Navigating the complex world of healthcare benefits for your small business in Los Angeles can be daunting. With rising costs and an array of options, finding the right group medical insurance plan can be challenging. This comprehensive guide aims to shed light on the key considerations, available options, and strategies to secure the best possible coverage for your employees.

Contents

The Importance of Group Medical Insurance for Small Businesses

Group medical insurance plans provide a valuable safety net for your employees, ensuring they have access to quality healthcare when they need it most. Offering such benefits not only safeguards your workforce but also contributes to a positive work environment and attracts top talent.

Key benefits of group medical insurance include:

- Attracting and retaining employees: Offering healthcare benefits can make your business more competitive in the job market, helping you attract and retain top talent.

- Improving employee morale and productivity: Knowing they have access to quality healthcare can enhance employee well-being and job satisfaction, leading to increased productivity.

- Tax advantages: Small businesses may be eligible for tax credits when offering group medical insurance to their employees, reducing their overall costs.

Navigating the Los Angeles Group Medical Insurance Market

The Los Angeles group medical insurance market offers a variety of options, each with its own set of benefits and drawbacks. Understanding the landscape and available plans is crucial for making an informed decision that suits your business needs and budget.

Key factors to consider when selecting a plan include:

- Cost: The cost of group medical insurance can vary depending on the size of your business, the level of coverage, and the insurance provider. Balancing affordability with adequate coverage is essential.

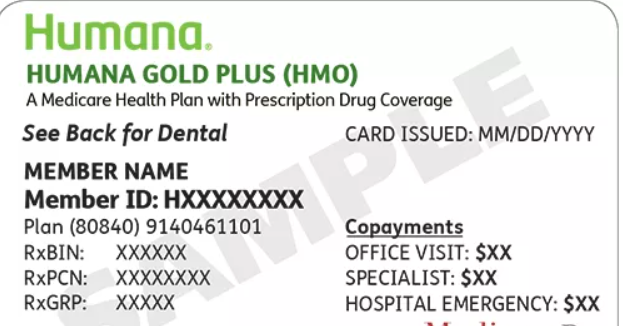

- Coverage options: Assess the different plans available, comparing deductibles, copayments, and out-of-pocket maximums. Ensure the plan covers essential services such as preventive care, hospitalization, and prescription drugs.

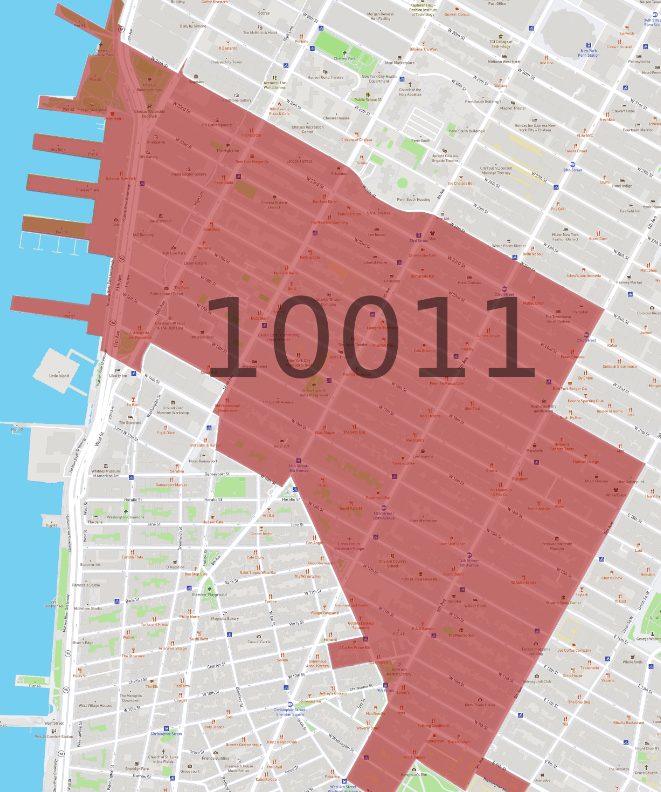

- Network of providers: Consider the insurance provider’s network of doctors and hospitals, ensuring your employees have access to quality healthcare within a convenient location.

Types of Group Medical Insurance Plans

Several group medical insurance plans are available for small businesses in Los Angeles, each catering to different needs and budgets. Understanding the key features of these plans can help you identify the most suitable option for your workforce.

Common types of group medical insurance plans include:

- Health Maintenance Organizations (HMOs): HMOs offer a network of providers and typically require referrals for specialist visits. They offer lower premiums but may have more restrictions on choice of providers.

- Preferred Provider Organizations (PPOs): PPOs offer a broader network of providers and do not typically require referrals. They offer more flexibility but may have higher premiums.

- Exclusive Provider Organizations (EPOs): EPOs combine features of HMOs and PPOs, offering a network of providers but requiring referrals for specialist visits outside the network.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles, making them suitable for employees who anticipate fewer healthcare needs. They can be paired with a Health Savings Account (HSA) for tax-advantaged savings.

Group Medical Insurance Requirements for Los Angeles Small Businesses

Small businesses in Los Angeles must meet certain requirements to qualify for group medical insurance. These requirements typically include:

- Minimum number of employees: The minimum number of employees required to qualify for group medical insurance varies depending on the insurance provider and plan. However, many providers offer plans for businesses with as few as two employees.

- Employee eligibility: Employees must meet specific criteria to be eligible for coverage, such as working a minimum number of hours per week or holding a specific job title.

- Participation rate: A certain percentage of eligible employees must enroll in the plan for it to be offered. This ensures the risk pool is large enough to sustain the plan.

Strategies for Securing Affordable Group Medical Insurance

Small businesses in Los Angeles can employ several strategies to secure affordable group medical insurance for their employees. These strategies include:

- Shop around and compare plans: Obtain quotes from multiple insurance providers, comparing costs, coverage options, and network of providers.

- Consider a professional employer organization (PEO): PEOs can help small businesses access group medical insurance plans at more affordable rates by pooling their employees with other small businesses.

- Explore tax credits: Small businesses may be eligible for tax credits when offering group medical insurance to their employees, reducing their overall costs.

- Promote employee wellness programs: Implementing employee wellness programs can help reduce healthcare costs and improve employee health, potentially leading to lower premiums in the long run.

The Role of a Broker in Securing Group Medical Insurance

A broker can play a crucial role in helping small businesses navigate the complex group medical insurance market in Los Angeles. They can:

- Provide expert guidance: Brokers have in-depth knowledge of the insurance market and can help you understand the different plans available and their suitability for your business.

- Simplify the process: Brokers can handle the administrative tasks associated with securing group medical insurance, saving you time and effort.

- Negotiate on your behalf: Brokers can leverage their relationships with insurance providers to negotiate the best possible rates and terms for your business.

- Provide ongoing support: Brokers can assist with employee enrollment, claims processing, and any questions or concerns that may arise.

Future Trends in Group Medical Insurance

The group medical insurance landscape is constantly evolving, with several trends shaping the future of healthcare benefits for small businesses.

- Telemedicine: The increasing adoption of telemedicine is transforming the way healthcare is delivered, offering greater convenience and accessibility for employees.

- Data analytics: The use of data analytics is helping insurance providers identify cost-saving opportunities and develop more personalized plans.

- Wellness programs: The emphasis on preventive care and wellness programs is growing, promoting employee health and potentially reducing healthcare costs.

Conclusion

Securing group medical insurance for your small business in Los Angeles is a crucial step in safeguarding your employees and creating a positive work environment. By understanding the available options, navigating the market, and employing effective strategies, you can find a plan that meets your needs and budget, ensuring your workforce has access to quality healthcare when they need it most. Remember, investing in your employees’ health is an investment in the future of your business.

Read More: LLC Insurance Ohio: A Comprehensive Guide