Understanding Oklahoma’s Insurance Landscape

Factors Affecting Insurance Premiums in Oklahoma

Several factors influence insurance premiums in Oklahoma, including:

- Location: Where you live in Oklahoma can significantly impact your insurance rates. Urban areas with higher crime rates and traffic congestion may have higher premiums than rural areas.

- Driving Record: Your driving history plays a crucial role in determining your auto insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums.

- Credit Score: In Oklahoma, insurance companies can use your credit score to assess your risk profile. A higher credit score typically leads to lower insurance premiums.

- Coverage Limits: The amount of coverage you choose will directly affect your premium. Higher coverage limits offer greater financial protection but come with higher premiums.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium but means you’ll pay more in the event of a claim.

- Insurance Company: Different insurance companies have varying pricing structures and underwriting guidelines. Comparing quotes from multiple insurers is essential to find the best rates.

Types of Insurance in Oklahoma

Oklahoma residents need various types of insurance to protect their assets and financial well-being. Some of the most common types of insurance in Oklahoma include:

- Auto Insurance: Auto insurance is mandatory in Oklahoma and provides financial protection in case of accidents, theft, or damage to your vehicle.

- Homeowners Insurance: Homeowners insurance protects your home and belongings from damage caused by fire, theft, natural disasters, and other perils.

- Renters Insurance: Renters insurance provides coverage for your personal belongings in a rented dwelling, as well as liability protection.

- Health Insurance: Health insurance helps cover the costs of medical care, including doctor visits, hospital stays, prescription drugs, and preventive care.

- Life Insurance: Life insurance provides financial support to your beneficiaries in the event of your death.

Tips for Finding Cheap Oklahoma Insurance

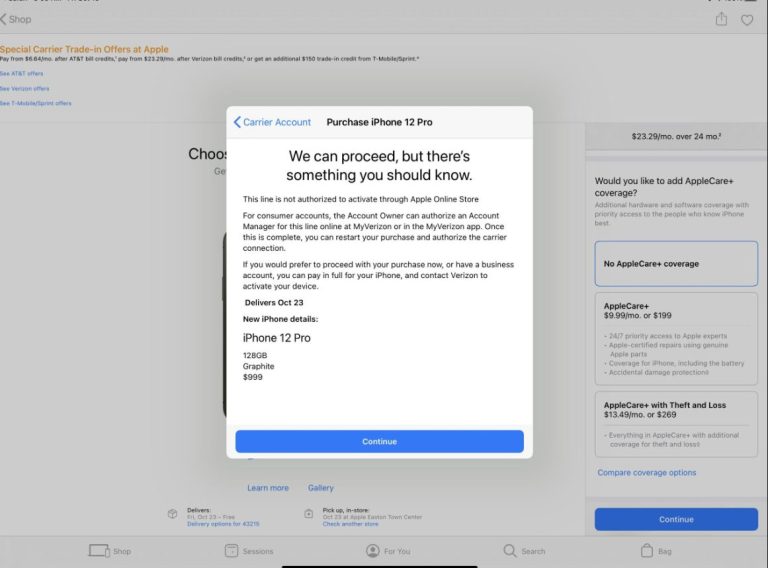

Shop Around and Compare Quotes

One of the most effective ways to find **cheap Oklahoma insurance is to shop around and compare quotes from multiple insurers. Each company has its own pricing structure and underwriting guidelines, so rates can vary significantly.

Consider Raising Your Deductible

Opting for a higher deductible on your insurance policies can lower your premiums. However, ensure you have enough savings to cover the deductible in case of a claim.

Bundle Your Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as auto and homeowners insurance, with the same insurer.

Maintain a Good Driving Record

A clean driving record with no accidents or traffic violations can help you secure lower auto insurance rates.

Improve Your Credit Score

A good credit score can lead to lower insurance premiums in Oklahoma. Paying bills on time, reducing debt, and maintaining a low credit utilization ratio can help improve your credit score.

Ask About Discounts

Insurance companies offer various discounts, such as discounts for safe drivers, good students, seniors, and military personnel. Inquire about available discounts to see if you qualify.

Review Your Coverage Regularly

Your insurance needs may change over time. Review your coverage regularly to ensure you have adequate protection without paying for unnecessary coverage.

Work with an Independent Insurance Agent

An independent insurance agent can help you compare quotes from multiple insurers and find the best coverage for your needs and budget.

Affordable Auto Insurance in Oklahoma

Auto insurance is mandatory in Oklahoma, and finding affordable coverage is essential for all drivers. Here are some tips for securing cheap Oklahoma auto insurance:

- Maintain a Clean Driving Record: A clean driving record is one of the most critical factors in determining your auto insurance rates. Avoid accidents and traffic violations to keep your premiums low.

- Choose the Right Car: The type of car you drive can affect your insurance rates. Consider choosing a car with good safety ratings and lower repair costs.

- Take a Defensive Driving Course: Completing a defensive driving course can often lead to discounts on your auto insurance premiums.

- Install Safety Features: Equipping your car with safety features like anti-theft devices and airbags can also help lower your insurance costs.

Affordable Homeowners Insurance in Oklahoma

Homeowners insurance is crucial for protecting your most valuable asset. Here are some ways to find cheap Oklahoma homeowners insurance:

- Increase Your Home’s Security: Installing security systems, smoke detectors, and deadbolts can help reduce your homeowners insurance premiums.

- Strengthen Your Home Against Natural Disasters: Making improvements to your home to withstand natural disasters like tornadoes and hailstorms can lead to discounts on your insurance.

- Shop Around for the Best Rates: Comparing quotes from multiple insurers is essential to find the most affordable homeowners insurance coverage.

Affordable Health Insurance in Oklahoma

Health insurance is vital for protecting your health and financial well-being. Here are some resources for finding cheap Oklahoma health insurance:

- The Affordable Care Act (ACA) Marketplace: The ACA Marketplace offers a variety of health insurance plans with subsidies available for eligible individuals and families.

- Medicaid: Medicaid provides health coverage to low-income individuals and families in Oklahoma.

- Employer-Sponsored Health Insurance: If your employer offers health insurance,** requires research, comparison shopping, and consideration of your individual needs and circumstances. By following the tips in this guide and working with a knowledgeable insurance agent, you can secure affordable coverage and protect your assets and financial future in the Sooner State.