What is short code 2300?In the realm of mobile communication, short codes play a crucial role in facilitating concise interactions between businesses and consumers. Short code 2300 stands out as a prime example, often associated with automated notifications and alerts related to financial transactions and account updates. Let’s delve deeper into the functionalities of this specific short code.

Contents

Understanding the Purpose of Short Code 2300

Short code 2300 primarily serves as a communication channel for financial institutions to disseminate important information to their customers. These messages often pertain to:

- Transaction Alerts: Real-time notifications about purchases, withdrawals, deposits, and other account activities.

- Account Balance Updates: Periodic summaries of available funds and recent transactions.

- Fraud Alerts: Timely warnings about suspicious activities detected on your account.

- Security Notifications: Updates regarding changes in passwords, security settings, or other account-related information.

- Promotional Offers: Special discounts, rewards programs, or other marketing messages.

Read also: Applications of the 2300 Short Code

Ensuring Security and Trustworthiness

Financial institutions take stringent measures to ensure the security of messages sent via short code 2300. These include:

- Encryption: Protecting sensitive information from unauthorized access.

- Sender Verification: Confirming the legitimacy of the messages’ origin.

- Opt-Out Options: Allowing users to unsubscribe from unwanted notifications.

Benefits of Short Code 2300

The utilization of short code 2300 offers several advantages to both financial institutions and their customers:

- Convenience: Enables quick and efficient communication without the need for lengthy emails or phone calls.

- Real-Time Updates: Keeps customers informed about their finances on the go.

- Enhanced Security: Provides timely alerts about potential fraudulent activities.

- Improved Customer Engagement: Facilitates targeted communication and personalized offers.

What is the code 2300 on T-Mobile? An Exclusive Look

Deciphering the Code

The enigmatic code 2300, when encountered on a T-Mobile device, usually indicates a network registration failure. In simpler terms, your phone is having trouble connecting to the T-Mobile network.

What Causes It?

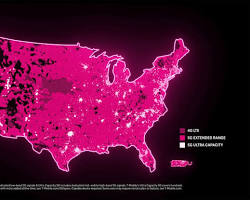

- Weak Signal: The most common culprit is a weak or unstable signal. This can occur in areas with poor network coverage or due to obstructions like buildings or trees.

- SIM Card Issues: A faulty or improperly inserted SIM card can also trigger the 2300 error.

- Network Outages: While less frequent, network outages or maintenance can temporarily prevent your device from registering.

- Software Glitches: Occasionally, software bugs or outdated firmware can cause network connectivity problems.

Troubleshooting Tips

- Restart Your Device: The good old restart often resolves minor glitches.

- Check Network Coverage: Ensure you are in an area with adequate T-Mobile coverage.

- Reinsert SIM Card: Carefully remove and reinsert your SIM card, ensuring it is properly seated.

- Update Software: Check for and install any available software updates for your device.

- Contact T-Mobile Support: If the problem persists, reach out to T-Mobile customer support for further assistance.

Conclusion

While the code 2300 on T-Mobile can be momentarily frustrating, it is usually a solvable issue. By understanding its cause and following the troubleshooting steps, you can restore your network connection and get back to enjoying seamless communication.

In Conclusion

Short code 2300 plays a pivotal role in the modern financial landscape, fostering seamless communication between banks and their customers. By delivering crucial account updates and security alerts, this short code empowers individuals to stay in control of their finances and safeguard against potential risks. As technology continues to evolve, short codes like 2300 are poised to become even more integral to the way we interact with our financial institutions.

Read More: Can Someone Track Your Texts?