In today’s dynamic business landscape, providing comprehensive health benefits is paramount for attracting and retaining top talent. Group health insurance serves as a cornerstone of employee well-being, offering financial protection against unexpected medical expenses. However, navigating the intricacies of group health quotes and selecting the right plan can be a daunting task for employers. This exclusive article aims to provide a comprehensive overview of group health quotes, empowering businesses to make informed decisions about their employee health benefits.

Understanding Group Health Quotes

Group health quotes represent the estimated cost of providing health insurance coverage to a group of employees. These quotes are typically provided by insurance carriers based on various factors, including the size of the group, employee demographics, plan design, and desired coverage levels. By analyzing group health quotes, employers can compare different insurance options, assess their affordability, and choose a plan that aligns with their budget and employee needs.

Factors Influencing Group Health Quotes

Several factors influence the cost of group health quotes. Understanding these factors can help employers anticipate potential cost drivers and make informed decisions about their health insurance plans.

Group Size and Demographics

The size of the employee group and its demographics significantly impact group health quotes. Larger groups often enjoy economies of scale, leading to lower premiums per employee. Additionally, the age, gender, and health status of the group members can influence the overall cost. Groups with a higher proportion of older or less healthy individuals may face higher premiums.

Plan Design and Coverage Levels

The specific plan design and coverage levels chosen by the employer play a crucial role in determining group health quotes. Plans with broader coverage and lower deductibles typically come with higher premiums. Employers need to strike a balance between providing adequate coverage and managing their budget.

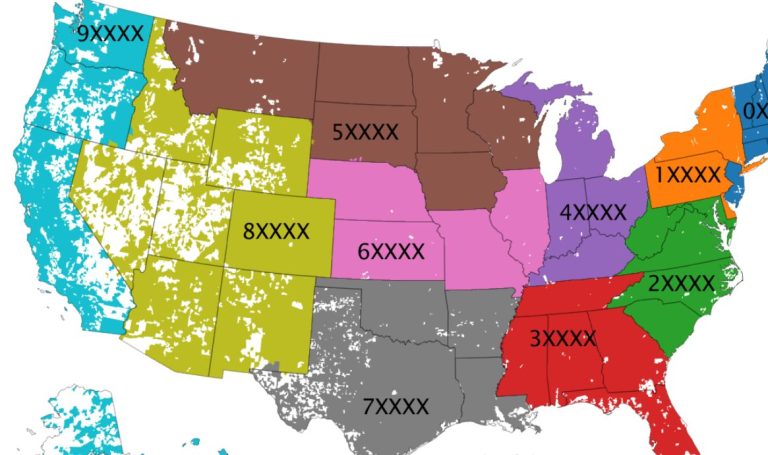

Network Providers and Geographic Location

The network of healthcare providers included in the plan and the geographic location of the group can also impact group health quotes. Plans with extensive provider networks and coverage in high-cost areas may have higher premiums.

Industry and Occupation

The industry and occupation of the employee group can influence group health quotes. Certain industries with higher risks of workplace injuries or occupational hazards may face higher premiums.

Additional Benefits and Riders

Employers may choose to add additional benefits or riders to their group health insurance plans, such as dental, vision, or life insurance coverage. These additional benefits can increase the overall cost of the plan.

Evaluating Group Health Quotes

When evaluating group health quotes, employers should consider various factors beyond just the premium cost.

Coverage and Benefits

Carefully review the coverage and benefits offered by each plan. Ensure that the plan provides adequate coverage for essential health services, such as preventive care, hospitalization, prescription drugs, and specialist consultations.

Network Providers

Assess the network of healthcare providers included in the plan. Ensure that the network includes a sufficient number of preferred providers in convenient locations for employees.

Deductibles and Copayments

Understand the deductibles and copayments associated with each plan. Higher deductibles and copayments can lead to lower premiums but may result in higher out-of-pocket costs for employees.

Employee Contributions

Consider the employee contributions required for each plan. Higher employee contributions can help reduce the employer’s cost but may impact employee satisfaction and participation rates.

Wellness Programs

Inquire about any wellness programs or incentives offered by the insurance carrier. These programs can promote employee health and well-being, potentially leading to lower healthcare costs in the long run.

Customer Service and Claims Processing

Assess the insurance carrier’s reputation for customer service and claims processing. Prompt and efficient claims processing can contribute to a positive employee experience.

Obtaining Group Health Quotes

Employers can obtain group health quotes through various channels.

Insurance Brokers

Insurance brokers specialize in helping businesses navigate the complexities of group health insurance. They can provide multiple quotes from different insurance carriers, assist with plan selection, and handle the enrollment process.

Insurance Carriers

Employers can contact insurance carriers directly to obtain group health quotes. This approach may require more research and comparison on the employer’s part.

Online Marketplaces

Some online marketplaces allow employers to compare group health quotes from multiple insurance carriers. However, these marketplaces may have limited options and may not provide personalized assistance.

Tips for Managing Group Health Costs

Managing group health costs is an ongoing process. Employers can implement various strategies to control costs while providing valuable health benefits to their employees.

Promote Employee Wellness

Encourage employees to adopt healthy lifestyles through wellness programs, health screenings, and educational resources. Healthy employees are less likely to require extensive medical care, leading to lower healthcare costs.

Consider High-Deductible Health Plans (HDHPs)

HDHPs typically come with lower premiums but require employees to pay higher deductibles before insurance coverage kicks in. Employers can pair HDHPs with Health Savings Accounts (HSAs) to help employees save for future medical expenses.

Review Plan Utilization

Regularly review plan utilization data to identify areas where costs can be reduced. This analysis can help employers make informed decisions about plan design and coverage levels.

Negotiate with Insurance Carriers

Employers can negotiate with insurance carriers to obtain better rates or additional benefits. Leverage the size of your group and your claims history to secure a favorable deal.

Communicate with Employees

Effectively communicate with employees about their health benefits and encourage them to be informed consumers of healthcare services. Educated employees are more likely to make cost-effective healthcare choices.

Conclusion

Providing comprehensive health benefits is a vital component of a successful employee retention strategy. Group health insurance offers financial protection and peace of mind to employees, while attracting and retaining top talent for employers. By understanding the intricacies of group health quotes and implementing cost-management strategies, businesses can navigate the complexities of employer-sponsored health insurance and create a win-win situation for both themselves and their employees. Remember, investing in employee health is an investment in the future success of your organization.

Read More: Howell’s Chiropractic Enumclaw: A Legacy of Healing and Wellness