Managing payroll is a critical but sometimes daunting task for small business owners. While outsourcing to a payroll service is an option, doing payroll yourself can save money and give you greater control over your finances. This guide will walk you through the process, step-by-step.

Contents

Understanding the Basics of Payroll

Before diving in, it’s crucial to grasp the fundamentals of payroll:

- Gross Pay: This is the total amount an employee earns before any deductions.

- Net Pay: This is the amount an employee receives after taxes and other deductions are taken out.

- Payroll Taxes: These are federal, state, and sometimes local taxes that employers must withhold from employee wages and pay on behalf of the business and employees.

- Payroll Schedule: This is the frequency with which you pay your employees (e.g., weekly, bi-weekly, monthly).

- Payroll Forms: Various forms are required for payroll, including the W-4 (Employee’s Withholding Certificate) and the I-9 (Employment Eligibility Verification).

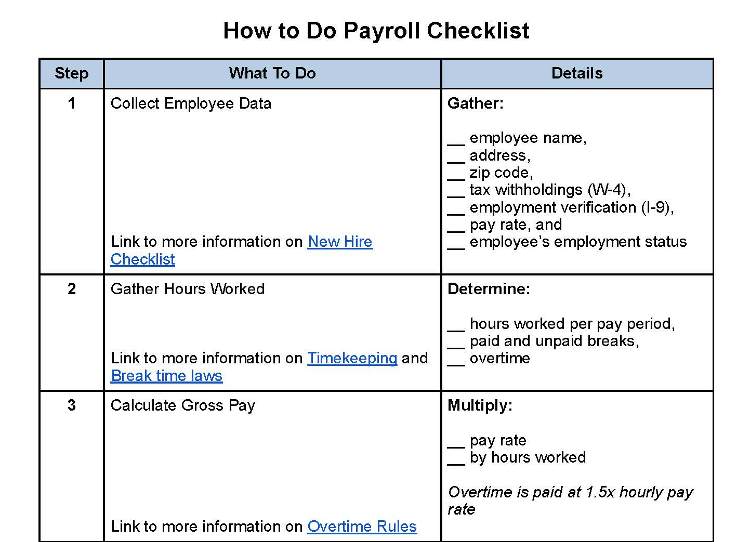

Step-by-Step Guide to DIY Payroll

- Obtain an Employer Identification Number (EIN): Your EIN is like a Social Security Number for your business. You can apply for it for free on the IRS website.

- Gather Employee Information: Collect W-4 forms from each employee. This form determines how much federal income tax should be withheld from their paycheck.

- Set Up a Payroll System: You have several options:

- Manual Payroll: Using spreadsheets or dedicated payroll software.

- Payroll Software: There are many affordable options designed for small businesses.

- Online Payroll Service: These services often handle tax filings and payments for you.

- Choose a Payroll Schedule: Decide how often you’ll pay your employees. Common options include weekly, bi-weekly, or monthly.

- Calculate Gross Wages: Determine each employee’s earnings based on their hourly rate, salary, or commission.

- Calculate and Withhold Payroll Taxes: This is the most complex part of payroll. You’ll need to calculate and withhold:

- Federal Income Tax: Use the W-4 and IRS Publication 15 (Circular E) for guidance.

- Social Security and Medicare Taxes: These are known as FICA taxes. The employer pays half, and the employee pays half.

- State and Local Taxes: Check your state and local requirements.

- Calculate and Deduct Other Deductions: This may include health insurance premiums, retirement contributions, or wage garnishments.

- Calculate Net Pay: Subtract all taxes and deductions from gross wages to determine each employee’s net pay.

- Pay Employees: Issue paychecks or direct deposits on your chosen payroll schedule.

- Deposit and Report Taxes: You’ll need to deposit payroll taxes and file payroll tax returns with the IRS and relevant state agencies. Deadlines vary.

- Year-End Reporting: At the end of the year, issue W-2 forms to employees and file Form W-3 with the Social Security Administration.

Tips for Success

- Keep Meticulous Records: Maintaining accurate records is essential for compliance and avoiding costly mistakes.

- Stay Up-to-Date on Tax Laws: Payroll tax laws can change frequently. Regularly check the IRS website and consult with a tax professional if needed.

- Consider Direct Deposit: It’s convenient for both you and your employees.

- Automate Where Possible: Payroll software can automate calculations and tax filings, saving you time and reducing errors.

- Seek Help When Needed: If you’re unsure about any aspect of payroll, don’t hesitate to consult with an accountant or payroll specialist.

The Benefits of DIY Payroll

- Cost Savings: You can avoid the fees associated with outsourcing payroll services.

- Control: You have direct oversight of your payroll process.

- Flexibility: You can customize your payroll system to fit your business’s specific needs.

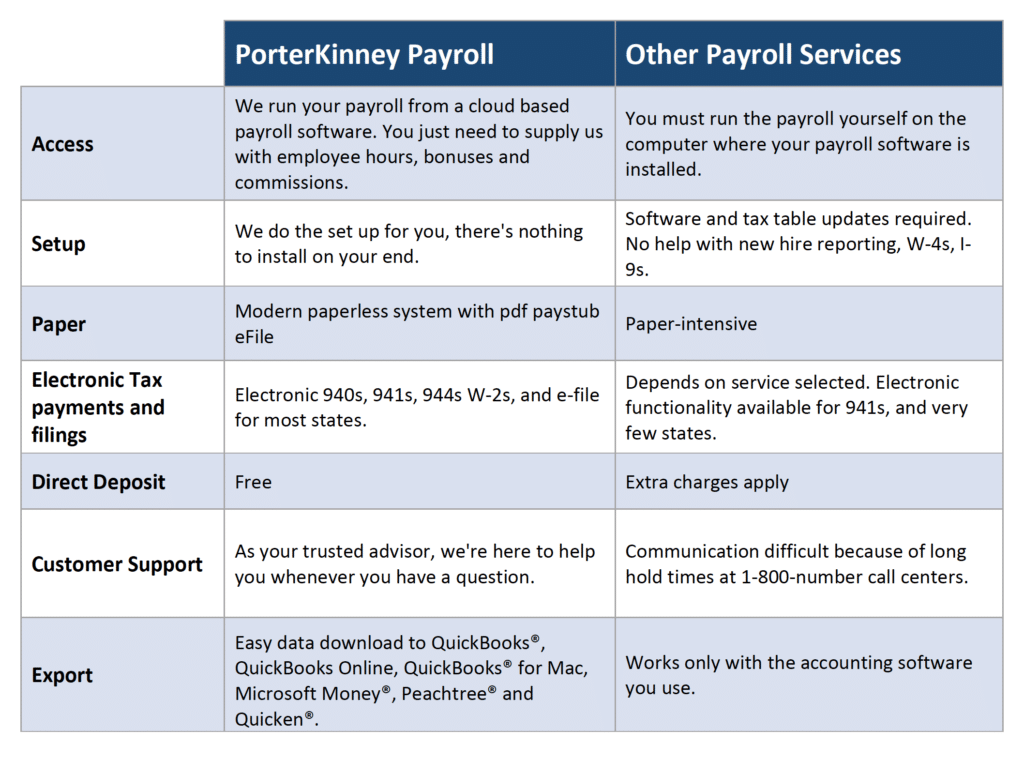

When to Consider Outsourcing

- Complex Payroll: If you have a large number of employees, multiple pay rates, or complex deductions, outsourcing might be more efficient.

- Time Constraints: If you lack the time or expertise to manage payroll yourself, a payroll service can take the burden off your shoulders.

- Risk Aversion: Outsourcing can help minimize the risk of errors and ensure compliance with tax laws.

Conclusion

While doing your own payroll requires effort and attention to detail, it’s a manageable task for many small businesses. By following this guide and utilizing the right tools, you can streamline the process, save money, and maintain control over your finances.