In the intricate world of business, understanding the nuances of insurance is paramount. Two crucial components that often intersect are general liability and workers’ comp. This comprehensive guide aims to shed light on these insurance types, their importance, and how they intertwine to protect businesses and their employees.

Contents

Understanding General Liability Insurance

General liability insurance is a fundamental safeguard for businesses against a wide array of risks. It provides financial protection in the event of third-party claims for bodily injury, property damage, personal and advertising injury, and certain legal defense costs.

Why is General Liability Insurance Essential?

-

Protection from Lawsuits: General liability insurance acts as a shield against lawsuits arising from accidents or incidents on your business premises or due to your operations.

-

Coverage for Medical Expenses: If a customer or visitor is injured on your property, general liability insurance can cover their medical expenses, preventing a financial burden on your business.

-

Property Damage Coverage: Accidents happen, and if your business operations cause damage to someone else’s property, general liability insurance can step in to cover the repair or replacement costs.

-

Reputation Management: In the event of a lawsuit, general liability insurance can cover legal defense costs, helping to protect your business’s reputation and financial stability.

What Does General Liability Insurance Typically Cover?

- Bodily Injury: Covers medical expenses, lost wages, and pain and suffering resulting from injuries caused by your business.

- Property Damage: Covers the cost of repairing or replacing property damaged due to your business operations.

- Personal and Advertising Injury: Covers claims of libel, slander, copyright infringement, and other forms of defamation.

- Legal Defense Costs: Covers attorney fees, court costs, and settlements in the event of a lawsuit.

Understanding Workers’ Compensation Insurance

Workers’ compensation insurance, often called workers’ comp, is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses. These benefits can include medical expenses, lost wages, and disability payments.

Why is Workers’ Compensation Insurance Important?

-

Employee Protection: Workers’ comp provides a safety net for employees, ensuring they receive necessary medical care and financial support if injured on the job.

-

Employer Protection: It protects employers from lawsuits filed by injured employees, as workers’ comp benefits are typically the exclusive remedy for work-related injuries.

-

Legal Compliance: In most states, workers’ compensation insurance is mandatory for businesses with employees, and failure to comply can result in fines and penalties.

-

Business Continuity: By providing prompt medical care and wage replacement, workers’ comp helps injured employees recover and return to work sooner, minimizing disruptions to your business.

What Does Workers’ Compensation Insurance Typically Cover?

- Medical Expenses: Covers the cost of medical treatment, hospitalization, and rehabilitation for work-related injuries or illnesses.

- Lost Wages: Provides a portion of an employee’s lost wages while they are unable to work due to a work-related injury.

- Disability Benefits: Offers financial support for employees who suffer permanent disabilities as a result of a work-related injury.

- Death Benefits: Provides financial assistance to the dependents of employees who die due to a work-related injury.

The Interplay Between General Liability and Workers’ Comp

General liability and workers’ comp are distinct insurance types, but they often work in tandem to provide comprehensive protection for businesses.

-

General liability covers injuries or damage caused to third parties, such as customers or visitors, while workers’ comp covers injuries or illnesses suffered by employees.

-

Both types of insurance are crucial for protecting your business from financial losses and legal liabilities.

-

In some cases, both general liability and workers’ comp may be triggered by the same incident. For example, if an employee is injured while operating a company vehicle and the accident also causes damage to a third party’s property, both insurance policies may come into play.

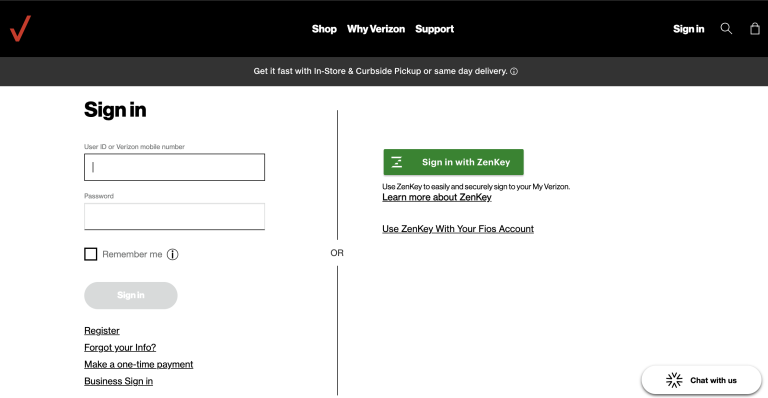

Choosing the Right Insurance Coverage

The specific insurance needs of your business will depend on various factors, such as the nature of your operations, the number of employees, and the level of risk involved.

-

Consult with an insurance professional: They can assess your business’s unique risks and recommend the appropriate types and amounts of coverage.

-

Review your policies regularly: Ensure your policies are up-to-date and adequately cover your current operations.

-

Understand your policy limits: Know the maximum amount your insurance will pay for covered claims.

Conclusion

General liability and workers’ comp are indispensable tools for protecting your business and your employees. By understanding their distinctions and how they work together, you can make informed decisions about your insurance coverage and ensure your business is prepared for the unexpected. Remember, investing in the right insurance coverage is not just a legal requirement; it’s a strategic decision that can safeguard your business’s future.