Louisiana, with its vibrant economy and diverse industries, presents a unique landscape for businesses. From the bustling streets of New Orleans to the industrial hubs of Baton Rouge, enterprises of all sizes thrive in the Pelican State. However, with opportunity comes risk, and that’s where business insurance Louisiana steps in, offering a safety net for businesses to navigate the uncertainties of the market.

Contents

Understanding the Importance of Business Insurance

In Louisiana, as in any other state, unforeseen events can disrupt operations, damage property, or lead to legal liabilities. Business insurance Louisiana acts as a financial safeguard, providing coverage for a wide range of risks, allowing businesses to focus on growth and innovation without the constant worry of potential losses.

Types of Business Insurance in Louisiana

The Louisiana insurance market offers a variety of coverage options tailored to the specific needs of different businesses. Some of the most common types of business insurance Louisiana include:

- General Liability Insurance: This coverage protects businesses from third-party claims of bodily injury, property damage, or personal and advertising injury.

- Property Insurance: This insurance covers damage or loss to a business’s physical assets, including buildings, equipment, inventory, and furniture, due to events such as fire, theft, or natural disasters.

- Workers’ Compensation Insurance: In Louisiana, as in most states, businesses with employees are required to carry workers’ compensation insurance. This coverage provides benefits to employees who suffer work-related injuries or illnesses.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects businesses that provide professional services from claims of negligence, errors, or omissions in their work.

- Commercial Auto Insurance: If a business owns or leases vehicles, commercial auto insurance is essential to cover liability and physical damage related to accidents involving those vehicles.

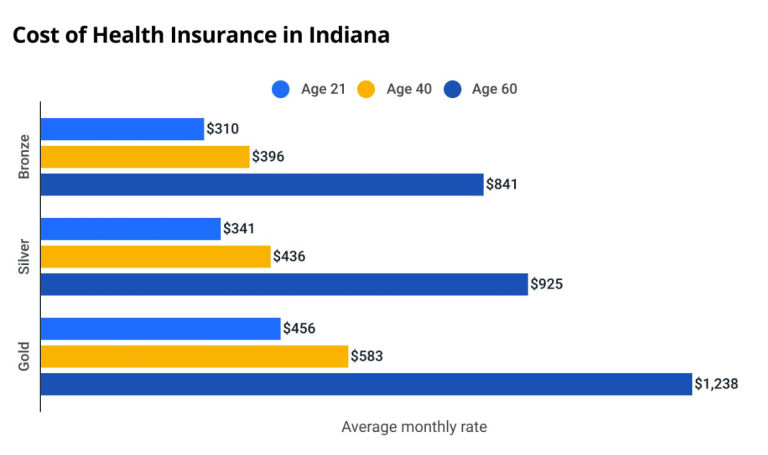

Factors Affecting Business Insurance Premiums in Louisiana

Several factors influence the cost of business insurance Louisiana. These include:

- Industry: The nature of a business’s operations significantly impacts its insurance premiums. Businesses in high-risk industries, such as construction or manufacturing, may face higher premiums than those in lower-risk sectors.

- Location: The location of a business also plays a role in determining insurance costs. Businesses in areas prone to natural disasters, such as hurricanes or floods, may face higher premiums.

- Size and Revenue: The size and revenue of a business also affect insurance premiums. Larger businesses with higher revenues typically require more extensive coverage, leading to higher premiums.

- Coverage Limits and Deductibles: The coverage limits and deductibles chosen by a business also impact premiums. Higher coverage limits and lower deductibles generally result in higher premiums.

- Claims History: A business’s claims history can also influence its insurance costs. Businesses with a history of frequent claims may face higher premiums than those with a clean record.

Choosing the Right Business Insurance in Louisiana

Selecting the right business insurance Louisiana requires careful consideration of a business’s specific needs and risks. Here are some tips to help businesses make informed decisions:

- Assess Your Risks: Identify the potential risks your business faces, including property damage, liability claims, and business interruption.

- Understand Your Coverage Needs: Determine the types and levels of coverage required to adequately protect your business from those risks.

- Compare Quotes from Multiple Insurers: Obtain quotes from several reputable insurance providers to compare coverage options and premiums.

- Review the Policy Carefully: Before purchasing a policy, carefully review the terms and conditions, including coverage limits, deductibles, and exclusions.

- Work with a Knowledgeable Insurance Agent: Consult with an experienced insurance agent who can guide you through the process and help you select the right coverage for your business.

The Role of Insurance Agents in Louisiana

Insurance agents play a crucial role in helping businesses navigate the complexities of the business insurance Louisiana market. They can provide valuable insights into coverage options, explain policy terms and conditions, and assist businesses in filing claims.

When choosing an insurance agent, it’s essential to look for someone who is licensed in Louisiana, has experience working with businesses in your industry, and is responsive to your needs and concerns.

The Future of Business Insurance in Louisiana

The business insurance Louisiana landscape is constantly evolving, driven by technological advancements, changes in the regulatory environment, and emerging risks. As businesses become increasingly reliant on technology, cyber insurance is gaining prominence, offering protection against data breaches and other cyberattacks.

Additionally, the increasing frequency and severity of natural disasters in Louisiana are prompting businesses to reassess their insurance needs and consider additional coverage for flood and hurricane damage.

Conclusion

Business insurance Louisiana is an indispensable tool for businesses seeking to protect their assets, manage risks, and ensure long-term success. By understanding the types of coverage available, the factors affecting premiums, and the importance of working with a knowledgeable insurance agent, businesses can make informed decisions and secure the right coverage for their unique needs.

Read More: Small Business Insurance Kansas: A Comprehensive Guide