Affordable health insurance in Louisiana is crucial for residents to access quality healthcare without financial hardship. With rising healthcare costs, finding the right health insurance plan is more important than ever. This article will explore the various options available, factors to consider when choosing a plan, and resources to help Louisiana residents find affordable health insurance that meets their needs.

Understanding Health Insurance in Louisiana

-

Types of Health Insurance Plans:

- Health Maintenance Organizations (HMOs): HMOs offer a network of healthcare providers, and you’ll need a primary care physician (PCP) to coordinate your care.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility in choosing healthcare providers, but out-of-network care may be more expensive.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs but may offer a wider network of providers.

- Point of Service (POS) Plans: POS plans combine elements of HMOs and PPOs, allowing some out-of-network care with referrals.

- High-Deductible Health Plans (HDHPs): HDHPs have lower monthly premiums but higher deductibles. They can be paired with a Health Savings Account (HSA).

-

Key Terms to Know:

- Premium: The monthly cost of your health insurance plan.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Copayment: A fixed amount you pay for certain healthcare services, like doctor visits or prescription drugs.

- Coinsurance: The percentage of healthcare costs you share with your insurance company after meeting your deductible.

- Out-of-Pocket Maximum: The most you’ll pay out-of-pocket for covered healthcare services in a year.

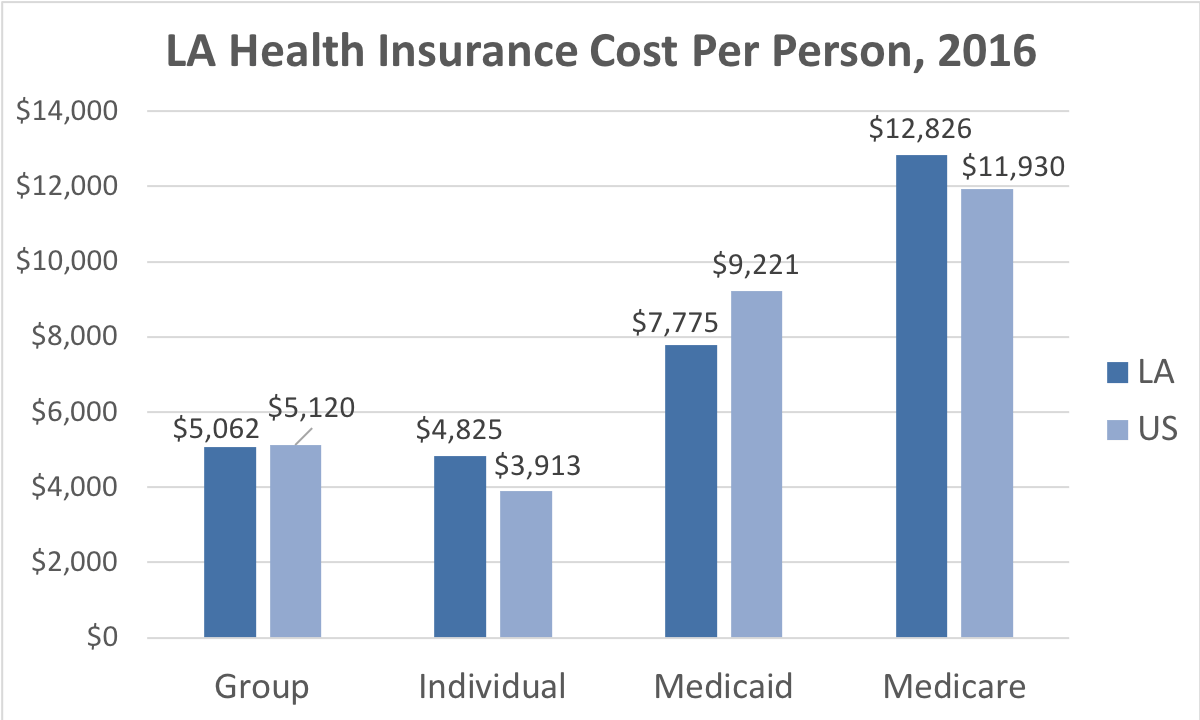

Factors Affecting Health Insurance Costs in Louisiana

- Age: Older individuals generally pay higher premiums than younger individuals.

- Location: Healthcare costs and insurance premiums can vary depending on where you live in Louisiana.

- Tobacco Use: Tobacco users may face higher premiums.

- Plan Category: Plans are categorized into metal tiers (Bronze, Silver, Gold, Platinum) based on their coverage levels. Higher-tier plans have higher premiums but lower out-of-pocket costs.

- Family Size: Covering more family members typically increases premiums.

Finding Affordable Health Insurance in Louisiana

-

The Health Insurance Marketplace: The Health Insurance Marketplace (also known as the Affordable Care Act (ACA) Marketplace or Obamacare) is a platform where you can compare and enroll in health insurance plans. You may be eligible for subsidies to lower your monthly premiums based on your income and household size.

-

Medicaid: Louisiana’s Medicaid program provides health coverage to low-income individuals and families. Eligibility requirements vary, so check if you qualify.

-

Employer-Sponsored Health Insurance: If your employer offers health insurance, it can be a cost-effective option. Compare your employer’s plan with options on the Marketplace to see which is more affordable for you.

-

Private Health Insurance: You can purchase health insurance directly from an insurance company or through a broker. Compare quotes from multiple insurers to find the best deal.

Tips for Choosing Affordable Health Insurance in Louisiana

- Assess Your Needs: Consider your healthcare needs, including any pre-existing conditions, medications, and expected healthcare utilization.

- Compare Plans Carefully: Review the premiums, deductibles, copays, coinsurance, and out-of-pocket maximums of different plans.

- Consider Subsidies: If you’re eligible for subsidies on the Marketplace, factor them into your decision.

- Don’t Overlook Preventive Care: Choose a plan that covers preventive care services at no cost to you.

- Seek Assistance: If you need help navigating your options, contact a licensed insurance agent or navigator.

Resources for Affordable Health Insurance in Louisiana

- Louisiana Health Insurance Marketplace: https://www.healthcare.gov/

- Louisiana Department of Health: https://ldh.la.gov/

- Louisiana Health Insurance Assistance Program (LHIAP):

Conclusion

Finding affordable health insurance in Louisiana requires careful consideration of your needs and budget. By understanding the different types of plans, factors affecting costs, and available resources, you can make an informed decision and secure the coverage you need to stay healthy. Remember, don’t hesitate to seek assistance from licensed professionals if you have any questions or need help navigating the process. With the right information and resources, you can find affordable health insurance that provides peace of mind and access to quality healthcare in Louisiana.

Read More: Unlocking Financial Security: A Comprehensive Guide to UHC Life Insurance