Navigating the world of health insurance can be overwhelming, especially when you’re on a budget. If you’re a Louisiana resident searching for affordable coverage, you’ve come to the right place. This comprehensive guide will delve into the intricacies of finding the cheapest health insurance in Louisiana, exploring various options, factors to consider, and resources to help you make an informed decision.

Contents

Understanding the Louisiana Health Insurance Landscape

Before we dive into the specifics of finding the cheapest health insurance, it’s crucial to grasp the broader context of the Louisiana health insurance market.

The Affordable Care Act (ACA) and its Impact

The Affordable Care Act, also known as Obamacare, has significantly impacted the health insurance landscape in Louisiana and across the United States. It introduced several key provisions, including:

- Health Insurance Marketplace: The ACA established the Health Insurance Marketplace, an online platform where individuals and families can compare and purchase health insurance plans.

- Subsidies: The ACA provides subsidies to eligible individuals and families, helping them afford health insurance coverage.

- Medicaid Expansion: The ACA expanded Medicaid eligibility in many states, including Louisiana, providing coverage to more low-income individuals.

Louisiana’s Health Insurance Marketplace

Louisiana utilizes the federally facilitated Health Insurance Marketplace, healthcare.gov, to offer health insurance plans to its residents. This platform allows you to compare plans from different insurance carriers, assess their coverage and costs, and enroll in a plan that suits your needs and budget.

Factors Affecting Health Insurance Premiums

Several factors influence the cost of health insurance premiums in Louisiana. Understanding these factors will empower you to make informed decisions when searching for the cheapest health insurance.

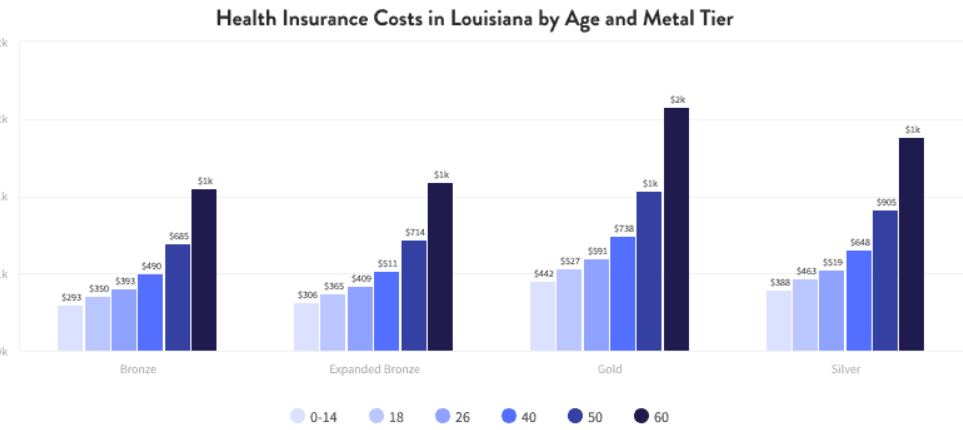

Age

Generally, as you get older, your health insurance premiums tend to increase. This is because older individuals are statistically more likely to require medical care.

Location

Where you live in Louisiana can also impact your health insurance premiums. Insurance carriers may adjust their rates based on the healthcare costs and utilization patterns in specific regions.

Tobacco Use

If you use tobacco products, you can expect to pay higher health insurance premiums. Insurance companies consider tobacco use a significant risk factor for various health conditions.

Plan Category

The ACA categorizes health insurance plans into metal tiers: Bronze, Silver, Gold, and Platinum. Bronze plans have the lowest monthly premiums but higher out-of-pocket costs, while Platinum plans have the highest monthly premiums but lower out-of-pocket costs.

Family Size

The number of people covered under your health insurance plan will also affect your premiums. Family plans typically cost more than individual plans.

Provider Network

The network of healthcare providers included in your health insurance plan can influence your premiums. Plans with narrower networks may have lower premiums but offer less flexibility in choosing your doctors and hospitals.

Finding the Cheapest Health Insurance in Louisiana

Now that you understand the factors affecting health insurance premiums, let’s explore strategies to find the cheapest health insurance in Louisiana.

Utilize the Health Insurance Marketplace

The Health Insurance Marketplace is a valuable resource for comparing health insurance plans and accessing subsidies. Visit healthcare.gov during the open enrollment period to explore your options and determine your eligibility for financial assistance.

Consider Catastrophic Plans

If you’re under 30 or qualify for a hardship exemption, you may be eligible for a catastrophic health insurance plan. These plans have very low monthly premiums but high deductibles. They offer essential coverage for major medical events but may not cover routine care.

Explore Medicaid

If you have a low income, you may qualify for Medicaid in Louisiana. Medicaid provides comprehensive health coverage at little or no cost to eligible individuals and families. Visit the Louisiana Department of Health website to learn more about Medicaid eligibility and enrollment.

Shop Around and Compare Plans

Don’t settle for the first health insurance plan you come across. Take the time to shop around and compare plans from different insurance carriers. Pay attention to the monthly premiums, deductibles, copays, and coinsurance to assess the overall affordability of each plan.

Consider a Health Savings Account (HSA)

If you opt for a high-deductible health plan, consider pairing it with a Health Savings Account (HSA). HSAs allow you to contribute pre-tax dollars to save for qualified medical expenses. Your contributions grow tax-free, and you can use the funds to pay for deductibles, copays, and other eligible healthcare costs.

Review Your Coverage Annually

Your health insurance needs may change over time. It’s essential to review your coverage annually during the open enrollment period to ensure it still meets your requirements and budget. You may find a more affordable plan or become eligible for subsidies that weren’t available previously.

Tips for Saving on Health Insurance

In addition to the strategies mentioned above, here are some additional tips to help you save on health insurance in Louisiana:

Maintain a Healthy Lifestyle

Adopting healthy habits, such as eating a balanced diet, exercising regularly, and avoiding tobacco products, can improve your overall health and potentially lower your health insurance premiums in the long run.

Take Advantage of Preventive Care

Most health insurance plans cover preventive care services, such as annual checkups, screenings, and immunizations, at no cost to you. Take advantage of these services to detect and address health issues early, potentially avoiding costly medical treatments in the future.

Utilize Generic Medications

When prescribed medications, ask your doctor if generic alternatives are available. Generic medications are typically much cheaper than brand-name drugs and offer the same effectiveness.

Negotiate Medical Bills

If you receive a medical bill that seems unusually high, don’t hesitate to contact the healthcare provider or insurance company to inquire about potential errors or negotiate a lower payment.

Consider Telemedicine

Telemedicine allows you to consult with a doctor remotely via phone or video call. It can be a convenient and cost-effective alternative to in-person visits, especially for minor health concerns.

Resources for Finding Affordable Health Insurance in Louisiana

Several resources can assist you in your search for the cheapest health insurance in Louisiana:

- Healthcare.gov: The official website of the Health Insurance Marketplace.

- Louisiana Department of Health: The state agency responsible for administering Medicaid and other health programs.

- Louisiana Health Insurance Assistance Program (LHIAP): A free program that provides unbiased assistance with health insurance enrollment and questions.

- Local Community Health Centers: These centers often offer sliding-scale fees based on income and may provide enrollment assistance for health insurance programs.

Conclusion

Finding the cheapest health insurance in Louisiana requires careful consideration of various factors and a proactive approach. By utilizing the Health Insurance Marketplace, exploring Medicaid, comparing plans, and adopting cost-saving strategies, you can secure affordable coverage that protects your health and financial well-being. Remember, health insurance is an investment in your future, so take the time to research your options and choose a plan that aligns with your needs and budget.

Read More: Affordable Health Insurance in Louisiana: A Comprehensive Guide