs, and any additional features offered.

- Seek Expert Advice: If you’re feeling overwhelmed by the choices, don’t hesitate to seek guidance from a licensed insurance agent specializing in Medicare. They can help you navigate the complexities of Medicare Supplement plans in Delaware and find the best fit for your individual circumstances.

Enrollment and Open Enrollment Periods

When it comes to enrolling in Medicare Supplement plans in Delaware, timing is crucial. The best time to enroll is during your Medigap Open Enrollment Period, which starts on the first day of the month you turn 65 and are enrolled in Medicare Part B and lasts for six months. During this period, you have the guaranteed right to enroll in any Medicare Supplement plan in Delaware without medical underwriting, regardless of your health status.

Important Considerations

- Pre-Existing Conditions: If you have pre-existing conditions, enrolling during your Medigap Open Enrollment Period is especially important. Outside of this period, insurance companies may deny coverage or charge higher premiums based on your health history.

- Medicare Advantage: Medicare Supplement plans cannot be combined with Medicare Advantage plans. If you’re considering switching from Medicare Advantage to Original Medicare, be sure to enroll in a Medicare Supplement plan in Delaware during your Medigap Open Enrollment Period.

Conclusion

Choosing the right Medicare Supplement plan in Delaware is a crucial step in securing your healthcare future. By understanding the different types of plans available, assessing your needs, and comparing options, you can make an informed decision that provides you with peace of mind and financial protection. Remember, seeking expert advice from a licensed insurance agent can be invaluable in navigating the complexities of Medicare Supplement plans and finding the best fit for your individual circumstances. Take the time to research, compare, and choose wisely, and you’ll be well on your way to enjoying a secure and fulfilling retirement in Delaware.

Read More: BCBS of Kentucky Provider Phone Number: Your Ultimate Guide