Contents

Finding the Cheapest Insurance in CT: Your Financial Advantage

Connecticut drivers know that car insurance is a necessity, but it doesn’t have to break the bank. In this guide, we’ll delve into the strategies, companies, and coverage options that can help you secure the cheapest insurance in CT while still getting the protection you need.

Understanding Connecticut’s Car Insurance Requirements

Before we dive into the specifics of finding affordable insurance, it’s crucial to understand Connecticut’s minimum coverage requirements:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured/Underinsured Motorist Bodily Injury: $25,000 per person / $50,000 per accident

- Uninsured/Underinsured Motorist Property Damage: $25,000 per accident

Key Factors Influencing Car Insurance Rates in CT

Several factors play a significant role in determining your car insurance premiums in Connecticut. Understanding these can help you make informed decisions:

- Driving History: A clean driving record will generally lead to lower rates.

- Credit Score: Your credit history can impact your premiums (though this is not allowed in all states).

- Vehicle Type: The make, model, and year of your car affect insurance costs.

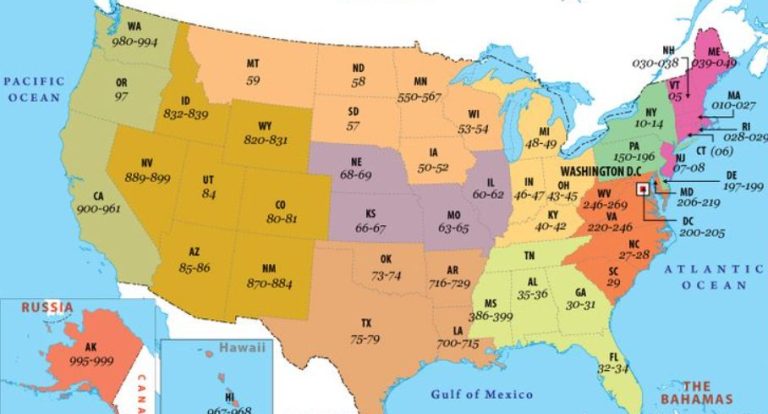

- Location: Where you live in Connecticut can influence your rates due to varying risk levels.

- Coverage Choices: The types and amounts of coverage you select will directly impact your premiums.

- Deductibles: Higher deductibles usually result in lower monthly premiums.

- Discounts: Many insurers offer various discounts that can significantly reduce your costs.

Top Companies Offering the Cheapest Insurance in CT

Based on recent data and analysis, the following companies consistently rank among the most affordable options for car insurance in Connecticut:

- State Farm: Often the cheapest insurance in CT for both full coverage and minimum coverage policies.

- Geico: A popular choice for its competitive rates and online convenience.

- USAA: Offers excellent rates for military members and their families.

- Travelers: A well-established insurer with a strong reputation and competitive pricing.

- Progressive: Known for its wide range of discounts and usage-based insurance programs.

Tips for Finding the Cheapest Insurance in CT

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Get quotes from multiple insurers to compare rates and coverage options.

- Bundle Your Policies: Many insurers offer discounts for bundling your car insurance with other policies, such as home or renters insurance.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, or discounts for completing defensive driving courses.

- Consider Usage-Based Insurance: If you’re a safe driver, you could save money by enrolling in a usage-based insurance program that tracks your driving habits.

- Adjust Your Coverage: Review your coverage needs regularly and adjust your policy to ensure you’re not paying for coverage you don’t need.

- Maintain a Good Credit Score: If your state allows it, maintaining a good credit score can help you qualify for lower rates.

- Choose the Right Car: When shopping for a new car, consider the insurance costs associated with different models.

The Importance of Working with an Independent Agent

An independent insurance agent can be a valuable resource in your search for the cheapest insurance in CT. They can help you compare quotes from multiple insurers, identify discounts you may be eligible for, and find the best coverage options to meet your needs and budget.

Your Path to Affordable Car Insurance in CT

Finding the cheapest insurance in CT requires some effort, but the savings can be substantial. By shopping around, comparing quotes, and taking advantage of discounts, you can secure affordable coverage that protects you and your vehicle without straining your finances. Remember, the cheapest option isn’t always the best, so make sure the policy you choose meets your individual needs and provides adequate protection.