As a sole proprietor, you might find yourself in a position where you need to hire employees to help your business grow. While this can be an exciting step, it also comes with new responsibilities, including understanding how to pay your employees correctly. In this comprehensive article, we’ll break down the key aspects of payroll for sole proprietors, ensuring you have the knowledge to navigate this crucial process.

Key Takeaways:

- Sole proprietors are responsible for handling payroll for their employees.

- Accurate payroll involves calculating wages, withholding taxes, and making timely payments.

- Seeking professional help can streamline the payroll process and ensure compliance.

1. Obtaining an Employer Identification Number (EIN)

Before you can start paying employees, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. This unique nine-digit number identifies your business for tax purposes. You can apply for an EIN online, by mail, or by fax.

2. Gathering Employee Information

Once you’ve hired employees, you’ll need to collect essential information from them, including:

- Form W-4: This form determines the amount of federal income tax to withhold from their wages.

- State tax withholding forms: These forms vary by state and determine the amount of state income tax to withhold.

- I-9 Form: This form verifies the employee’s eligibility to work in the United States.

3. Calculating Gross Wages

The first step in calculating payroll is to determine each employee’s gross wages. This is the total amount earned before any deductions are taken out. Gross wages can be calculated based on:

- Hourly rate: Multiply the employee’s hourly rate by the number of hours worked.

- Salary: Divide the employee’s annual salary by the number of pay periods in a year.

- Commission: Calculate the commission earned based on the employee’s sales or performance.

4. Withholding Taxes

As an employer, you’re responsible for withholding certain taxes from your employees’ wages. These include:

- Federal income tax: The amount withheld depends on the employee’s W-4 form and their income level.

- Social Security tax: Both the employer and employee contribute 6.2% of the employee’s wages up to a certain limit.

- Medicare tax: Both the employer and employee contribute 1.45% of the employee’s wages, with no limit.

- State income tax: The amount withheld varies by state and the employee’s income level.

- Local taxes: Some localities may also require income tax withholding.

5. Paying Employer Taxes

In addition to withholding employee taxes, you’ll also need to pay your share of Social Security and Medicare taxes. You may also be responsible for paying federal and state unemployment taxes.

6. Making Timely Payments

It’s crucial to pay your employees on time and in accordance with your state’s laws. You can choose to pay your employees weekly, biweekly, semimonthly, or monthly.

7. Filing Tax Returns

As a sole proprietor, you’ll need to file various tax returns related to your employees. These include:

- Form 941: This quarterly return reports federal income tax, Social Security tax, and Medicare tax withholding.

- Form 940: This annual return reports federal unemployment taxes.

- State tax returns: You’ll also need to file state tax returns related to your employees’ wages and withholding.

- W-2 Forms: At the end of the year, you’ll need to provide each employee with a W-2 form, which summarizes their earnings and tax withholding for the year.

8. Record Keeping

Maintaining accurate payroll records is essential for tax purposes and compliance. You should keep records of:

- Employee information: W-4 forms, state tax withholding forms, I-9 forms

- Payroll records: Gross wages, tax withholding, net pay

- Tax payments: Federal and state tax deposits, tax returns

9. Seeking Professional Help

Handling payroll can be complex, especially for sole proprietors who may not have experience in this area. Consider seeking professional help from a payroll service provider or an accountant. They can help you:

- Calculate payroll accurately

- Withhold the correct taxes

- Make timely payments

- File tax returns

- Maintain accurate records

10. Staying Compliant

Payroll regulations can change frequently, so it’s important to stay up-to-date on the latest requirements. Failure to comply with payroll laws can result in penalties and fines.

Additional Tips for Sole Proprietors

- Use payroll software: Payroll software can automate many of the payroll tasks, saving you time and reducing the risk of errors.

- Set up direct deposit: This convenient option allows you to pay your employees electronically, eliminating the need for paper checks.

- Communicate with your employees: Make sure your employees understand their pay stubs and how their wages are calculated.

Conclusion

How does a sole proprietor pay employees? By understanding the key aspects of payroll and following the steps outlined in this article, you can ensure that your employees are paid accurately and on time, while also remaining compliant with tax laws. Remember, seeking professional help can be a valuable investment for your business, allowing you to focus on growing your operations while leaving the complexities of payroll to the experts.

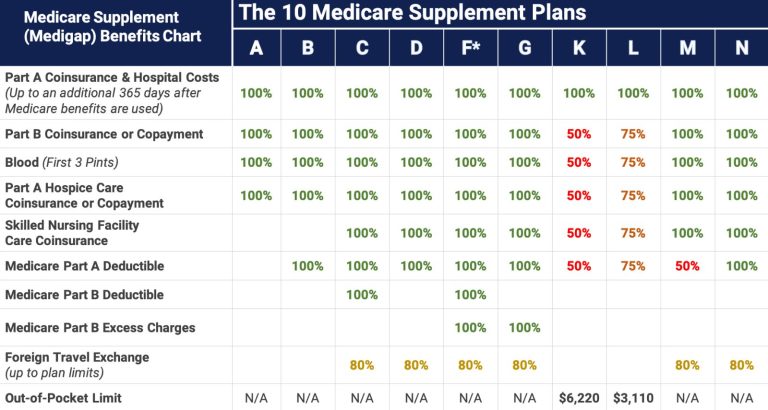

Read More: Illinois Medicare Supplement: A Comprehensive Guide