Alabama, with its rich history and vibrant culture, also boasts a robust insurance industry that provides a wide range of coverage options for its residents and businesses. In this comprehensive article, we delve into the landscape of insurance companies in Alabama, exploring their offerings, regulatory environment, and tips for choosing the right insurance provider.

Contents

The Importance of Insurance in Alabama

Insurance plays a crucial role in safeguarding individuals and businesses from financial losses due to unexpected events. From natural disasters like hurricanes and tornadoes to accidents and property damage, insurance provides a safety net that allows individuals and businesses to recover from unforeseen setbacks. In Alabama, insurance is not just a financial product; it is a tool that empowers residents and businesses to thrive amidst uncertainties.

Types of Insurance Companies in Alabama

Alabama’s insurance industry is diverse, comprising various types of companies that cater to different needs. Here are some prominent types of insurance companies in Alabama:

-

Property and Casualty Insurance Companies: These companies offer coverage for property damage, liability, and other risks related to homes, automobiles, and businesses.

-

Life Insurance Companies: These companies provide financial protection to families in the event of the insured’s death.

-

Health Insurance Companies: These companies offer coverage for medical expenses, including hospitalization, surgeries, and medications.

-

Specialty Insurance Companies: These companies focus on specific types of risks, such as professional liability, cyber insurance, and pet insurance.

Leading Insurance Companies in Alabama

Alabama is home to several leading insurance companies that have established a strong presence in the state. Some of the prominent insurance companies in Alabama include:

-

Alfa Insurance: Alfa Insurance is a well-established insurance company in Alabama, offering a wide range of insurance products, including auto, home, life, and health insurance.

-

State Farm: State Farm is a national insurance company with a significant presence in Alabama. It offers various insurance options, including auto, home, life, and health insurance.

-

Allstate: Allstate is another major insurance company operating in Alabama, providing auto, home, life, and other insurance products.

-

Geico: Geico is known for its competitive auto insurance rates and has a growing presence in Alabama.

-

Blue Cross Blue Shield of Alabama: Blue Cross Blue Shield of Alabama is a leading health insurance provider in the state, offering various health insurance plans to individuals and businesses.

Regulatory Environment for Insurance Companies in Alabama

The Alabama Department of Insurance plays a crucial role in regulating the insurance industry in the state. It oversees the licensing of insurance companies, agents, and brokers, ensuring that they adhere to state laws and regulations. The department also protects consumers by investigating complaints and taking action against fraudulent or unethical practices.

Choosing the Right Insurance Company in Alabama

Selecting the right insurance company is a critical decision that can significantly impact your financial well-being. Here are some tips to consider when choosing an insurance company in Alabama:

-

Assess Your Needs: Identify the types of insurance coverage you need based on your personal or business circumstances.

-

Compare Quotes: Obtain quotes from multiple insurance companies to compare coverage options and premiums.

-

Check Financial Strength: Review the financial ratings of insurance companies to ensure their stability and ability to pay claims.

-

Read Reviews and Testimonials: Research online reviews and testimonials from other customers to gauge their experiences with different insurance companies.

-

Seek Recommendations: Ask friends, family, or colleagues for recommendations based on their experiences with insurance companies.

Factors Affecting Insurance Premiums in Alabama

Several factors influence insurance premiums in Alabama. These include:

-

Type of Coverage: The type of insurance coverage you choose will significantly impact your premiums.

-

Coverage Limits: Higher coverage limits generally result in higher premiums.

-

Deductibles: Choosing a higher deductible can lower your premiums but will increase your out-of-pocket expenses in the event of a claim.

-

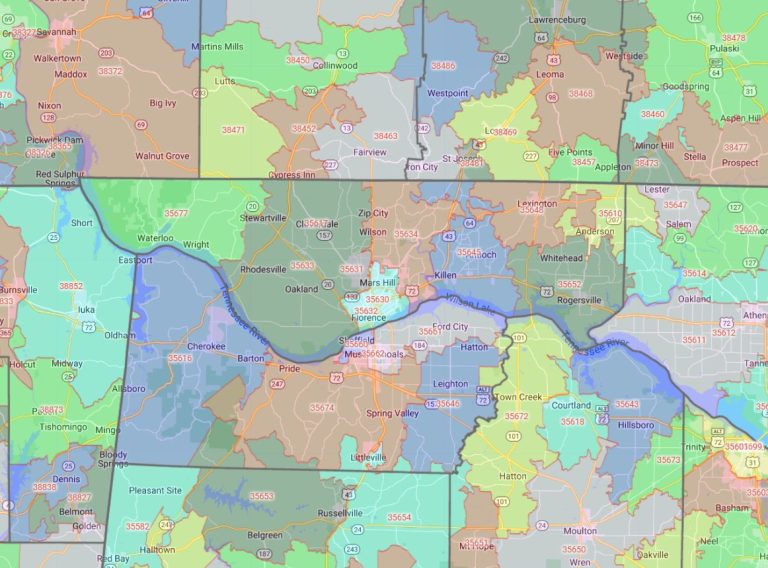

Risk Factors: Individual risk factors, such as driving record, age, health condition, and location, can affect your premiums.

-

Discounts: Many insurance companies offer discounts for various factors, such as bundling multiple policies, maintaining a good driving record, or installing safety features in your home or vehicle.

Insurance and Natural Disasters in Alabama

Alabama is prone to natural disasters, including hurricanes, tornadoes, and floods. Insurance plays a crucial role in mitigating the financial impact of these events. It is essential to have adequate coverage for your home, business, and personal belongings to protect yourself from losses due to natural disasters.

The Future of Insurance in Alabama

The insurance industry in Alabama is constantly evolving, adapting to technological advancements and changing consumer needs. The rise of digital platforms and data analytics is transforming the way insurance companies operate and interact with customers. Additionally, the increasing frequency and severity of natural disasters are driving innovation in insurance products and risk management strategies.

Conclusion

Insurance companies in Alabama play a vital role in protecting individuals and businesses from financial losses. Choosing the right insurance provider requires careful consideration of your needs, budget, and risk factors. By understanding the insurance landscape in Alabama, you can make informed decisions that safeguard your financial well-being and ensure peace of mind. Remember, insurance is not just a financial product; it is an investment in your future.