Medicare Advantage (MA) plans, also known as Part C, offer an alternative to Original Medicare (Part A and Part B). These plans provide comprehensive coverage, often including prescription drug coverage (Part D), and additional benefits like dental, vision, and hearing. However, one common question among beneficiaries is, “Can I switch Medicare Advantage plans anytime?“

The answer is both yes and no. There are specific enrollment periods and certain situations where you can change your MA plan. Let’s explore these in detail.

Contents

When Can You Switch Medicare Advantage Plans?

1. Annual Enrollment Period (AEP)

- Timeframe: October 15 to December 7 each year

- Flexibility: You can switch from one MA plan to another, enroll in an MA plan for the first time, or disenroll from an MA plan and return to Original Medicare.

The AEP is the most common time to switch Medicare Advantage plans. It allows you to reassess your current plan, compare it with other options, and make changes that better suit your needs for the upcoming year.

2. Medicare Advantage Open Enrollment Period (MA OEP)

- Timeframe: January 1 to March 31 each year

- Limitations: You can only switch from one MA plan to another or disenroll from an MA plan and return to Original Medicare. You cannot enroll in an MA plan for the first time during this period.

The MA OEP provides a second chance to switch plans if you’re unhappy with your current one. However, it’s important to note that you cannot enroll in an MA plan if you’re currently on Original Medicare during this period.

3. Special Enrollment Periods (SEPs)

- Timeframe: Varies depending on the qualifying event

- Flexibility: You may be able to switch MA plans, enroll in an MA plan, or disenroll from an MA plan and return to Original Medicare, depending on the specific SEP.

SEPs are triggered by certain life events that may impact your healthcare needs or eligibility for Medicare. Some common SEPs include:

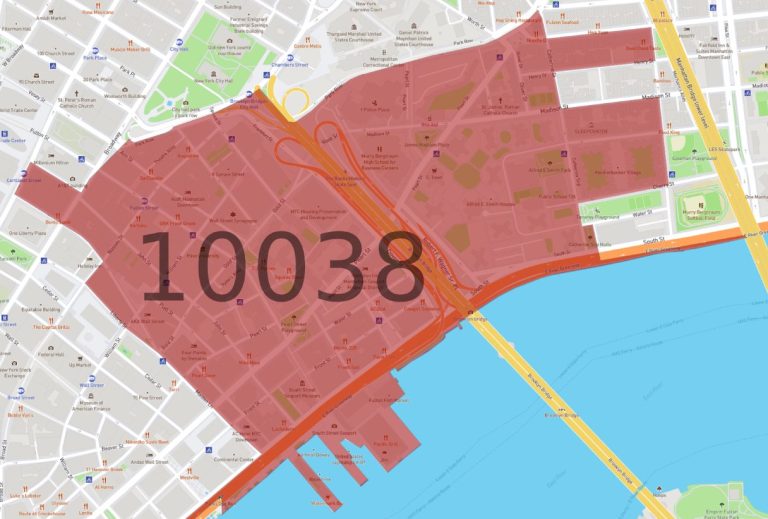

- Moving: If you move to a new address that’s outside your current plan’s service area, you may be eligible for an SEP.

- Losing employer or union coverage: If you lose your employer or union health coverage, you may qualify for an SEP to enroll in an MA plan.

- Qualifying for Medicaid: If you become eligible for Medicaid, you may have an SEP to switch or enroll in an MA plan.

- Other qualifying events: There are other SEPs for situations like moving into or out of a nursing home, losing eligibility for a Special Needs Plan (SNP), or experiencing exceptional circumstances.

If you experience a qualifying event, it’s essential to contact Medicare or your plan provider to understand your options and deadlines for switching plans.

Important Considerations When Switching Medicare Advantage Plans

1. Plan Benefits and Costs

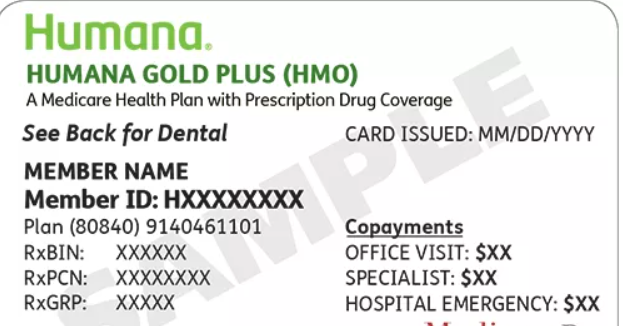

- Coverage: Compare the coverage offered by different plans, including prescription drug coverage, additional benefits, and any out-of-pocket costs like deductibles, copays, and coinsurance.

- Provider network: Ensure that your preferred doctors and hospitals are included in the plan’s network.

- Premiums: Consider the monthly premium for each plan and how it fits into your budget.

- Star ratings: Check the plan’s star rating, which reflects its quality and performance.

2. Prescription Drug Coverage

- Formulary: Review the plan’s formulary (list of covered drugs) to ensure that your medications are included and at an affordable tier.

- Costs: Compare the costs for your medications under different plans, including any deductibles, copays, or coinsurance.

- Pharmacy network: Make sure your preferred pharmacy is in the plan’s network.

3. Enrollment Deadlines

- AEP and MA OEP: Pay attention to the enrollment deadlines for these periods to avoid missing the opportunity to switch plans.

- SEPs: If you qualify for an SEP, act quickly to enroll in a new plan, as the deadlines can be short.

4. Additional Benefits

- Dental, vision, and hearing: Consider whether you need these additional benefits and compare the coverage offered by different plans.

- Fitness programs: Some plans offer fitness programs or gym memberships as part of their benefits package.

- Transportation: If you have difficulty getting to medical appointments, look for plans that offer transportation services.

5. Plan Availability

- Service area: Ensure that the plan you’re considering is available in your area.

- Enrollment restrictions: Some plans may have enrollment restrictions, such as being limited to certain counties or ZIP codes.

Can I Switch Medicare Advantage Plans Anytime Outside of Enrollment Periods?

In general, you cannot switch Medicare Advantage plans outside of the enrollment periods mentioned above. However, there are a few exceptions:

- 5-Star Special Enrollment Period: If you’re enrolled in an MA plan that receives a 5-star rating from Medicare, you may be able to switch to another 5-star plan once per year between December 8 and November 30.

- Exceptional circumstances: In rare cases, Medicare may grant an SEP for exceptional circumstances, such as if your plan provider leaves Medicare or significantly reduces its service area.

Conclusion

While you cannot switch Medicare Advantage plans anytime, there are specific enrollment periods and certain situations where you have the flexibility to change your plan. Understanding these options and carefully considering your healthcare needs will help you make informed decisions about your Medicare coverage.

Read More: Right Away Insured: Your Guide to Instant Coverage