Can I do my own payroll for my small business? It’s a question many entrepreneurs and small business owners grapple with. The answer is yes, but it’s crucial to understand the complexities involved before diving in. This comprehensive guide will walk you through the pros, cons, and essential steps of DIY payroll.

Contents

Understanding the Pros and Cons

Pros of DIY Payroll

- Cost Savings: Handling payroll in-house can eliminate the fees associated with payroll service providers.

- Control: You have direct oversight of the payroll process, ensuring accuracy and timeliness.

- Flexibility: You can tailor your payroll system to fit your specific business needs.

Cons of DIY Payroll

- Time-Consuming: Payroll involves meticulous calculations, tax filings, and compliance, demanding a significant time investment.

- Complexity: Payroll laws and regulations are intricate and subject to change, requiring ongoing learning and attention to detail.

- Risk of Errors: Mistakes in payroll can lead to financial penalties, employee dissatisfaction, and legal complications.

Is DIY Payroll Right for Your Small Business?

Deciding whether to handle payroll yourself depends on several factors:

- Number of Employees: The more employees you have, the more complex payroll becomes.

- Budget: If your budget is tight, DIY payroll can save costs, but weigh it against the potential for errors.

- Time Availability: Do you have the time to dedicate to learning payroll regulations and completing tasks accurately?

- Comfort Level: Are you comfortable with numbers, tax filings, and meticulous record-keeping?

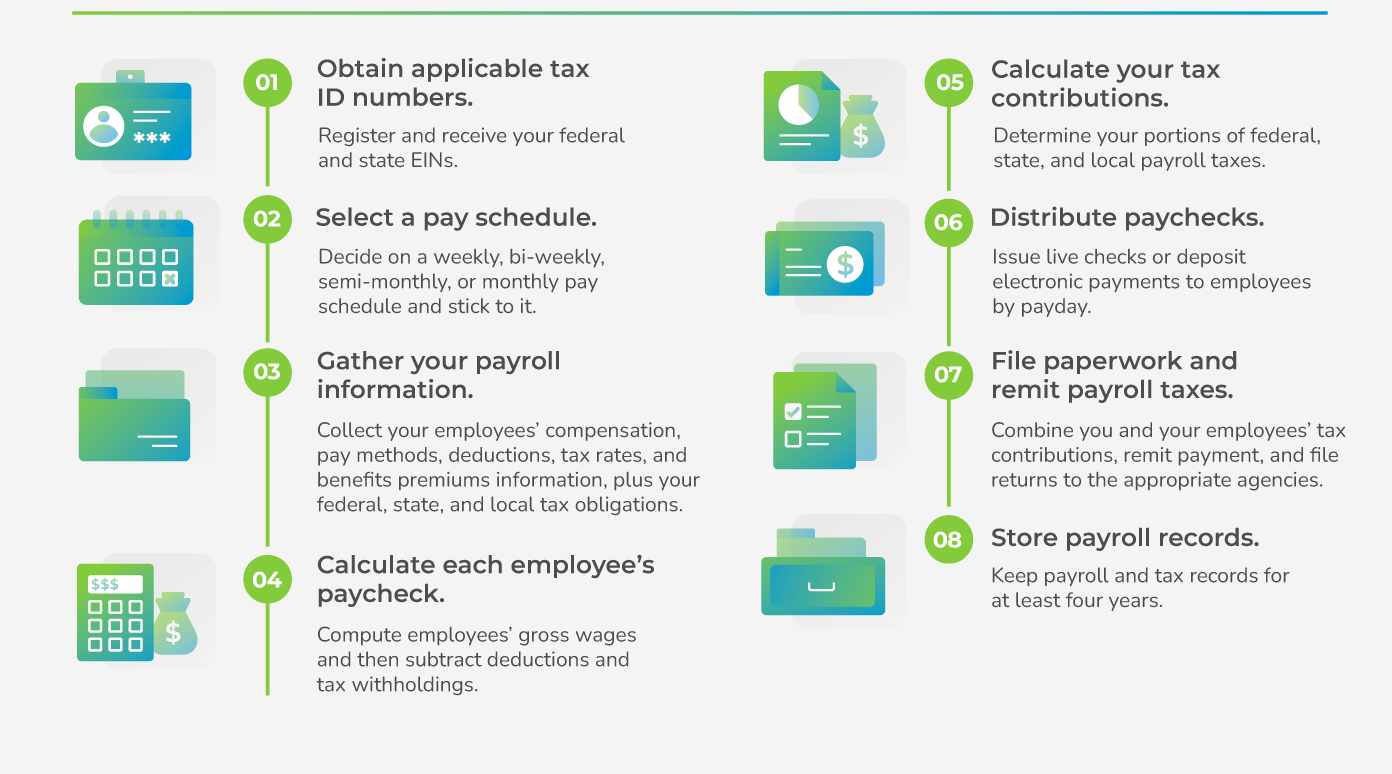

Essential Steps for DIY Payroll

If you decide to take on payroll yourself, follow these key steps:

- Obtain an Employer Identification Number (EIN): This unique identifier is required for tax filings.

- Register with Tax Agencies: Register as an employer with federal, state, and local tax authorities.

- Choose a Payroll Schedule: Decide on a pay frequency (weekly, bi-weekly, monthly).

- Gather Employee Information: Collect W-4 forms and relevant personal information.

- Calculate Gross Pay: Determine each employee’s earnings based on hours worked, salary, or commission.

- Calculate and Withhold Taxes: Deduct federal, state, and local income taxes, as well as FICA taxes (Social Security and Medicare).

- Pay Employees: Distribute net pay (gross pay minus deductions) through checks, direct deposit, or other methods.

- Pay Payroll Taxes: Remit withheld taxes to the appropriate agencies on time.

- File Tax Forms: Submit quarterly and annual tax reports accurately and on schedule.

- Maintain Accurate Records: Keep meticulous records of payroll data, including hours worked, wages paid, and tax deductions.

Tools and Resources for DIY Payroll

Several tools can simplify DIY payroll:

- Payroll Software: Affordable software automates calculations, tax filings, and record-keeping.

- Online Calculators: Utilize online tools to estimate tax withholdings and ensure compliance.

- Government Resources: The IRS and state tax agencies provide comprehensive guides and resources.

Can I Do My Own Payroll for My Small Business? The Verdict

While it’s possible to manage payroll for your small business yourself, it’s a significant undertaking that requires dedication, knowledge, and attention to detail. Weigh the pros and cons carefully, assess your resources, and consider seeking professional guidance if needed. Remember, accurate and timely payroll is essential for maintaining a healthy and compliant business.

When to Consider Outsourcing Payroll

If you find that DIY payroll is overwhelming or too time-consuming, outsourcing is a viable option. Payroll service providers handle all aspects of payroll, ensuring compliance and freeing up your time to focus on core business activities.

Remember: Can I do my own payroll for my small business is a question only you can answer. Choose the path that aligns with your business needs, resources, and comfort level.