Navigating the complexities of Medicare can be daunting, especially when it comes to understanding the different supplement plans available. In Texas, Medicare Supplement Plan G stands out as a popular choice due to its extensive coverage and benefits. This article delves into the intricacies of Medicare Supplement Plan G in Texas, providing you with a comprehensive understanding of its features, advantages, and considerations to help you make an informed decision about your healthcare coverage.

Contents

Understanding Medicare Supplement Plans

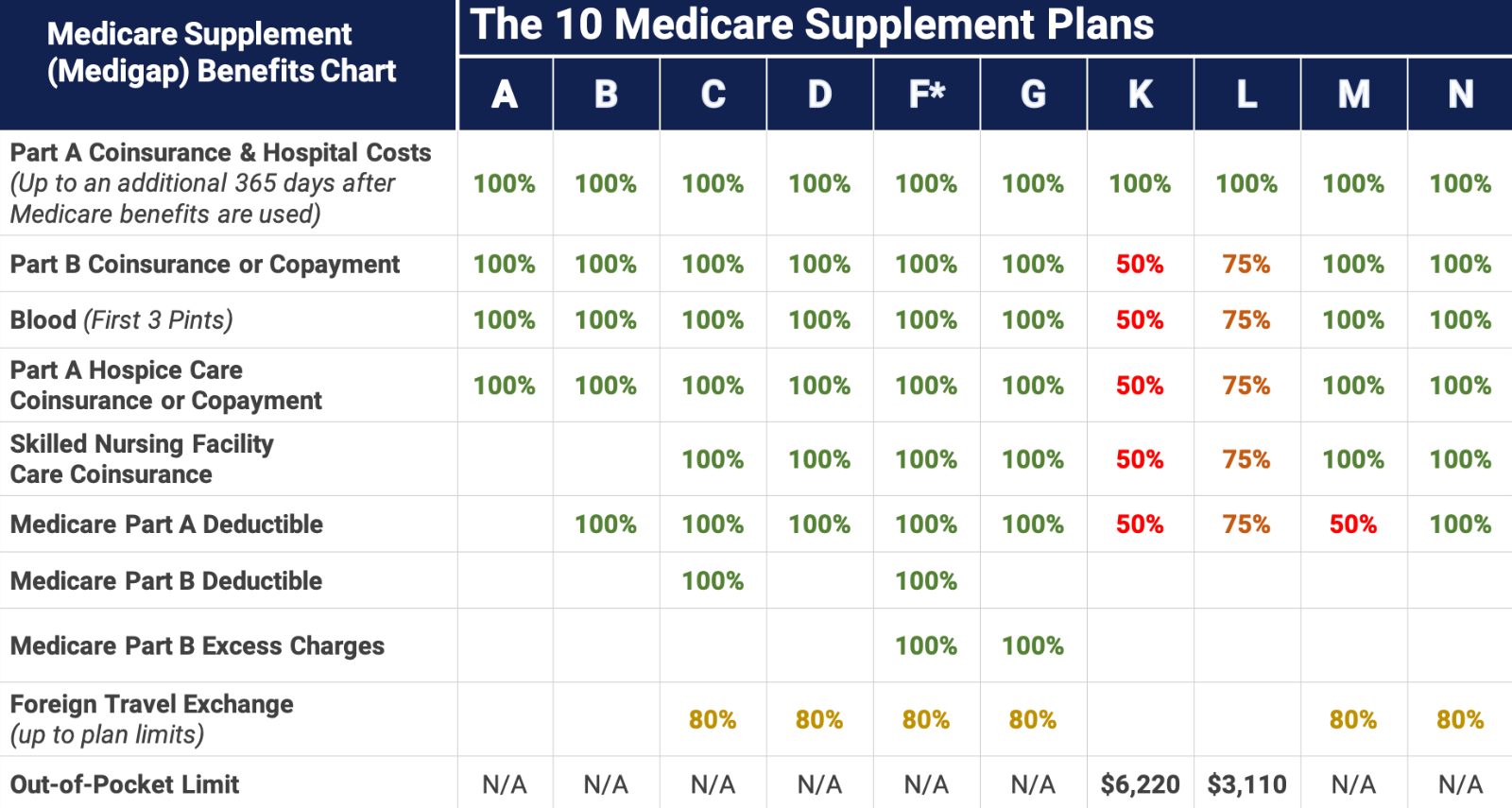

Before exploring the specifics of Medicare Supplement Plan G in Texas, it’s crucial to grasp the fundamentals of Medicare Supplement plans, also known as Medigap plans.

- Original Medicare and its Gaps: Original Medicare (Parts A and B) covers a significant portion of your healthcare expenses, but it doesn’t cover everything. There are gaps in coverage, such as deductibles, coinsurance, and copayments, that you’re responsible for.

- The Role of Medicare Supplement Plans: Medicare Supplement plans are designed to fill these gaps in Original Medicare coverage. They offer standardized benefits, meaning that plans with the same letter designation provide the same coverage, regardless of the insurance company offering them.

- Plan G’s Popularity: Medicare Supplement Plan G in Texas is highly sought after because it offers one of the most comprehensive coverage options available. It covers most of the out-of-pocket costs that Original Medicare doesn’t, giving you greater financial peace of mind.

Key Benefits of Medicare Supplement Plan G in Texas

Medicare Supplement Plan G in Texas offers a wide array of benefits that significantly enhance your healthcare coverage:

- Coverage for Medicare Part A Deductible: Plan G covers the Part A deductible, which is the amount you must pay each benefit period before Medicare starts covering your inpatient hospital costs.

- Coverage for Medicare Part B Coinsurance and Copayments: Plan G covers the 20% coinsurance that Original Medicare doesn’t cover for Part B services, such as doctor visits, outpatient care, and medical equipment. It also covers the Part B deductible.

- Coverage for Part A Hospice Care Coinsurance or Copayments: Plan G covers any coinsurance or copayments associated with hospice care under Part A.

- Coverage for the First Three Pints of Blood: If you need a blood transfusion, Plan G covers the cost of the first three pints of blood each year.

- Skilled Nursing Facility Care Coinsurance: Plan G covers the coinsurance for skilled nursing facility care after you’ve met the Medicare requirements.

- Foreign Travel Emergency Coverage: If you experience a medical emergency while traveling outside the U.S., Plan G provides coverage for 80% of eligible expenses, up to a lifetime maximum.

What Medicare Supplement Plan G in Texas Doesn’t Cover

While Medicare Supplement Plan G in Texas offers extensive coverage, there are a few things it doesn’t cover:

- Medicare Part B Excess Charges: These are charges that some doctors and healthcare providers may choose to bill above the Medicare-approved amount. Plan G doesn’t cover these excess charges.

- Prescription Drugs: Plan G doesn’t cover prescription drugs. You’ll need a separate Medicare Part D plan for prescription drug coverage.

- Routine Dental, Vision, and Hearing Care: Plan G doesn’t cover routine dental, vision, and hearing care. You may need additional coverage for these services.

Choosing the Right Insurance Company

Selecting the right insurance company for your Medicare Supplement Plan G in Texas is essential. Several factors come into play:

- Financial Strength and Stability: Choose an insurance company with a strong financial rating, indicating its ability to meet its financial obligations and pay claims.

- Customer Service: Consider the company’s reputation for customer service. Read reviews and testimonials from other policyholders to gauge their experiences.

- Premiums: Compare premiums from different insurance companies, but remember that the lowest premium isn’t always the best option. Consider the company’s financial strength and customer service as well.

- Additional Benefits: Some insurance companies may offer additional benefits with their Medicare Supplement Plan G in Texas policies, such as discounts on gym memberships or wellness programs.

Eligibility and Enrollment for Medicare Supplement Plan G in Texas

To be eligible for Medicare Supplement Plan G in Texas, you must meet certain requirements:

- Age: You must be 65 or older.

- Enrollment in Original Medicare: You must be enrolled in both Medicare Part A and Part B.

- Residency: You must be a resident of Texas.

The best time to enroll in Medicare Supplement Plan G in Texas is during your Medigap Open Enrollment Period. This is a six-month period that starts on the first day of the month you turn 65 and are enrolled in Medicare Part B. During this period, you have the guaranteed right to enroll in any Medigap plan available in your area, regardless of your health condition.

Cost of Medicare Supplement Plan G in Texas

The cost of Medicare Supplement Plan G in Texas varies depending on several factors, including:

- Your Age: Premiums tend to increase as you get older.

- Your Gender: In some cases, premiums may be different for men and women.

- Your Location: Premiums can vary depending on where you live in Texas.

- The Insurance Company: Different insurance companies may charge different premiums for the same plan.

- Your Smoking Status: Smokers may pay higher premiums than non-smokers.

It’s important to compare quotes from different insurance companies to find the best rate for your Medicare Supplement Plan G in Texas policy.

Tips for Choosing Medicare Supplement Plan G in Texas

Consider these tips when choosing Medicare Supplement Plan G in Texas:

- Assess Your Healthcare Needs: Evaluate your current and anticipated healthcare needs to determine if Plan G’s coverage aligns with your requirements.

- Compare Plans: Compare Plan G with other Medicare Supplement plans to see which one best suits your needs and budget.

- Shop Around: Get quotes from multiple insurance companies to find the best rate.

- Consider Your Budget: Factor in the premiums, deductibles, and other out-of-pocket costs when choosing a plan.

- Read the Fine Print: Carefully review the policy documents before enrolling to understand the coverage, exclusions, and limitations.

- Seek Professional Advice: If you’re unsure which plan to choose, consult with a licensed insurance agent or financial advisor.

Conclusion

Medicare Supplement Plan G in Texas provides comprehensive coverage for most of the out-of-pocket costs that Original Medicare doesn’t cover. It’s a popular choice among beneficiaries due to its extensive benefits and financial protection. By understanding the key features, advantages, and considerations of Plan G, you can make an informed decision about your healthcare coverage and enjoy greater peace of mind knowing that you’re well-protected. Remember to compare quotes from different insurance companies, assess your healthcare needs, and seek professional advice if needed to ensure you choose the best plan for your individual circumstances.

Read More: Mid-Size Business Employee Health Insurance: A Comprehensive Guide