Connecticut, often referred to as the “Constitution State” or the “Nutmeg State,” boasts a thriving insurance industry. Home to several major insurance companies and countless independent agencies, Connecticut residents have access to a wide range of insurance products and services. In this comprehensive guide, we’ll delve into the world of insurance companies in CT, exploring their offerings, strengths, and how they cater to the diverse needs of individuals and businesses in the state.

Major Insurance Companies in CT

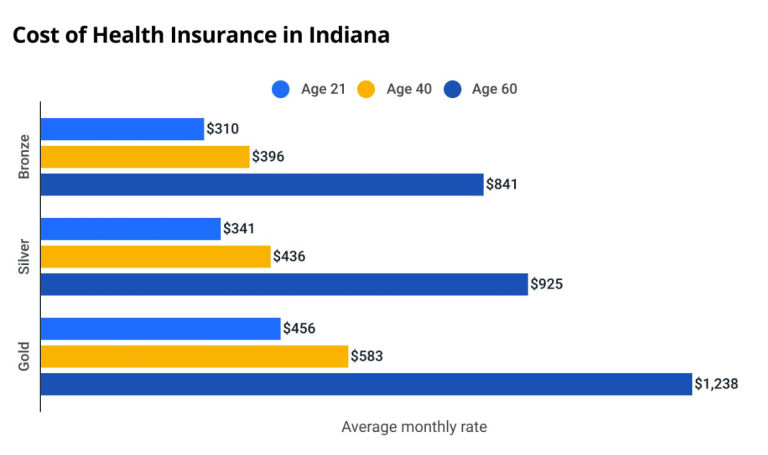

- Aetna: Founded in 1853 and headquartered in Hartford, Aetna is one of the largest health insurance providers in the United States. It offers a variety of health insurance plans, including employer-sponsored plans, individual and family plans, Medicare, and Medicaid. Aetna is known for its extensive network of healthcare providers and its focus on innovation and technology.

- The Hartford: Established in 1810, The Hartford is a leading property and casualty insurer, providing a wide array of insurance products, including auto, home, business, and life insurance. The Hartford is recognized for its strong financial stability, excellent customer service, and commitment to corporate social responsibility.

- Cigna: Headquartered in Bloomfield, Cigna is a global health services company offering health insurance, pharmacy benefit management, and other health-related services. Cigna serves individuals, families, employers, and government organizations worldwide. It is known for its focus on personalized healthcare and its innovative approach to wellness programs.

- Travelers: Founded in 1864, Travelers is a major property and casualty insurer providing a comprehensive suite of insurance products, including auto, home, business, and personal umbrella insurance. Travelers is renowned for its strong financial strength, its expertise in risk management, and its dedication to customer satisfaction.

- Assurant: Assurant, headquartered in New York City, has a significant presence in Connecticut. It specializes in lifestyle and housing-related insurance products, including renters insurance, extended warranties, and mobile device protection. Assurant is known for its innovative insurance solutions and its focus on protecting consumers’ valuable assets.

Types of Insurance Companies in CT

- Stock Insurance Companies: These companies are owned by shareholders and operate for profit. They offer a wide range of insurance products and are known for their financial stability and ability to pay claims.

- Mutual Insurance Companies: Owned by policyholders, mutual insurance companies prioritize policyholder benefits over profit. They are known for their strong customer focus and commitment to providing affordable insurance coverage.

- Fraternal Benefit Societies: These organizations offer insurance products to members of a specific group or organization, such as a religious or social group. Fraternal benefit societies are known for their community focus and their charitable activities.

- Captive Insurance Companies: Established by a parent company to insure its own risks, captive insurance companies provide a cost-effective way for businesses to manage their insurance needs.

Choosing the Right Insurance Company in CT

Selecting the right insurance company is crucial to ensure you have adequate coverage and receive excellent service. Consider the following factors when making your decision:

- Financial Strength: Choose an insurance company with a strong financial rating from independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s. This ensures the company has the financial resources to pay claims, even in challenging economic times.

- Coverage Options: Ensure the insurance company offers the specific types of coverage you need, whether it’s auto, home, life, health, or business insurance. Compare coverage options and limits to find the best fit for your needs and budget.

- Customer Service: Look for an insurance company with a reputation for excellent customer service. Read online reviews and testimonials to gauge customer satisfaction levels. Choose a company that is responsive, helpful, and easy to work with.

- Claims Process: Inquire about the insurance company’s claims process. How easy is it to file a claim? How quickly are claims processed and paid? Choose a company with a streamlined claims process and a track record of prompt and fair claim settlements.

- Price: While price is important, it shouldn’t be the sole deciding factor. Compare quotes from multiple insurance companies to find the best value for your money. Consider the coverage options, financial strength, and customer service reputation of each company.

Tips for Finding the Best Insurance Companies in CT

- Get Recommendations: Ask friends, family, and colleagues for recommendations on insurance companies in CT. Their personal experiences can provide valuable insights.

- Consult an Independent Insurance Agent: Independent agents represent multiple insurance companies and can help you compare quotes and find the best coverage for your needs.

- Check the Connecticut Insurance Department: The Connecticut Insurance Department provides resources and information on insurance companies licensed to operate in the state. You can check the company’s licensing status and complaint history on their website.

- Read Online Reviews: Read online reviews and testimonials from other customers to get a sense of the company’s reputation and customer service levels.

- Get Multiple Quotes: Don’t settle for the first quote you receive. Get quotes from at least three different insurance companies to compare coverage options and prices.

Conclusion

Insurance companies in CT play a vital role in protecting individuals and businesses from financial losses. With a wide array of insurance products and services available, Connecticut residents have access to comprehensive coverage for their homes, vehicles, health, and businesses. By carefully considering your needs, comparing quotes, and choosing a reputable insurance company, you can ensure you have the protection you need to safeguard your assets and your future. Remember, insurance is an investment in your peace of mind, so choose wisely and enjoy the benefits of comprehensive coverage.

Read More: Medicare Supplement Plan G in Florida: Your Comprehensive Guide