Understanding Insurance in Mississippi

Before diving into the search for cheap insurance, it’s crucial to understand the insurance landscape in Mississippi.

- Mandatory Insurance: Mississippi law mandates that all drivers carry minimum liability insurance coverage. This includes bodily injury liability and property damage liability.

- Additional Coverage: While minimum coverage is required, it’s advisable to consider additional coverage options such as collision, comprehensive, and uninsured/underinsured motorist coverage for enhanced protection.

- Factors Affecting Insurance Premiums: Several factors can impact your insurance premiums in Mississippi, including your driving record, age, location, vehicle type, and coverage limits. Understanding these factors will help you make informed decisions.

Tips for Finding Cheap Insurance Mississippi

Now that you have a basic understanding of insurance in Mississippi, let’s explore some effective strategies to find affordable coverage.

1. Shop Around and Compare Quotes

One of the most crucial steps in finding cheap insurance is to shop around and compare quotes from multiple insurance providers. Each insurer uses its own unique formula to calculate premiums, so rates can vary significantly.

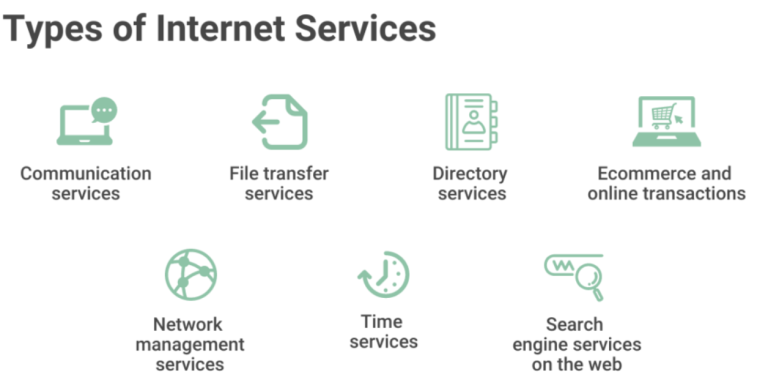

- Online Comparison Tools: Utilize online comparison tools to gather quotes from different insurers quickly and easily.

- Independent Agents: Consider contacting independent insurance agents who can provide quotes from multiple carriers and offer personalized advice.

2. Take Advantage of Discounts

Insurance companies offer various discounts that can help you save on your premiums. Some common discounts include:

- Good Driver Discount: Maintain a clean driving record to qualify for this discount.

- Multi-Policy Discount: Bundle your auto insurance with other policies, such as homeowners or renters insurance, to enjoy a discount.

- Safety Features Discount: Install safety features in your vehicle, such as anti-theft devices or airbags, to qualify for a discount.

- Student Discount: If you’re a student with good grades, you may be eligible for a discount.

3. Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums. However, ensure you have enough savings to cover the higher deductible in case of an accident.

4. Maintain a Good Credit Score

In Mississippi, insurance companies can use your credit score as a factor in determining your premiums. Maintaining a good credit score can help you secure lower rates.

5. Consider Usage-Based Insurance

Usage-based insurance programs track your driving habits and offer discounts based on your driving behavior. If you’re a safe and responsible driver, this could be a great option to save on your premiums.

6. Choose the Right Vehicle

The type of vehicle you drive can significantly impact your insurance costs. Generally, newer and more expensive vehicles tend to have higher insurance premiums. Consider choosing a safe and reliable vehicle with good safety ratings to potentially lower your insurance costs.

7. Drive Less

The fewer miles you drive, the lower your risk of an accident. Some insurance companies offer low-mileage discounts to drivers who drive less than the average mileage.

8. Review Your Coverage Regularly

As your circumstances change, so do your insurance needs. Review your coverage regularly to ensure you have adequate protection without paying for unnecessary coverage.

9. Ask About Group Discounts

Some employers, professional organizations, or alumni associations offer group insurance discounts to their members. Inquire about potential group discounts to see if you qualify.

10. Avoid Lapses in Coverage

Maintaining continuous insurance coverage is crucial. Lapses in coverage can lead to higher premiums when you reinstate your policy.

Finding the Best Cheap Insurance Mississippi Providers

Several insurance providers offer competitive rates in Mississippi. Here are some of the top options to consider:

- State Farm: State Farm is a well-established insurer with a strong presence in Mississippi. They offer a wide range of coverage options and discounts.

- Geico: Geico is known for its affordable rates and user-friendly online platform. They offer various discounts and convenient policy management tools.

- Progressive: Progressive is another popular choice for cheap insurance in Mississippi. They offer competitive rates and innovative features like Snapshot, their usage-based insurance program.

- Allstate: Allstate offers a variety of coverage options and discounts. They also provide tools and resources to help you manage your policy and file claims easily.

- USAA: USAA is an excellent option for military members and their families. They offer competitive rates and comprehensive coverage options.

Additional Resources for Finding Cheap Insurance Mississippi

Besides the tips and providers mentioned above, here are some additional resources that can help you in your search for cheap insurance in Mississippi:

- Mississippi Insurance Department: The Mississippi Insurance Department website provides valuable information about insurance regulations, consumer guides, and complaint resolution.

- Independent Insurance Agents: Consult with independent insurance agents in your area who can provide personalized guidance and quotes from multiple insurers.

- Online Reviews and Ratings: Read online reviews and ratings of different insurance providers to get insights from other customers.

Conclusion: Securing Cheap Insurance Mississippi

Finding cheap insurance in Mississippi requires research, comparison, and smart decision-making. By following the tips and strategies outlined in this guide, you can secure affordable coverage that meets your needs and budget. Remember, cheap insurance Mississippi doesn’t mean compromising on quality. It’s about finding the right balance between cost and coverage to protect yourself and your assets.